An Intro to B2B Cross-Border Payments

International business transactions are slow and expensive. But why?

I spent much of my time at Motivate Ventures this year entrenched in the world of payments – cross-border, peer-to-peer and remittance, business-to-business, crypto, and blockchain-based payments, as well as how a business monetizes payments, payroll and AR/AP automation, and how financial institutions move money.

Understanding the history and key stakeholders in our financial system is imperative to understand the problems and opportunities in the payments sector. It became clear in my research that the need for businesses to make international payments drove many advancements in the global financial system, but is also a category that still suffers from legacy technology and the complexities of collaboration between financial institutions.

As such, this post is intended to serve as an introduction to how businesses and financial institutions move money internationally so that founders, investors, and anyone in fintech can get up to speed quickly about the global financial infrastructure.

This post is not comprehensive nor gospel, and I’ve borrowed heavily from a variety of resources to build a picture of the current landscape. The best part about writing exploratory pieces like this is learning from readers, so please reach out with questions, feedback, and especially to let me know what I missed.

An Introduction to B2B Cross-Border Payments

Global exports of goods and services accounted for 29% of the world’s GDP, or $25T, in 2019. While COVID had a dramatic impact on the global economy, there is more international trade than ever as we rebound from the pandemic, which means there are more dollars flowing between international business than ever before as well. In 2021, there are estimated to be 14 billion business-to-business (b2b) cross-border transactions accounting for $35T in volume.

Historically, banks were at the center of b2b cross-border payments. Banks allow businesses to access the global financial system and send money internationally using payment systems like SWIFT, a system built by banks in the 70s that still carries about 50% of cross-border transactions today.

If you’ve ever initiated a wire transfer or paid an invoice for your business, you know domestic payments can be a pain. Add the complexity of routing through multiple banks in different countries, manual checks for fraud by a financial institution, conversions to different currencies, and then delivered in one of ten different payout methods to a business in, say, rural Estonia. That’s a typical b2b cross-border payment and it’s as complex as it sounds.

This complexity is costly, too. Businesses often pay between 5-10% per transaction and banks spend hundreds of billions of dollars each year to prevent fraud, often resulting in significant delays which can be a death sentence for businesses who rely on timing of cash flows.

So the legacy infrastructure is slow and expensive… but “who” and “what” make up the cross-border payments infrastructure?

The Cross-Border B2B Payment Infrastructure

To begin, the Payer is a business that sends money internationally, like the Japanese car manufacturer in the top left of this flow chart. The Payer Bank is the bank of the business making a payment, or “Bank A Tokyo” above. These banks are often regional or community banks who have trouble facilitating cross-border transactions because of limited resources or because they are unable to access global payments systems. These smaller banks use intermediary banks, called Correspondent Banks, or “Bank B in the USA” above, who help facilitate international payments on their behalf. I’ll cover correspondent banks in detail below given their importance to the global financial system.

Correspondent Banks

A correspondent bank serves as a middleman providing treasury services between originating and receiving banks, specifically those in different countries. These banks are either connected to the domestic payment network in a specific country or hold accounts with foregin banks, providing access to international banks for those that can’t do it themselves. These accounts are called Nostro / Vostro accounts and they’re used by banks to facilitate transactions in different countries and currencies. A Nostro account is in a foreign currency (“our” money at your bank) and a Vostro account is in the local currency of the bank where the money is being held (“your” money at our bank). These accounts also establish payment corridors, which are pairs of countries that can send or receive payments from one another, or pairs of currencies that can be exchanged.

But why can’t all banks send and receive international payments themselves? For starters, it’s very expensive because of high regulatory and compliance hurdles. Banks spend nearly $200B annually on compliance and fraud prevention and millions to maintain accounts with foreign banks. Large global banks like Citi and HSBC have the resources to do all of this themselves, but most banks don’t, so they rely on correspondent banks for these services.

Though correspondent banks play a significant role in the global economy, high costs and regulatory friction are causing some to cease correspondent banking services. According to the Financial Stability Board (FSB), about 40% of banks claim it is not cost-effective or no longer profitable to act as a correspondent bank, and 22% of correspondent banks terminated active relationships for reasons related to compliance and reputation.

The implications of this decline are significant. The number of payment corridors have a direct impact on the cost of cross-border transactions and limit access to the global economy, especially for small banks and developing countries. In 2019, 26% of banks claimed access to the US payment system has been severely limited or lost entirely due to the withdrawal of correspondent banks.

Now, back to the original graphic to understand how money is actually moved. Banks use multiple technology systems to move money between one another. Examples include communication protocols like SWIFT and SEPA, payment networks like Visa and Mastercard, and settlement systems like Fedwire and CHIPS in the image above.

Communication Protocols

These protocols are used to send messages between banks about where and when to move money. The primary communication protocols are SWIFT, SEPA, and ISO 20022. In the graphic above, “MT 103” is an example of a SWIFT message – MT stands for “message type” and the 3 digits represent the payment type and to whom money should be sent:

Below is a breakdown of the primary communication protocols used for international business transactions:

SWIFT is the most popular communication protocol, recording an average of 42M messages per day, but ISO 20022 is expected to replace SWIFT in the near future. ISO 20022 promises granular data collection and payment tracking, which are key weaknesses of current protocols and contribute to the costs required to verify international transactions today. ISO 20022 is expected to facilitate 80% of high-value transactions by 2023, but, as with any new technology for financial institutions, adoption is slow.

Card Networks

You likely know the largest of these networks, Visa and Mastercard, because their logo is on millions of credit and debit cards, some of which are used by businesses to make international payments. When a business uses a Mastercard-branded card, the Mastercard network routes the payment from the business’s bank to the bank of the recipient. This is a popular option for businesses because Mastercard-branded cards are accepted in hundreds of countries and their network allows businesses to receive payments via multiple payout methods, like bank accounts, cards, and mobile wallets.

Settlement Systems

Like the Mastercard network, settlement systems are responsible for transferring funds between banks.

The two types of settlement systems are Real-Time Gross Settlement (RTGS) and Continuous Net Settlement (CNS). RTGS allows money to be moved real-time, which means it’s preferable for high-value, time-sensitive payments, but it is liquidity-intensive for banks as funds must be immediately debited to the recipient’s account. Examples include Fedwire, which is operated by the Fed for same-day settlement of USD, and TARGET2, the Fedwire equivalent for Euros.

CNS systems settle payments most efficiently, but at the cost of settlement speed which means it’s commonly used for low-value, high-volume payments without much urgency. Examples include CHIPS, which requires participants to pre-fund their accounts from which transactions are drawn down, and ACH, which settles payments in 1-2 days and is less expensive than Fedwire or CHIPs. The majority of USD transactions use the CHIPS.

The participants outlined above combine to support trillions of dollars in cross-border payments each year. Banks have and always will play a key role in these transactions, but their legacy technology systems and antiquated compliance requirements don’t have to.

What’s Wrong With The System?

It’s too difficult for a business to make an international payment. The average cross-border transaction takes weeks to clear which, for businesses operating on the margin, can be a fatal disruption to cash flows. International payments are also brutally expensive for banks, who invest hundreds of billions each year in fraud prevention, and businesses, who pay up to 10% per transaction in fees. But the existing infrastructure is not just slow and expensive, it’s also inaccessible for many. For example, more than a quarter of global banks claim access to the U.S. payment system is severely limited, which is the most accessible system in the world.

The speed, cost, and accessibility of the global payments system is so problematic that the G20, a global economic forum made up of the world’s largest economies, made cross-border payments the #1 item to address at the G20 Summit for the last two years.

Cost

Cross-border payments are subject to a variety of fees along their journey between sender and recipient including payment network fees and foreign exchange rates and fees. They’re also expensive to service for banks and payment networks because they use antiquated technology to comply with regulations and verify transaction legitimacy. High costs for financial institutions means high fees for business customers, who pay 5-10% per transaction plus flat fees of up to $60.

Nostro / Vostro account maintenance is an example of how legacy infrastructure drives high servicing costs for banks. Globally, banks spend about $1.5B per year just to maintain “nostro” accounts at other banks, and the average U.S. bank spends about $27k per year to maintain just one “nostro” account. But this isn’t even the biggest expense.

Each year, banks spend about $180B on compliance and fraud prevention. For example, to approve a payment, a bank must know details about the business owner, what their business does, the intent or purpose of the transaction, and verify that the receiving bank / country does not have restrictions against receiving money from the country of origin. Very little of this is solved with technology today, which means costs are sky high to validate the integrity of any single payment. And despite hundreds of billions of dollars spent each year to do so, roughly 5% of global GDP is illegally laundered through banks each year and only 2% of illicit transactions are prevented.

Because regulatory and compliance costs are so high, banks often avoid taking on less profitable customers which is a key component in the declining access to global payment networks for small banks and developing nations.

Speed

According to Visa, the average US business waits 33-35 days to receive a cross-border payment, more than twice as long as it takes to receive a domestic payment. Banks spend hundreds of billions on compliance and fraud prevention, but they still lack the technology required to facilitate fast payments. As a result, over 60% of cross-border b2b transactions (over 8 billion transactions) require manual intervention which can cause significant delays. Other factors that hamper international payments include dispute resolution, the speed of communication protocols, and, believe it or not, bank operating hours.

Legacy infrastructure is a problem for businesses, too. Many lack modern payment technology like payment automation or unified invoicing and payment systems, and still rely on manual processes. For example, 60% of b2b transactions are still conducted via paper check. Banks can only move money when instructed, so delays from business customers hamstring payment speed from the start.

Access

High fees and strict regulatory requirements prevent many small and mid sized (SMB) banks and developing nations from accessing the global payments network. Most SMB banks don’t have the resources to ensure transactions are legitimate nor can they afford relationships with international banks, which, in turn, also restricts small businesses’ access to the global payments network.

The decline in correspondent banks and payment corridors plays a role here, too. Fewer correspondent banks means fewer SMB banks can support cross-border payments and fewer payment corridors means fewer currencies can be transacted between countries. For example, In 2019, 26% of banks claimed access to the US payment system has been severely limited or lost entirely due to the withdrawal of correspondent banks.

A Path Forward

While the existing cross-border payments system is rife with problems, financial institutions, government entities, and technology companies are taking notice. To start, the G20 identified 5 focus areas to improve cross-border payments:

So we know what needs to change, but who’s going to do it?

Innovation in B2B Cross-Border Payments

Incumbent financial institutions, technology providers, and startups are attacking international business payments from all angles – faster and cheaper transactions, greater visibility into the payment flow, enhanced payment security, and making global payments more accessible for SMBs and developing nations.

Incumbent Innovation

Though banks are notoriously slow and reliant on manual processes, it seems we’re entering a golden-age of technology adoption by large financial institutions. U.S. banks spent an estimated $80B on technology and IT in 2021, which is expected to grow to $114B in 2021, and new initiatives like SWIFT gpi, Visa B2B Connect, and JPM Coin demonstrate their efforts to modernize legacy infrastructure.

SWIFT gpi (Global Payments Innovation) aims to provide faster, cheaper, and more transparent tracking for international payments than previous messaging protocols – like a GPS tracker for payments. Visa B2B Connect provides cross-border transactions for businesses via direct bank transfer and assigns a unique digital identity to each network participant, promising fast, cheap, and secure payments. JPM Coin is a stable coin intended to help businesses make faster, more secure, and cheaper transactions leveraging the benefits of decentralization and blockchain technology.

While encouraging, incumbent innovation is still painfully slow and hampered by red tape.

Startups

Like the incumbents, dozens of startups have recognized the shortcomings of the existing cross-border payments infrastructure.

Some chose to target financial institutions directly, with a promise of updating legacy technology. For example, CurrencyCloud allows financial institutions to transact in a wide variety of currencies and payout methods and automated transaction screening to help banks better serve business customers and reduce fraud. Payall, a Motivate portfolio company, helps banks collect and verify data about transaction participants to verify the legitimacy of a transaction, allowing any bank to facilitate cross-border payments, or “correspondent banking-as-a-service.” This model is especially impactful for banks that lost or never had the ability to make cross-border payments, and Payall expects to reduce the cost of cross-border transactions by up to 95% and transaction execution speed from days to just minutes.

Other startups working with financial institutions include TenureX, Unite Global, Thunes, and Bottomline Technologies.

Another crop of startups turned their focus to businesses. Airwallex, for example, posited that businesses who transacted across borders were underbanked. Their platform offers international business bank accounts, card issuing, foreign exchange services, and a variety of payout methods to enable businesses to easily transact internationally. Flywire helps businesses automate invoicing for international customers and optimize foreign exchange rates, a key prohibitor for SMBs today.

Payall also works directly with businesses to execute faster payments, eliminate the need to handle and store sensitive banking data about who they are paying, and reduce cross-border payment fees by up to 90%. Their product allows payors to choose from 8+ payout methods, too.

Other startups making cross-border payments easier for businesses include Payoneer, Tipalti, Trolley, and Rapyd.

Lastly, there are a handful of crypto and/or blockchain-based startups tackling international business transactions. Veem, for example, uses blockchain technology to move money faster and cheaper than existing payment rails – the blockchain eliminates the intermediary required to settle transactions as well as wire and FX fees.

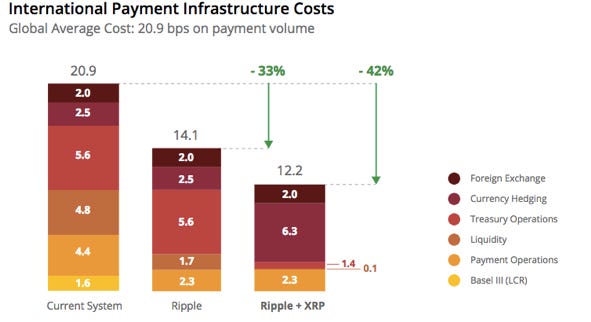

Companies like Ripple and Circle help businesses move money across borders via blockchain technology, too, and they promote the use of digital assets, like XRP and USDC respectively. XRP, Ripple’s own cryptocurrency, acts as a settlement mechanism between two currencies or networks, facilitating faster and cheaper exchanges. USDC, owned by Circle, is one of the fastest growing stable coins that supported over $1.4T in transactions in the last year. The graphic below demonstrates how blockchain and/or digital assets can reduce the cost of cross-border payments.

Crypto and blockchain offer significant improvements over the existing cross-border payments infrastructure, but adoption among businesses and financial institutions is low. Crypto has had much more success with peer-to-peer payments given the lower regulatory and adoption hurdles. Enterprise adoption will come, but first we need clearer regulations and to onboard the millions of businesses that still rely on paper checks to digital payments.

Where do we go from here?

It should be clear that we have a long way to go to make international payments fast, affordable, accessible, and secure. The existing infrastructure is outdated and largely controlled by legacy financial institutions, which results in extraordinarily high, even prohibitive, costs for all participants.

But not all hope is lost. Even incumbents recognize the need to provide modern solutions to increase access to the global financial system and easy international trade. Startups offer a variety of updates to legacy infrastructure, too, and will play an integral role in the adoption of digital payments, decreasing international transaction costs, and improving the health of the global financial system.

I’m bullish on technologies that serve incumbent financial institutions because they still control the way money is moved across borders and are the primary access point to the global financial system for many businesses, so it’s critical to update the existing infrastructure. Software helping businesses make more efficient international payments are compelling, too. Most business transactions are still conducted via paper check and most accounting systems don’t connect to a business's bank account, which means manual processes are required to execute payments. Solutions that unify the disparate payment systems and provides access to the global financial system are critical for global trade and will be an essential part of a business’s financial tech stack.

Lastly, I believe strongly in potential of blockchain technology and crypto to modernize the global financial system, but we’re still in the early innings. The lack of a clear regulatory framework is a hurdle for many financial institutions and most businesses aren’t comfortable with digital assets yet. Those that abstract away the underlying technology are most likely to succeed in the near term and as regulation becomes more clear, those promoting the use of digital assets will catch on.

It’s easier now than ever to conduct business internationally, but there’s plenty of work to do to make the global financial system efficient and accessible. Please reach out if you’re building a payments company or working on anything that improves the global financial system — you can reach me at jackson@motivate.vc

A BIG thank you to Matthew Miller, Zack Bahm, Eric Kaufman, David Wieland, Lauren DeLuca and everyone else who helped this post come together.

Really great piece. Thanks for the hard work and putting it together.

Very informative. The delta upside to spending billions justifies the need to improve cross border payments!