Stealing Signs #58

Consumer Expectations Crushing Restaurants, Power Tools & Lithium-ion, Get Rich or Die Tryin', Is Everything Getting Old?, Tails: You Win, Payments Humor, Quiltt, & Sandy Alcantara

Worth Reading

Restaurants Can’t Survive Customers’ Dining Expectations

Saba Rahimian, Eater

But before Joon hit a stride with the online model, demands shifted. As early as March 2021, media reports about dismal closures were replaced by coverage of diners hitting the streets in response to the patios that allowed for a return to dining out. With it came the first lull in sales. Patience for online ordering and takeout grew tenuous. The compliments on our courage faded and in their place came requests for a more desirable experience.

“What are your plans with the space? How long do you think it will be before you have seating available?”

Restaurants are a fragile business. Not only do they operate with razor thin margins, ~2-5%, but they’re nearing commoditization. Nothing’s made this clearer than the rise of food delivery apps which made restaurant substitutes more accessible than ever. Restaurants which once won consumer demand due to location, charm, food quality, or service level now frequently loose to the fastest, cheapest alternative, and each marginal decision in favor of the fast/cheap alternative erodes customer loyalty to the restaurant on the losing end.

A common post-COVID narrative is that people crave in-person, unique dining experiences and quickly grew tired of the fastest, cheapest alternative. As such, demand for unique, personalized dining experiences which won in the pre-food delivery era was re-invigorated. However, this article demonstrates that not even a global pandemic which deprived people of these dining experiences for nearly a year changed the modern consumer’s relationship with food (and restaurants in particular). People are picky and have little patience when their needs are not met because they have access to nearly infinite substitutes.

Lawns, Power, and Lithium-ion

Reilly Brennan, Trucks Venture Capital

Power tool companies have become battery-moated customer retention businesses. And since larger manufacturers can buy cells at scale, there’s been an all-out race to consolidate power tool brands under massive holding companies, lock up supply contracts, and go big.

Score one for Midwestern innovation. Apparently, power tool manufacturer Milwaukee changed the industry forever with its introduction of lithium-ion batteries. Though small and powerful, these batteries are expensive, which forced Milwaukee to prioritize interchangeability, meaning battery packs could be swapped in and out of different Milwaukee power tools. Every major power tool brand followed suit after it became clear Milwaukee’s batteries created consumer lock-in and deterred them from purchasing non-Milwaukee power tools.

Get Rich or Die Tryin’

Michael Dempsey, Compound VC

The Social Network and the broader publicity of wealth creation via entrepreneurship/private markets taught us how to survive in this new world. A world where non-linear wealth creation is the only way to make it. Whether this is true economically or a fever dream that has been proliferated through social media, these generations' social values align with a Get Rich or Die Trying mindset (I think I just dated myself with that reference).

The Social Network and the broader publicity of wealth creation via entrepreneurship/private markets taught us how to survive in this new world. A world where non-linear wealth creation is the only way to make it.

New, young investors (Millennials, Gen Z) are more interested in alternative and high-risk assets than any generation before due to the environment in which they grew up and the forms of wealth creation they were exposed to: “a world with multiple bubbles (2000, 2008, 2021), a couple of wars, a global pandemic, low wage growth, and perhaps high inflation. Also they have Robinhood and Coinbase.”

It’s also never been easier to access alternative assets: crypto, vacation rentals, multifamily real estate, startups, venture capital*, collectibles, small businesses, etc. Not all of these assets are high-risk, but they’ve historically been exclusive assets restricted to wealthy, privileged investors. Accessibility is crucial piece of foundation on which the proclivity to high-risk assets is built and typically results in liquidity, which supports Michael’s theory that alternative assets will recover faster than they have in the past, too.

*indicates a Motivate portfolio company

Is Everything Getting Old?

Byrne Hobart, The Diff

Which raises one more possible explanation for the aging of everything: it's a real-world instance of the secular decline in real interest rates. An interest rate measures the value of some lump of productive assets, relative to its current output. When rates are high, current results are more salient; when they're low, the total accumulated value matters more. If you think of a political career as a process of forming valuable connections—to other politicians, to staffers, to donors, to voters and the people who influence them—it's an ongoing investment that accumulates value over time. And the natural converse of low rates producing high asset values for a given level of income is that low rates make accumulating productive assets with a given annual return that much more expensive. The political capital was locked up when it was cheap, and now it's expensive.

Good investigation into why leaders across industry, politics, and culture are older than ever. Theories explored in this post include advancements in science/healthcare, a premium placed on experience, risk-aversion, and measurement error (e.g. TikTok stars not counted as entertainers).

Politics seems least likely to buck this trend in the near future, though it may be the field we should hope adopts youth leaders the soonest, and culture / entertainment seems most likely to prioritize youth in the near term. It also seems plausible that we’re at the tail end of this trend more broadly, or as Byrne would say, a secular increase in real interest rates. Technology innovation has made it infinitely easier to start a company, build and monetize an audience, and generally turn value into dollars, and young people tend to be more open to change and technology, so a shift lower the median age across industry, politics, and culture seems likely.

Tails, You Win

Morgan Housel, Collaborative Fund

Snow White and the Seven Dwarfs changed everything. The $8 million it earned in the first six months of 1938 was an order of magnitude higher than anything the studio earned previously. It transformed Disney Studios. All company debts were paid off. Key employees got retention bonuses. The company purchased a new state-of-the-art studio in Burbank, where it remains today. By 1938 Walt had produced several hundred hours of film. But in business terms, the 83 minutes of Snow White was pretty much all that mattered.

Long tails drive everything.

Another lovely piece from Morgan which demonstrates that the long tail drives everything — stock market returns, venture investing, successful careers and companies, etc. A seemingly obvious addition to this list is invention. For example, Thomas Edison failed something like 1,000 times before successfully creating his first lightbulb.

Morgan astutely points out that we tend to pay attention to things that are huge, successful, profitable, and influential, which are typically the result of a tail, so we tend to underestimate how rare tail events are. This logic ties in nicely with the current trend of young investor preference for high-risk assets (discussed above in Get Rich or Die Tryin’). Young investors have narrowed in on huge, profitable, and influential wealth creation events e.g. crypto.

The global crypto market cap is $1.1T. The Bitcoin and Ethereum market caps combined account for 62.7% of this, or $627.9B. With nearly 1,600 cryptocurrencies listed today, just 0.1% of cryptocurrencies account for nearly 63% of total “value” generated. A tail, if you will!

Not a subscriber yet? Click below to subscribe

<stuff>

LOL

Some good payments humor on the back of news that two senators are preparing legislation to give merchants choice over which card networks to use. Visa and Mastercard are the dominant networks and this bill aims to even the playing field for other networks like Discover and American Express:

Funding

Motivate portfolio company, Quiltt, announced a $4M Seed round co-led by Greycroft and Newark Venture Partners. Congrats to Ruben, Mark, and the Quiltt team!

Quiltt's low-code infrastructure platform helps businesses easily embed financial services into their product. Businesses can implement services like account aggregation, transaction enrichment, banking-as-a-service, payroll data, and more, and can easily turn on/off services with minimal engineering work or complexity. Quiltt's growing list of partners includes Plaid, Spade, ApexEdge, and Rightfoot.

We were fortunate enough to lead Quiltt’s pre-seed round in 2020 and I’ve worked closely with the team since the beginning of my time at Motivate. While we joke that “everything is fintech,” it’s only true if you know how to build financial products and services, which… most don’t. Founders Ruben and Mark want to change that — with Quiltt, everything can be fintech :)

Baseball

Catching up on the first half of the 2022 season! Sandy Alcantara has cemented himself as a top 5 pitcher in the game — and maybe even the best. Just check out the video below… good luck. Also, yes, hitting a baseball is the most difficult thing to do in all of sports :)

As of July 29th, Sandy’s stats are…insane:

1.81 ERA (2nd in MLB)

144.1 innings pitched (1st),

133 Strikeouts (9th)

0.90 WHIP (4th)

2 Complete Games (1st)

.187 batting average against (3rd)

5.5 Wins above replacement (1st incl. position players. The last time a pitcher led the league in WAR was Clayton Kershaw in 2014)

8 starts of at least 8 innings pitched (no one else has more than 3 and is more than anyone had all of last season)

He’s one of maybe 10 players in baseball who qualify as must-watch-TV right now. Tune in.

Cause why not… here’s my list of players who qualify as must-watch-TV right now — in no particular order:

Mike Trout (Angels, CF) — greatest player of our generation

Shohei Ohtani (Angels, DH/SP) — challenging Trout for greatest player ever as a hitter AND pitcher… first player since to do it since Babe Ruth. Impossible to overstate his impact on the game of baseball.

Julio Rodriquez (Mariners, CF) — rookie who is setting the world on fire. Nearly won the HR derby. Should be a star for years to come

Aaron Judge (Yankees, DH/CF) — hits a homerun every day. On pace to break Roger Marris’ Yankees single season HR record of 61

Sandy Alcantara (Marlins, SP) — see above

Edwin Diaz (Mets, CP) — throws 100 and has an ELECTRIC walkout song

Yordan Alvarez (Astros, DH) — may end up as one of the best hitters ever

Dylan Cease (White Sox, SP) — electric stuff, strikes everyone out. Former Cub 🥲

The Los Angeles Dodgers — basically an all-star team

Late addition to this section: the MLB trade deadline is today. One of the best players of our generation, Juan Soto, is on the block. Cardinals seem to be the leader in the clubhouse… yuck. Cubs catcher Willson Contreras is also likely to be moved, the last major piece from the Cubs 2016 World Series team. Thanks, Willson!

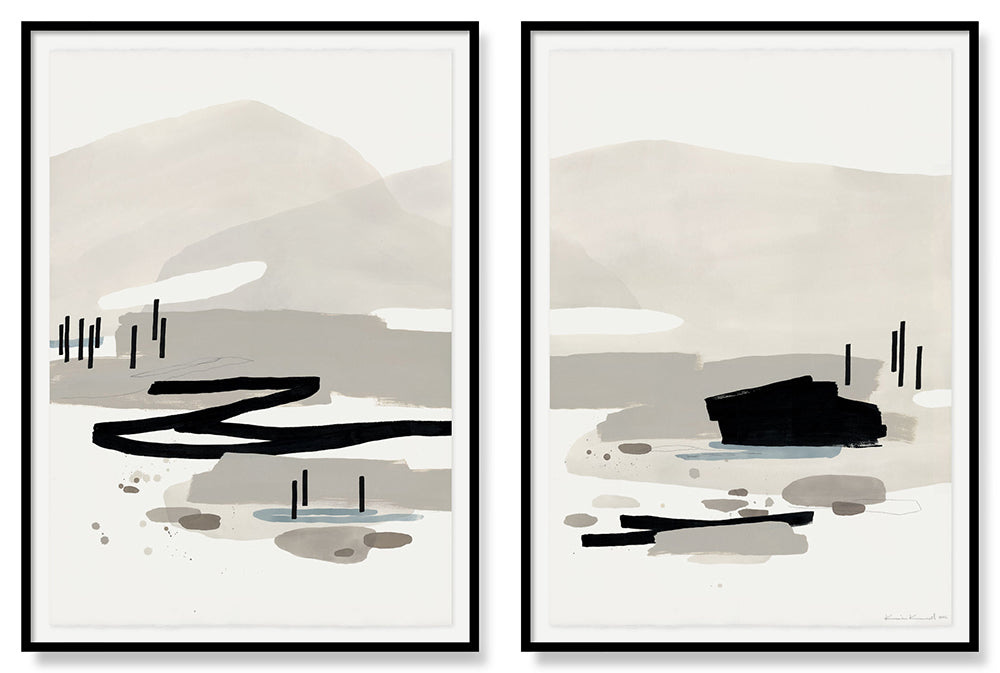

Art

Coastal Waters I & II (Diptych)

Until next time,

✌️