Stealing Signs - Issue 07 (01/03/20)

Mars, Platforms, YouTube, Scouting Reports, and Theo Van Doesberg

Worth Reading

In Mars Co. We Trust

Michael Solana, Quillette

“But even were some government from Earth willing to fund a single trip to Mars—a fairly popular project that NASA has been pretending to work toward for many decades—full-scale Martian colonization is just not politically viable... Our great, Martian task therefore falls to a different kind of co-operative body capable of managing such a production: the corporation.”

A well-thought-out piece on how our Martian civilization might look and who is likely to be responsible for it: the corporation (!). Pretty spot on imo. Market incentives are probably the only thing that will move humanity forward.

Maintaining Platform-Product Fit

Will Larson, Head of Foundation Engineering at Stripe

In 2011, Steve Yegge wrote his Google Platforms Rant, which states "the Golden Rule of platforms is that you Eat Your Own Dogfood," arguing that APIs are good to the extent that the folks developing them depend on their quality and feature coverage. The memo came to mind earlier this week when a coffee chat with a friend veered towards their conviction that Google Cloud lacks necessary functionality because folks within Google simply don't build upon their cloud offering. Amazon, conversely, has their teams build extensively on AWS.”

YouTube Investment Memo

Roelef Botha, Sequoia Capital

“YouTube has a great founding team that has hit on several promising themes. The company follows a trend of user-generated content that started with text (blogs), images (flickr, webshots, ofoto), and audio (podcasting). Video is a natural next step, and YouTube is well positioned to capture the lead. The company has not yet enabled advertising revenue streams. But our checks with Yahoo! An Adbrite indicated very strong advertiser demand for online video advertising. We will rapidly need to surround the company with management talent, specifically a CEO.”

This is a special one for me. I first found this memo about a year ago while figuring out how to write my first “investment memo.” An investment memo is a narrative-style document that VC’s use to pitch an investment to their firm. I used Roelef’s YouTube memo as a template and obsessively studied his writing - sentence structure, voice, document structure, key details included and omitted, etc. This pdf includes some background given it was released as part of a YouTube court case, so scroll to Exhibit #2 for the investment memo. Also, I was shocked that he mentioned podcasting as a key format of user-generated content in 2005 (date of this memo). It’s only blown up in the last 4-5 years as I understand it. Maybe he thought it was huge then or was waaay ahead of the curve. Either way, pretty interesting.

Google Chrome, the Perfect Antitrust Villain?

Alex Danco, Former VC at Social Capital

“This isn’t the first time Google has used this tactic, and it’s a good one: “Oh, nice open source project you’ve got there! You’re free to do anything you want with it, which obviously makes us the progressive good guys of the Free Internet. However, if you want it to actually work in any real-world conditions, then you’ll need to license our proprietary stuff and play by our very particular rules.”

Competitive Moats that Shaped the World’s Largest Companies

CB Insights

“The ‘razor blade business model,’ as it is now known, refers to any business that operates on a combination of low- and high-margin purchases. A low-margin product is priced low enough to attract as many people as possible, while a high-margin product is priced just high enough to create healthy profits. Repetition is the key here. After a customer makes the low-margin purchase, they must make the high-margin purchase continuously. The initial investment psychologically primes customers to keep buying because they’ve already spent money, limiting consumers’ theory of their own choice.”

From OpenTable to Pfizer and IBM to Patagonia, this piece is offers a perfect snapshot of how some of the most effective competitive advantages on the planet were developed. Together, these 19 moats are a great framework for startup assessment - How does Startup X’s moat compare to these world-changing examples? Which additional moats can develop over time and at scale? imo these stories never get old. My favorites on this list are Amazon’s marketplace moat (#1), Google’s data moat (#4), Gillette’s sunk cost moat (#9), and Disney’s knowledge moat (#17).

<stuff> Weekly!

LOL Weekly - Veg Loaf

Music legend(?) goes vegan but, unfortunately, won’t change name. lolllll

Podcast Weekly - From 0 to 1, from Mosaic to Netscape

Mike Maples Jr (Floodgate) and Marc Andreessen (founder of Netscape, Mosaic, and Andreessen Horowitz)

“There were two incoming email inboxes where you could see the flywheel kick in: One was entries for the “What’s New” page...and the other email was “Customer Support” email for the browser, which was the thing that almost killed me, was providing support for the entire internet .”

One of my favorite podcast eps ever is replacing the “Funding Weekly” section since the last week or so has been quiet. Next week will resume regularly scheduled programming.

Absolutely brilliant. Marc Andreessen is obviously GOAT and Mike Maples is a storied VC. Marc dives deep into the Mosaic founding story and is very open about the struggles and lessons learned both with Mosaic and in his life at that time. He’s told this story a bunch, but this iteration is unique. Mike is very vocal throughout and adds a ton of great color.

Baseball Weekly - Predicting Future MLB Players Using Scouting Reports

Jacob Danovitch, Microsoft Intern & Student at Carleton University

Pretty cool application of NLP and neural networks. The study shows that specific words and phrases in scouting reports can predict future performance of amateur baseball players. Their best NLP model produced 56% accuracy. Still a long way to go, but the data suggest that the company I mentioned in Issue #5, Draftpoint, has serious potential.

I was skeptical of their capabilities and disappointed that it wasn’t a significant improvement in player scouting, and instead an enhancement of current practices. I was wrong about the former position - the text mining approach appears to be valuable when applied to scouting reports. The latter position, disappointment that Draftpoint didn’t advance player scouting methods, still stands, I think. This is not a revolutionary approach - still reliant on the same data and evaluation methods. I’ll be very excited when we establish new data sets and technologies for player evaluation.

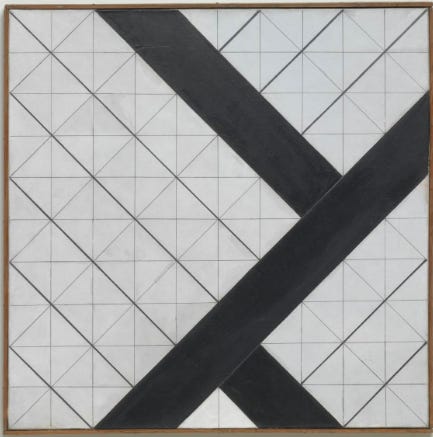

Art Weekly - Counter-Composition VI

Theo van Doesberg

“Curator and writer Magdalena Dabrowski writes that these works ‘illustrate [Theo’s] search for means to convey dynamic quality in art, a quest aligned with the spirit of the contemporaneous theories of the fourth dimension and the space-time relationship’”