Stealing Signs - Issue 14

Email Newsletters, From PM to VC, Moats & Innovation in the Premier League, & Kanye's Sunday Service

Worth Reading

Shots on Goal

Semil Shah, Haystack VC

“Newer investors need the shots on goal to have a chance to catch fire, but over time, the way to generate returns is via concentration, by having conviction, and by taking on more portfolio risk.”

A thought-provoking piece from Semil that forced me to reflect on how I operate as a VC. The way I’ve thought about proving my worth over the past 2+ years has definitely been rooted in the “interim metrics,” as Semil calls them — co-investing in a hot deal or with a premier fund, a company we back raising a huge round, etc. It made sense to optimize for those milestones because they are much nearer-term than an exit and are usually enough to build credibility — essentially, it was the quickest way to demonstrate value.

This thinking certainly evolved over time as I learned more about the mechanics of venture investing, but it’s hard to detach from the excitement of taking many shots on goal and the metrics I think I’m evaluated on, the “interim metrics.” There’s a lot to unpack here, but I really enjoyed this post. Semil perfectly captures the evolution of the venture capitalist and nails the mindset of a young investor.

10 Questions Every Founder Should Be Able to Answer

Dave Kellogg, Entrepreneur, Angel Investor, & Advisor

“I’m admittedly fanatical about this, but I want to know what it says on the target buyer’s business card. I can’t tell you the number of times that I’ve heard ‘we sell to the CIO,’ only to be introduced to someone whose business card said ‘director of data warehousing.’ If you don’t know who you’re selling to, you’re going to have trouble targeting them.”

This post was as helpful for me as I think it will be for entrepreneurs. Some combination of these 10 questions are often discussed, but imo this is a pretty sophisticated take on them. A few of Dave’s explanations made me rethink how I ask questions in pitch meetings, like #7, for example: Who’s using your product and why did they select it? He makes an important distinction between users and “accidental customers” — active users that chose your product while understanding all available options vs. people who didn’t know all of their options or bought it because they have a friend at the company. Founders typically use a slide of recognizable company logos when they talk about current users, but, as Dave points out, I think investors prefer a few deep stories about active customers.

Dave’s explanation for Question #9, “Why are you and your team the best people to invest in,” was helpful for me, too. The “driver vs. passenger” concept is definitely something I struggled with early on in my career. Dave makes the key point that it’s critical to understand what the team did in their previous jobs — did they lead projects and teams or were they just along for the ride? Driver or passenger? It took me some time to understand this early on— I’d often be blinded by founder’s impressive work histories at brand name startups or established enterprises and fail to dig into what they actually did there. It’s aligned with the “interim metrics” concept in Semil’s post above — investing in pedigreed founders is a near-term metric that can help build credibility for young investors, but it’s not how we get paid and ultimately a meaningless metric.

Lastly, Dave’s bonus question is about origin story — tell me how you came to found your company? This is actually my favorite question because the it’s one of the few where the founders can relax a bit and where you can start to understand them as a person rather than a founder. It also goes a long way towards building a strong founder<>investor relationship in my experience.

When a Storied PM becomes a VC

Todd Jackson, First Round Capital

“Jackson remembers one session in particular where he brought a prototype in for review and Mayer told him it was too busy. ‘Marissa told me to go back and add up a point every time I used a new font, font size or color — and that the entire page needed to stay below five points before it could ship,’ he says. ‘She was incredibly rigorous in how she approached building simple products, and I couldn't help but pick that up from her.’”

Some awesome stories from this interview with Todd Jackson, a former PM of Google’s GMail and Facebook’s Newsfeed, and VP of Product & Design at Dropbox. He’s now an investor at First Round Capital and shares a ton of great lessons from his past experiences including building killer products, finding product-market fit, navigating an acquisition, and what’s required to reach an IPO.

I particularly enjoyed Todd’s perspective on product managers-turned founders — he notes they often jump into “execution mode,” letting the excitement of the build take over without thinking about whether the market they've chosen and the problem they’re solving is big enough. I was certainly guilty of this on the investing side at the beginning of my career — I’d sometimes get really excited about a product or founding team and jump right into pitching the company internally without considering the viability of the company, capital requirements, deal dynamics, etc. More “hey this team rocks and they’re doing something very cool,” and less “I think this is the right team to win with this product in x market and the deal makes sense.” Now, of course, it’s much, much more the latter, but there are still times where the excitement about an idea or team is overwhelming and I can’t help but champion it without much diligence! I’m working on it :).

Newsletters and Alternative Trade Routes

Julian Lehr, Stripe

“As other distribution channels are becoming increasingly crowded, email provides an alternative trade route.”

Brilliant post from Julian. He surfaces a very interesting point that newsletters lack the unique design aspects that blogs do (Julian’s blog design is one of my favorites, also love Andrew Bosworth’s blog), a feature that makes blogs feel special. Casey Newton of The Verge also recently tweeted about this — I think it’s absolutely a fair criticism and something Substack will address over time. It’s simple, but a very obvious way to differentiate in readers’ inboxes and with the potential to enable much easier customization then coding one’s own blog

Julian’s note on discoverability is also interesting — while blogs certainly benefitted from reference in other blogs, I think newsletters can and will benefit from the same phenomenon. I think platforms like Substack will build features to encourage writers to reference other publications — maybe a unique embedded content design feature for Substack references (orange highlight?) or a referral program where Writer A can increase their rank on Substack’s “top posts” feed by referencing another Substack newsletter by Writer B, but only after the Writer B “hearts” the post in support (to avoid referral fraud). This would drive readers to more Substack publications — a big time value prop for writers and acquisition & retention tool for Substack.

I’m not quite sure how Telegram blogs will avoid the same fate as traditional blogs, social media networks, and eventually email — overcrowding leading to too much noise for readers to effectively discover and curate content. It seems like just another medium waiting to be flooded with content (I’m familiar w/ Telegram but haven't used it, so I may be misunderstanding it’s functionality).

Moats, Innovation, and the Premier League

Sergio Badilescu-Buga

“…football clubs are involved in a game of ‘red ocean strategy’: they are seeking a stake in a reasonably definite, enormous financial pie. This compares to the typical ‘blue ocean’ strategies that Neumann implicitly makes reference to, where market creation is not only plausible but necessary for the success of an up-and-coming business. This poses a significant problem for clubs looking to crack the European places, as there is an inherent limitation to their ability to become a new incumbent. They can’t invent something radical — at the end of the day, they have to manufacture football success. There is almost certainly no way to make money by losing.”

Famed venture capitalist Jerry Neumann wrote a series of posts suggesting that uncertainty is one of the strongest moats a startup has in the early years. In this fascinating post, Sergio applies this framework to the the Premier League (EPL), one of the top soccer leagues in the world, to explore how small, upstart soccer clubs “disrupt” the large, established clubs that usually dominate.

imo the most effective way to unseat established incumbents in any sport is to invest in young, high risk talent. Sergio nails it with his section on soccer academies, much like MLB’s minor league system and the NBA’s D-League — it’s a pipeline of young talent where organizations develop new talent and take “talent risks” without harming the main team. What’s crucial here is that the “disruptor” clubs can afford to make much riskier decisions in talent scouting and development and prioritize long-term results, while incumbents cannot afford to sacrifice short term results because they are burdened by expectations. As Sergio puts it, for established clubs, excess profit comes from being consistently first, not just consistently competing. The uncertainty moat is the most powerful in talent scouting and development because top talent produces the highest returns — while moneyballin’, as Sergio puts it, can certainly produce success, it’s extremely difficult to sustain. Top talent is more reliable. So, I guess the point I’m making is that the uncertainty moat in talent scouting and development becomes a “certainty moat” faster than any other potential moat and is more sustainable, too.

Sam Hinkie, former GM of the Philadelphia 76ers, echoes this strategy and emphasizes the importance of taking risks on young, high uncertainty talent to differentiate from competition in his resignation memo. Upstart teams must have a high risk tolerance and significant appetite for it in talent scouting and development to unseat the top teams.

I love the anecdote about Brighton — an upstart EPL club owned by an uber-successful professional gambler who appears to be differentiating on data-driven decisions. Will have to dig deeper into that!

So, so much more to unpack here. Phenomenal piece from Sergio and one I’ll be thinking about for a while.

<stuff> Weekly!

LOL Weekly - Debating the Inventor of “Copy & Paste”

lol love this story

Funding Weekly - GumGum

GumGum raised $22M in Series B funding from Morgan Stanley, NewView Capital (an NEA spinout), and Upfront Ventures. This is one of the coolest companies I’ve come across lately. They’re doing some very clever things with AI to customize online ads and with computer vision to track and quantify ad performance. It’s incredibly cool and it’s definitely a company I wish I knew about earlier. We’re eager to learn more about ad customization and the evolution of in-store retail experiences. If you are building or working on a business in this space, we’d love to chat!

Baseball Weekly - In-Market Game Streaming!

I legitimately couldn’t be happier about this news. It’s baffling to me that this is the first time I’ll be able to stream a Cubs game while in Chicago. Previously, due to restrictive media rights, MLB prohibited streaming services, including their own, from streaming in-market MLB games — can’t watch the Cubs in Chicago, the Red Sox in Boston, the Angels in LA, and so on. MLB is constantly looking for ways to grow the game and get in front of younger audiences, but never addressed the biggest problem (imo): game accessibility. Only cable customers could watch hometown games. Not only that, only a few games were aired on basic cable, so expensive cable packages were required to watch the majority of games.

I’m glossing over a lot of detail here, but the long and the short of it is that Chicagoans can now stream Cubs games while in Chicago and I am very happy.

Art Weekly - Sunday Service

Kanye West

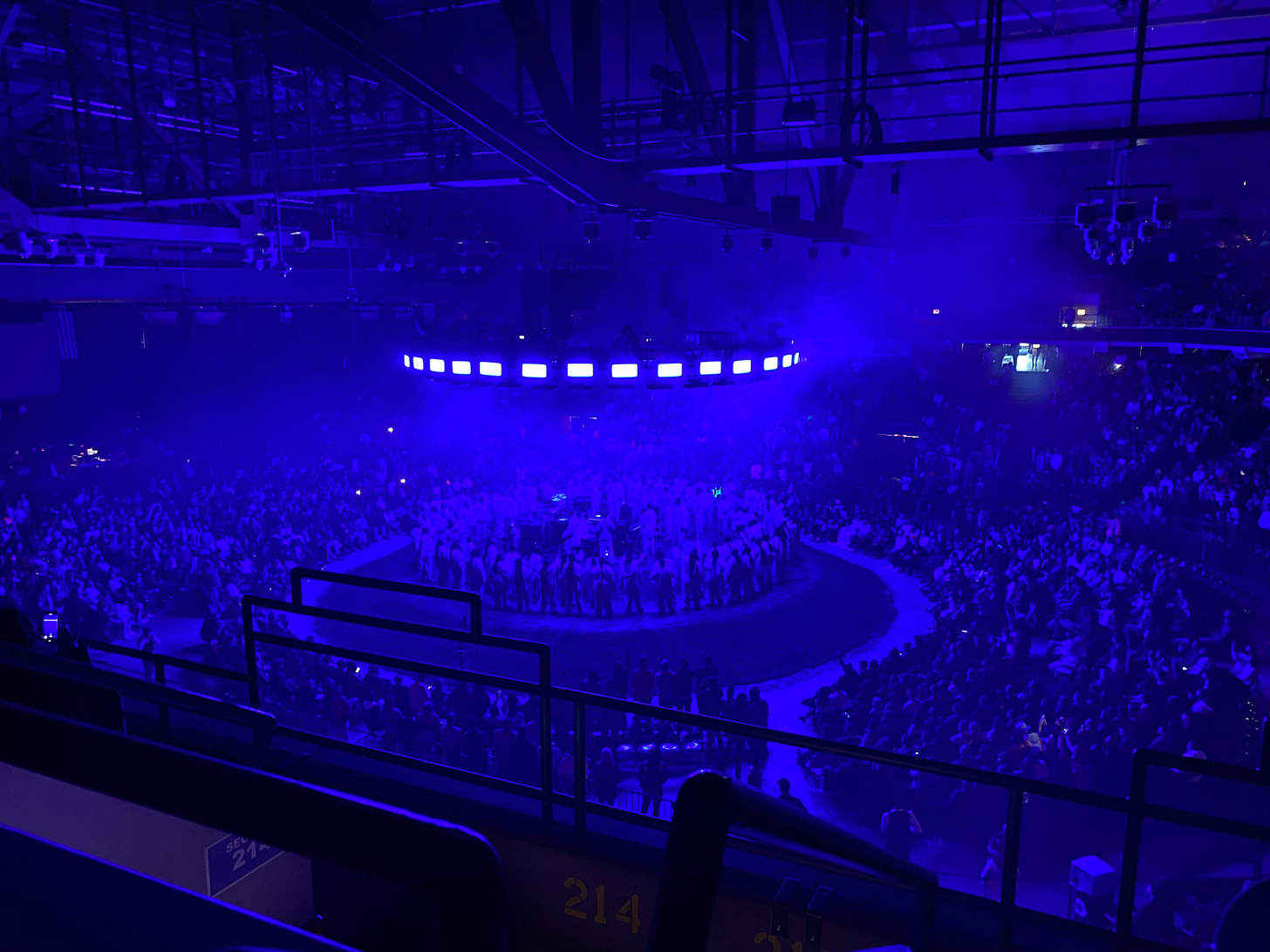

I was lucky enough to snag a spot at Kanye’s Sunday Service last weekend and it did not disappoint. The stage was a large, carefully sculpted dirt platform at the center of which sat a large band. Surrounding the band was a ~125 person choir whose voices filled every inch of the arena. Kanye weaved in a few classics to the gospel-heavy performance like “Jesus Walks” and “Can’t Tell Me Nothing” as well as some more recent hits like “Father Stretch My Hands,” “Follow God,” and “Ultralight Beam.” He ended with a short monologue stating that he doesn’t do “performances,” and instead was just here to tell us what changed him and how he got his mind right.

It was a very cool experience. Huge plus that he played a few of my favorite songs, too, “Can’t Tell Me Nothing” and Follow God.”

Photo cred: my mother (yes, she went!)