Stealing Signs - Issue 17

Wartime CEO, Internal Startups, Where to Build a Marketplace?, Baseball's History w/ Disease, & Kevin Love Steps Up

Quick recognition of an incredibly impressive response to the Coronavirus outbreak. Bravo, Kevin:

Onto the newsletter!

Worth Reading

How VC Associates Can Be Good “Partners” to Founders

Jay Kapoor, LaunchCapital

“Being a high-quality associate doesn’t mean you source the most deals. Your job isn’t to do the most deals, it’s to produce returns on the deals that you do. This comes from being a true partner to founders — even if you are just an Associate.”

One of the best pieces I’ve read about being a junior VC and I highly recommend it to young or new investors.

Jay calls out the importance of “Founder NPS,” the “satisfaction score” an investor is “given” by founders — I made this a top priority from day one in my short VC career. I came into the industry with virtually no work experience, but I’ve always been affable, curious, and able to quickly build a rapport with people. I knew I had to quickly differentiate myself from the herd, so I made it a point to focus on these strengths (after all, I was genuinely interested in every founder I met and curious to learn about their work). The goal was, and still is, to set myself apart from other VCs by building genuine relationships with founders and being an investor they enjoyed chatting with — an authentic investor. In addition to being genuine and interested in a founder’s work, a key component of this approach is transparency — direct feedback about the company, the fund, the diligence process, and next steps. I learned early on that this fostered respect among founders. As a young investor with little tangible value to offer, respect and a genuine relationship were things I could build with the skillset I did have.

Jay also calls out that Associates often get criticized for meeting with founders without doing any diligence in preparation, “kicking the tires” — “The first call with a Founder is not an opportunity for you to start your research into a market.” He’s spot on here and I learned this the hard way. About a year ago, shortly after I was given responsibility to meet with founders solo and run deals through our investment process, I met with an awesome entrepreneur building a consumer social product. We had an intro call and a follow up Zoom meeting which both went well, but the third meeting was what changed my perspective on my interactions with founders. The entrepreneur asked why we needed another call to answer these questions and why the risks I discussed hadn’t been surfaced earlier, as they did not evolve out of newly learned information. He was blunt, direct, and 100% correct. I didn't learn new info or need another call even, but I wanted to chat more with him about the market and business — I didn’t respect his time and he called me out. He taught me a key lesson in how to be a good partner to an entrepreneur as a young VC. We didn’t end up investing in this company, but I have a good relationship with this entrepreneur today and can’t thank him enough for this experience.

Peacetime CEO/Wartime CEO

Ben Horowitz, Andreessen Horowitz

“When Steve Jobs returned to Apple, the company was weeks away from bankruptcy—a classic wartime scenario. He needed everyone to move with precision and follow his exact plan; there was no room for individual creativity outside of the core mission. In stark contrast, as Google achieved dominance in the search market, Google’s management fostered peacetime innovation by enabling and even requiring every employee to spend 20% of their time on their own new projects.”

A classic post from the legendary entrepreneur and VC, Ben Horowitz, that is especially relevant now in light of the Coronavirus outbreak. It appears everyone is a Wartime CEO now.

Product Innovation Through Internal Startup

Henry Edison, Xiaofeng Wang, and Pekka Abrahamsson

“internal startup is an ideal environment to nurture innovation and entrepreneurship in large companies. Although the internal startup is still operating within the corporation, the way of working is different with respect to the traditional research and development (R&D) system. An internal startup takes the responsibility from end to end; from finding a business idea to developing a new product and introducing it to market. Therefore, internal startup is also seen as a learning process to create new competence different from the main business. Competence makes a difference among companies in yielding the outputs.”

There aren’t many thorough case studies on internal startup initiatives inside large enterprises, but this is a fascinating one. The authors study the efforts of F-Secure, a $100M+ Finnish cybersecurity and privacy company, to develop a software product around “people protection” and what they ended up with in 2013 was very similar to Apple’s Find My Friends today.

The case study examines this product, Lokki, from ideation to release, the many roadblocks they encountered with the F-Secures core business and executives, and the often overlooked advantages a large enterprise infrastructure offers. Many of the authors’ findings reflect our experiences at Founder Equity and Digital intent, as we often work with F500-1000 enterprises on internal innovation initiatives and product development.

One of the most interesting findings from the study is how difficult it was for the Lokki team lead to find people within F-Secure that were the right fit for a startup. The team lead was looking to build a full-stack team, from marketing to development to design, but struggled mightily to find people with an entrepreneurial mindset — it took him 2 months to find the right people:

“They all wanted to hear that nothing is gonna happen and we’re gonna be great for years. The problem is I cannot tell that. I mean, I don’t know what’s gonna happening.”

In our experience, this is a common problem for internal innovation efforts at large enterprises and is often the core point of failure. The entrepreneurial mindset is the biggest advantage startups have in competing against incumbents — entrepreneurs seek and embrace risk, they move quickly, encourage cross-collaboration, and question every established norm. This approach is at odds with how many large, established enterprises operate and why they succeed at such massive scale — low-risk tolerance, slow-moving, concrete division of labor, clear hierarchies, etc. This case study is a powerful juxtaposition of these mindsets and provides deep insight into how an internal startup team can navigate an established corporate environment.

I’d love to hear from readers who have come across similar case studies — feel free to DM me @bubjacks or reach out via email at jackson.bubala[@]founderequity.fund

”White Space” for Building a Marketplace

Sarah Tavel, Benchmark

“the fact that more people didn’t buy collectible sneakers from eBay wasn’t a symptom of how big the addressable market was. The opportunity was being constrained by a lack of trust. By fixing that core vulnerability, GOAT not only took share away from eBay, they actually expanded the size of that market opportunity.”

Sara outlines an approach to finding a “white space” in which to start a marketplace business and how to capitalize on incumbents’ vulnerabilities. I particularly like option 1. Look at the large horizontal marketplaces, identify the verticals with low NPS, and use product to leapfrog the liquidity of the incumbent’s supply base. I’ve been thinking a lot about this approach as it relates to the healthcare industry and I think there are some key opportunities here given the industry-wide low NPS. In-home care is a particular area of interest for me here. Option 2 lends itself well to a SaaS-enabled marketplace: Nail a small, overlooked and under-appreciated niche, then land and expand from there. A software tool solving a major pain point for a niche user group seems like a good way to “nail the nice” and build supply with a “sticky” product. Great post from Sara.

Writing for Business

Jerry Neumann, Neu Venture Capital

“You do not need to entertain: a clearly and concisely stated opinion with analysis to back it up is already interesting.”

This memo is jam-packed with useful advice on how to write effectively in a business context. A significant chunk of a VC’s time, especially junior VC’s, is being a salesperson — selling a founder on your firm, selling a Partner on a thesis, or selling the Investment Committee on deal. VC’s also spend a lot of time as project managers — communicating with founders, coordinating schedules, managing documents and information across teams, product and strategy analysis, and lots meetings and emails. Both skillsets, salesperson and PM, require one skill above all else — effective and efficient communication. We use the Amazon-style narrative format for investment memos, so I get to practice this a lot (and have failed a lot!!).

RE: COVID-19 — I imagine the significant increase in remote work will result in a greater need for written documents. Meetings and conversations will move to video chats and calls, but I think written documents can also serve as an effective replacement — the clear, concise, and data-driven documents will stand out among the rest, so Jerry’s framework is especially important!

<stuff> Weekly!

LOL Weekly: Zoom Backgrounds

lol John Collison, Co-Founder of Stripe, with an awesome Zoom background. This feature has been quite popular on Twitter with the increase in people working from home. I’ve yet to find the right one. For those unfamiliar with the background in this tweet, check out this video — it’s an all-time great television blooper.

Funding Weekly: Sparta Science

“ …a leader in the application of movement diagnostic software in the pursuit of human resilience. Sparta Science optimizes health and performance for athletes, warfighters, and patients with evidence-based movement scans and data-driven exercise prescriptions that minimize injury risk and speed effective rehabilitation to physical activity.”

Sparta Science raised $16M from GSR Ventures, Qualcomm Ventures, and Arsenal Growth. This is a very cool company truly innovating on the edge of sports science. This funding round will be used to expand their data science capabilities and “accelerate the deployment of the Sparta System globally to include health systems, hospital networks, and corporations focused on improving the personal health of their employees.” The application of this tech beyond sports is pretty interesting. We’ve seen a number of health & wellness companies over the past year, many of which are taking the employee benefit route — it’s clear people are seeking out a deeper understanding of their bodies and expect more control of their health data. Employers are smart to enable their employees to take advantage of the many advanced tools out there to do so, like Sparta Science.

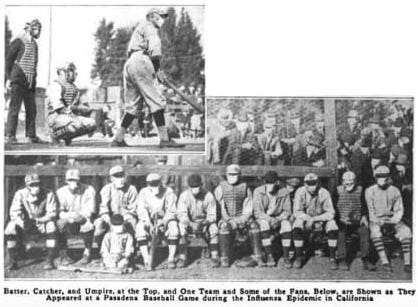

Baseball Weekly: Baseball’s History w/ Infectious Diseases

Emma Baccellieri, Sports Illustrated

Interesting look at baseball’s history with infectious diseases — from the Yellow Fever and Cholera outbreak in the mid 1800s, where men used the disease to justify playing baseball as it was considered a “healthy pursuit,” to the Influenza outbreak in 1918, where the league did not cancel games, but rather required everyone to wear a mask (pictured below). A ton of great links in this piece, too — baseball’s longevity is one of my favorite aspects of the sport. It’s central to so much of American history!

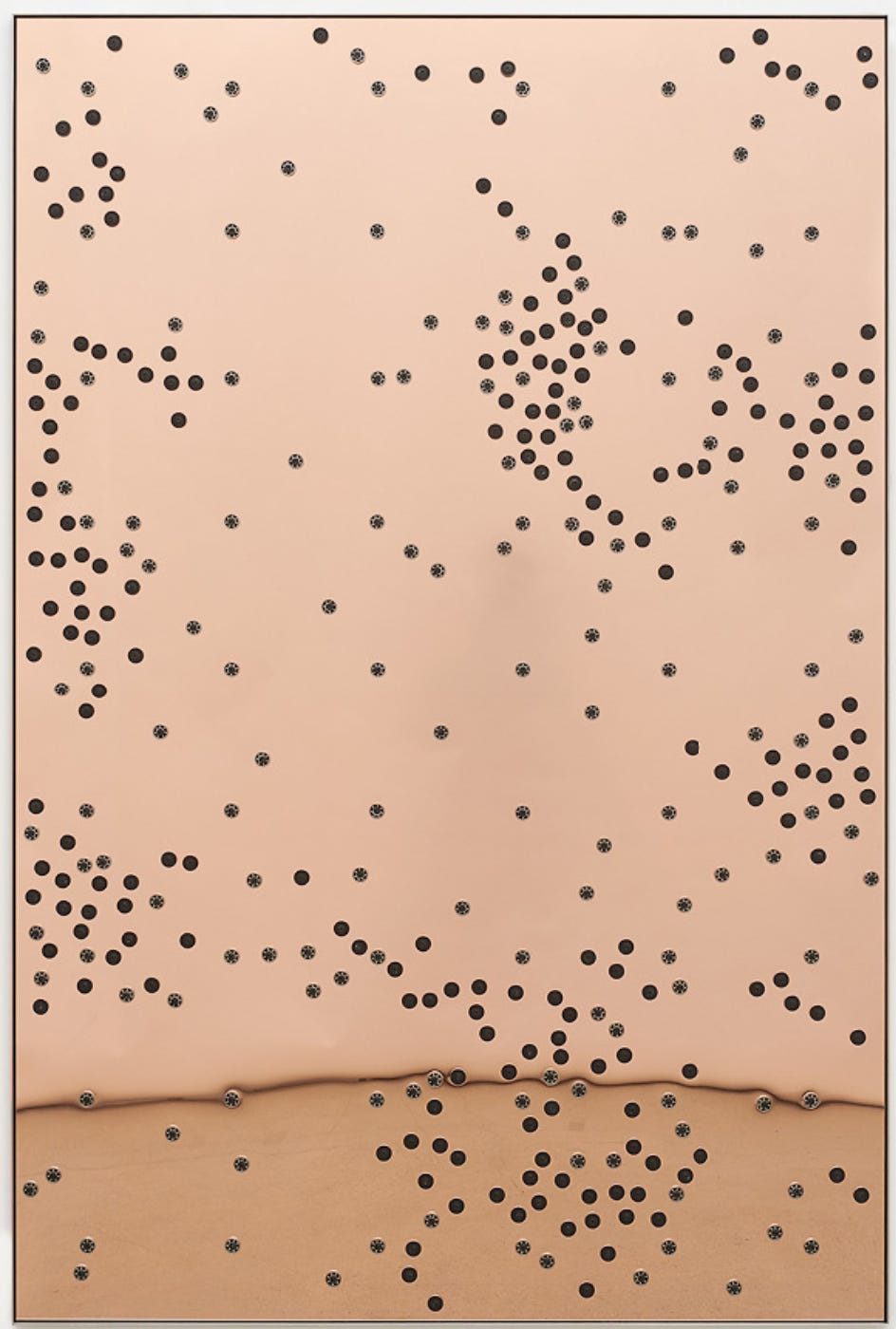

Art Weekly: Spread (2019)

Davina Semo

“I keep coming back to thinking about how strange it is to be alive,” Semo has said, “and how in this time of total connection there is so little attention paid to the fundamental or metaphysical reality in which we exist, which is that there is no way for you to read my mind, and no way for me to read yours.”