Stealing Signs - Issue 21

Chinese Apps & COVID-19, Tock, Bridging the Chasm, Quibi, Player-Avidity Ranking, & Index Ventures's Logo

Worth Reading

How Chinese Apps Handled COVID-19

Dan Grover, Product Manager @ Facebook

To flatten the curve of armchair epidimiology, I should recognize, as a tech guy, I’m clearly not qualified to speculate as to which country’s systems better handled this epidemic. Much is still unknown about the virus itself, the numbers behind it. And political intrigue still abounds in the halls of the White House, Zhonghanhai, and the WHO.

But as someone who’s built apps in both countries, and viewing this crisis narrowly through the lens of apps, there’s no contest. I mean, really. What has Silicon Valley done so far? We’ve added some PSAs to our apps with links to the CDC and WHO, throw in some news and some cutesy clipart

Really interesting post. Dan breaks down how Chinese apps have rapidly and efficiently adapted their products in response to COVID-19, including screen shots with detailed callouts of key features. While he also covers how major U.S. apps, like Facebook and Twitter, have adapted their product in response to the crisis, he’s clear to point out that the U.S.’s response does not compare to China’s swift and comprehensive response.

I’m incredibly impressed by the speed at which Chinese products seamlessly integrated new features to help their users navigate the new, COVID-19 world. More broadly, it’s crazy how quickly China moved their healthcare system online — according to Bruce Aylward of the WHO, they moved nearly 50% of all medical care online soon after the virus hit.

Tock: Spotify for Restaurant Reservations

Connie Loizos, TechCrunch & Nick Kokonas, Founder of Tock

[I wanted a way to] look up every single thing that you eat and what you liked and what you didn’t like and left on the table, and your wife or spouse likes to drink. We were doing that in a very real way [in house, but] we couldn’t share that information with our other restaurants. [That information was] siloed on purpose because of the business model of OpenTable and Booking.com. So I started building it for myself.

Brilliant interview with Nick Kokonas, the founder of Tock, a restaurant reservation software company, and co-owner of The Alinea Group, the famous Chicago restaurant group with which includes Alinea, Next, Aviary, and Roister.

Tock is pioneer of restaurant technology. Their core offering enables restaurants to sell prepaid tickets for meals, which Nick claims drastically reduces the number of no-shows and food waste. Tock is also becoming a data company — a key initiative of theirs is to aggregate many different customer data points, like food and wine preferences important dates, and order history, to enable restaurants to build deeper relationships with diners.

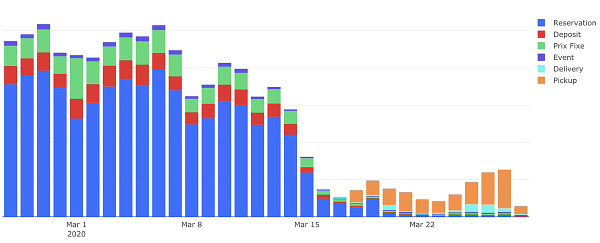

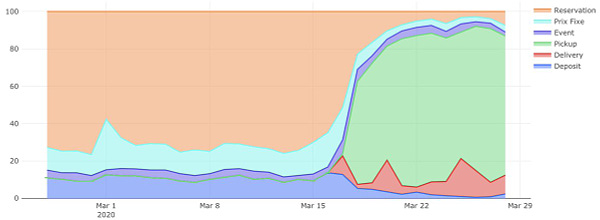

This interview took place pre-COVID-19 lockdowns, so it misses one of Tock’s most impressive feats: Tock to Go. After state-wide lockdown orders in mid-March threatened the collapse of the restaurant industry, Nick and the Tock team spun up software which helps restaurants offer pickup and delivery orders in a matter of days. By March 28th, this offering pushed their “diners served” count back to pre-lockdown levels, and saw Tock adding 30-50 restaurants per day across the world.

Below are two Tweets from Nick with graphs that demonstrate both the speed and success of the impressive “Tock to Go” pivot:

Bridging the Chasm in Enterprise Software

Brianne Kimmel, Work Life VC

There’s a common misconception that enterprise companies are either self-serve or bottom-up. This fallacy creates a fairly large psychological hurdle for early stage companies who view the decision as a binary outcome with immediate impact on engineering, product, and design teams and noticeable changes to company culture as the team begins to hire for marketing, sales and customer success.

This is where Moore’s framework for Crossing the Chasm is easily misinterpreted by enterprise companies. Enterprise startups don’t cross the chasm, they bridge them by building a balanced self-serve and enterprise-grade platform with multiple reinforcements.

Brianne covers the key lessons Michael Grinich, Founder and CEO of WorkOS, learned from interviews with cloud-company founders on the “crossing the chasm.” She then incorporates these learnings into a great analysis of why it’s difficult to cross the chasm in enterprise software.

A common theme throughout the post is difficulties self-serve SaaS companies face when taking on enterprise clients for the first time — enterprise features usually have very different requirements than existing features, they tend to be more expensive than anticipated, and are often low-level integrations and security features… not terribly exciting!

They key insight, though, is that the gap between self-serve and enterprise sales can’t be crossed as Geoffrey Moore defines, instead it needs to be bridged with a balanced, dual approach of both self-serve and enterprise options.

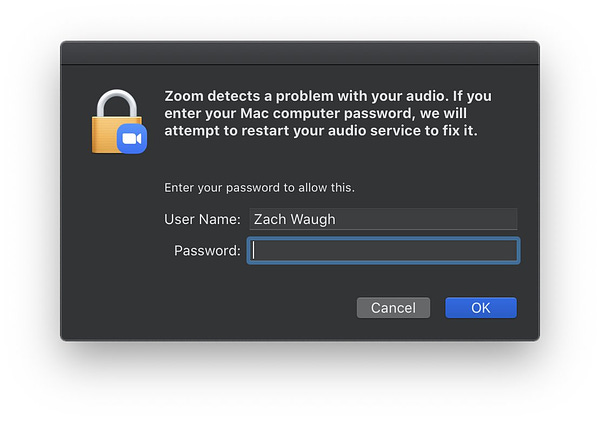

Zoom is a great example of the difficulties in switching from self-serve to enterprise. They’ve received a ton of backlash in recent weeks for glaring security vulnerabilities as a result of prioritizing self-service features and growth over enterprise features, like security, according to Founder and CEO Eric Yuan. The vulnerabilities are evidenced by the rise in “Zoom-bombing” and can also be seen when a user experiences an audio issue — a Zoom pop-up appears asking the user to enter their computer password, which allows Zoom to help fix the issue for them:

These security vulnerabilities have prevented many enterprise clients from adopting Zoom during the COVID-19 lockdowns and may have jeopardized meaningful enterprise marketshare over time. I imagine they’d be better off if they adopted a balanced approach early on, building a self-serve and enterprise-grade platform.

Quibi Will be a Multi-Billion Dollar Company

Nathan Baschez, Divinations Newsletter and Co-Founder of Product Hunt

If you look at the success and failure of various TV shows and movies over time, there’s a clear relationship between “amount invested” and “amount returned.” Of course, it’s not perfect. There are many expensive flops, and cheap successes. But as a general rule, quality can be bought with decent predictability. In fact, there is a stable positive correlation (.744) between budget and box office gross revenue!

Quibi, the new mobile video platform for Hollywood-style content, has been the subject of intense criticism leading up to their launch on April 6th. Many labeled it a failure simply for the fact that they raised $1.75B prior to launch. Nathan, however, is bullish on the new media company. He makes the case that Quibi will prove the doubters wrong and become a multi-billion dollar company — at least more “multi-billion” than it already is ;).

I’m not ready to get on this train yet, but I agree with Nathan that Quibi is not competing in the “streaming wars.” Instead of going head to head with Netflix or Disney+, the long-form content platforms designed for television, they’re competing with YouTube, Insta, and TikTok, the user generated content (UGC) platforms designed for mobile consumption. This is a key distinction and important to understand as it informs Quibi’s content strategy and marketing spend.

The most surprising part of this piece is Nathan’s initial reaction to Quibi’s content:

…at its worst, Quibi reminds us of the default content you get in the back of a taxi or in an airplane seat. There’s a limited selection and they’re trying to please everybody, so it feels sort of “lowest common denominator.

Oof. Brutal.

I’m excited to give Quibi a chance, even if the content isn’t any better than the shows in my late-night rides home from Five Faces (iykyk). One thing I’m curious about is if Quibi’s content strategy will change over time. UGC mobile platforms are certainly here to stay, but I wouldn’t make a 1:1 comparison of Quibi’s content to TikTok or Insta’s content. Similar, but distinctly different. I wonder if Quibi will loosen the requirements on content production over time to shift more towards the TikTok-type content: raw, social, and inclusive short-form videos. I doubt it, but it’d be an interesting move.

Observer Effect

Aashay Sanghvi, Haystack VC

…what are potential consequences of successful investing strategies that have driven returns over the past few years? We don’t pay enough attention to Wall Street and macro conditions as we feign isolation in the early-stage venture environment, but some of the same rules still apply. Spurning the efficient market hypothesis, constructed narratives and observations take their toll on market structures. These are not just markets of securities, they’re also markets of information and information front-running

This is an interesting exploration of how the observer effect, a phenomenon common in the public markets, maps to private technology investing. Aashay also poses what have recently become very relevant and important questions of about the consequences of successful venture investing strategies, namely massive capital injections into companies with astronomical valuations.

I’m a big fan of Aashay’s work — he’s a talented writer and I highly recommend reading through his archive.

<stuff> Weekly

LOL Weekly: Live at Mariano’s

lol so good. What better way to spend your quarantine than attending live, interactive meetups hosted by your local grocery store?

Funding Weekly: Arturo

Arturo combines property images with artificial intelligence to analyze and evaluate property risk at the pricing, underwriting, and renewal stages of the policy lifecycle

Arturo, a Chicago company(!), raised $8M from Crosslink Capital and IAG Firemark Ventures. They provide real-time, granular property data via enhanced imagery — a godsend for insurers and property owners who typically rely on outdated public data to conduct assessments. I’m intrigued by this approach and am pumped for the Chicago startup scene.

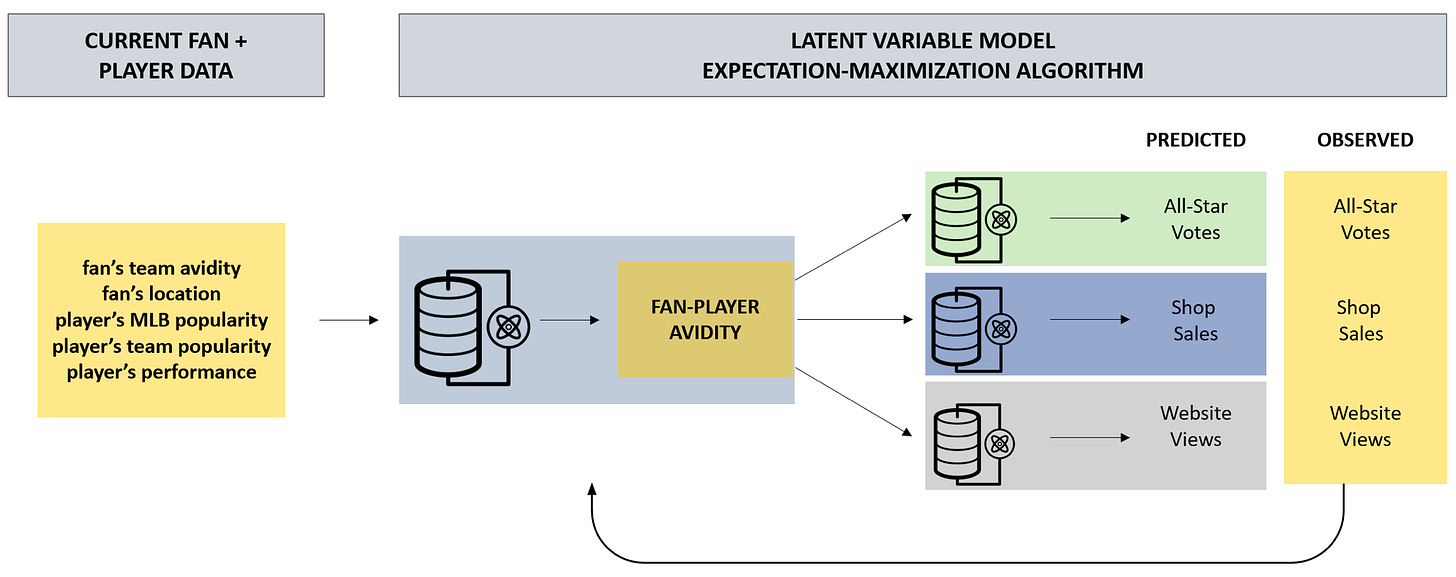

Baseball Weekly: Quantifying Fan-Player Relationship

Frank Lenoir, MLB Technology Blog

Love this analysis of the fan-player relationship from MLB’s Technology Blog. In short, Frank & team develop a “player avidity ranking,” leveraging causal data (factors that may influence a fan’s relationship with a player, like location and a player performance) and behavioral data (actions that the fan carries out, like ASG voting and merchandise purchases) to rank the strength of a fan’s relationship with specific players, enabling clubs to better customize how they connect with fans.

Art Weekly: An Artistic Take on Index Ventures’s Logo

Index Ventures

An artistic take on our logo. We chose the hand as our mark symbolizing the humility, care and effort of entrepreneurs building their businesses. It also stands for our commitment to them as partners in realizing their vision.

This is about as “junior VC content” as it gets, but idc! Index Ventures released an artistic take on their logo with the announcement of their new $2B fund and I love it.