Stealing Signs - Issue 24

Service Marketplace Strategies, Trapdoor Decisions, Future of TV, The 'Pass' Email, & Baseball's Technology Era

Support the Startup Community!

I've been on the lookout for ways to support both startups I know and the broader community, and recently one of the co-founders of Branch reached out with an awesome idea. They're an NYC-based startup that typically furnishes high-end offices, but has pivoted to helping people with WFH setups during the lockdown. They’re having a huuuuge sale right now and discounting ergonomic chairs and desks up to 35%! Further, instead of collecting the affiliate revenue, I’m working with Branch to donate 8% of every purchase by Stealing Signs readers to Good Sports, a charity working to provide sporting equipment to underprivileged youth communities across Chicago, Boston, and New York City.

Check out Branch using this link to support a cool startup and a great cause with your purchase!

Worth Reading

Winning Strategies for Service Marketplaces

Julia Morrongiello, Point Nine Capital

Increasingly, we are seeing more B2B marketplaces enter the SaaS-enabled marketplace category. B2B transactions are by nature more complex, they often involve multiple parties, larger order values, negotiation and complicated workflows. Because of this, B2B service marketplaces must generally focus more on providing value in terms of convenience and trust and, as a result, will need to be more SaaS-heavy than your traditional B2C marketplace.

Valuable insights in this post on the significant hurdles service marketplaces face and the models these marketplaces can leverage to overcome them. Long-time readers know I’m a marketplace junkie — specifically, I’m fascinated by SaaS-enabled marketplaces, which is why I particularly appreciated Julia’s observation in the quote above. Not only do I think her analysis is spot on, but I also think it’s especially relevant in light of COIVD-19. I anticipate that we’ll see many more SaaS-enabled B2B marketplaces because the many businesses have been forced to operate digitally (some for the first time) as a result of the lockdowns. Add in the transaction complexity and complicated workflows Julia calls out above, and I think we have the perfect recipe for an explosion of SaaS tools that also facilitate the discovery of new supply and demand, or a SaaS-enabled marketplace.

Making Trapdoor Decisions

Steve Cheney, Co-Founder of Estimote

Tech as an industry tends to associate “moving fast” with positive progress. Try to de-associate that for decisions that are both high-impact and not easily reversible. Each decision at a startup comes with untold costs which become known later.

The “trapdoor decision” framework is helpful in understanding the costs associated with decisions and speed with which to make them. I found the psychology of trapdoor decisions especially interesting — Steve notes trapdoor decisions often feel empowering in the moment and intoxicate people from the consequences before they’ve played out. He also notes the the tech industry typically associates “moving fast” with positive progress, which, combined the the intoxicating nature of decision-making, results in many trapdoor decisions made too quickly without appropriate consideration of their implications, especially by founders.

Trapdoor decisions are dangerous because they’re difficult to reverse, or hard to undo, as Tobi Lütke, Founder & CEO of Shopify, would say. Tobi outlines how he thinks about decision-making at Shopify in this 2018 interview on Shane Parrish’s The Knowledge Project podcast, which is very similar to Steve’s "trapdoor decision” framework:

The most important thing that people have to understand is how “undoable” is a decision. If an idea is fully undoable, I want people to make it as quickly as they can. The problem is that you can never un-VC fund yourself. When a decision is something that you can’t take back, then it’s worth really really understanding. The most important thing is to get all of the context and then make the decision.

Both Steve and Tobi highlight the decision to take venture funding and likely would agree that it’s the ultimate trapdoor decision. Tobi shares a great anecdote about how he chose to take venture funding for Shopify in this podcast — highly recommend it. Also look out for the taco truck story in this ep!

The Future of TV

Jason Kilar, Founding CEO of Hulu

Consumers are demonstrating that they are the greatest marketing force a good television show or movie could ever have, given the powerful social media tools at consumers’ disposal. Consumers now also have the power to immediately tank a bad series, given how fast and broad consumer sentiment is disseminated. This is nothing short of a game-changer for content creators, owners, and distributors.

Incredible memo from the former CEO of Hulu, Jason Kilar, about the future of TV according to Hulu — in 2011!! He identifies three stakeholder groups positioned to have the most significant impact on the television industry: consumers, advertisers, and content owners. Two insights I found particularly interesting and certainly prescient:

Content consumption is changing due to increasing consumer preference for content convenience — specifically on-demand and multi-device viewing

Social media tools will greatly impact TV content’s reach, relevance, and potentially content creation decisions

Both insights are quite interesting today in the context of Quibi’s content strategy. First, Quibi made a bet on mobile-first content, a play I think Jason would have supported back in 2011, even if consumers were not yet ready for it. Second, Quibi severely limits the social sharing of their content. As cited in this recent Vulture article, Quibi does not allow users to take screenshots in the app and does not have in-app sharing features. More specifically, it’s difficult to make a Quibi show meme! The other SVOD block screenshots in their mobile apps, too, but users can screenshot in the browser versions of the services, which enables meme creation and sharing. For example, Tiger King (Netflix) memes were plastered all over the internet, which, in part drove a national conversation about the show. It’s hard to imagine why Quibi would actively prevent the social sharing of their shows, but I bet it’s a strategy Jason would have advised against in 2011.

The Original Apocalypse

Jeff Fluhr, Craft Ventures & Co-Founder of StubHub

We did not let the climate affect our commitment or end goal. We knew that ticket scalpers and eBay were suboptimal solutions for ticket resale. We knew we could build a 10x better mousetrap and we stayed focused on that ultimate goal. We were naive, but we had grit and kept charging ahead despite the significant obstacles.

Jeff examines 5 lessons from his experience co-founding StubHub at the the peak of the dot-come bubble, March 2000. Each lesson includes fascinating details about StubHub’s GTM, product strategy, fundraising efforts, and much more. As Jeff suggests, the lessons learned in founding a company on the brink of an economic crash are highly relevant for founders in the current economic climate.

StubHub’s shift to a B2C product from a B2B product is an interesting story. The company spent three years building partnerships with media companies and sports teams because they didn’t yet have effective consumer acquisition channels. In 2003, they began experimenting with paid advertising, which at the time was an “innovative new advertising channel” — this experiment quickly drove significant traffic to their site, resulting in a CAC of $30-50, which meant an immediate customer payback period with $60-70 in profit on each transaction.

Jeff points out that, though the team had their sights set on a consumer product from the beginning, StubHub started as a B2B product because it was more “financeable” than a consumer product. Another lens through which to view this strategy is that StubHub started with the supply side of the marketplace. In a sense, StubHub was a SaaS-enabled marketplace because they built white-label solutions for specific teams to sell tickets — while this approach isn’t a perfect SaaS-enabled marketplace, it certainly has elements of the strategy.

Passing On Promising Opportunties

Jake Chapman, Alpha Bridge Ventures

We really believe there is a huge opportunity to know your customers on a deeper level and there should be some type of assessment that the customer enters into as part of the purchase flow. This can create a super valuable recommendation engine for you to keep you customers engaged based on their specific preferences.

For whatever reason, I don't think the [company name] brand is connecting with customers in an emotional or substantive manner. This will be key in creating the organic network effects necessary to lower CAC and create a flywheel for sticky growth curves.

This is an email Jake sent to a company after concluding that it was not a fit for their fund. This is one of the very few detailed “pass” emails I’ve seen in the wild from an investor and it’s fascinating. It’s clear Jake and team have thought deeply about the business and is a great example of what VCs look for in startups. What I appreciate most about the email is that it's a concise breakdown of more or less the entire business — he appears to be evaluating a consumer company and Jake hits on every key point of a consumer business in a few short, direct sentences: customer retention & acquisition, recurring revenue, brand building, and positioning in a crowded market.

<stuff> Weekly

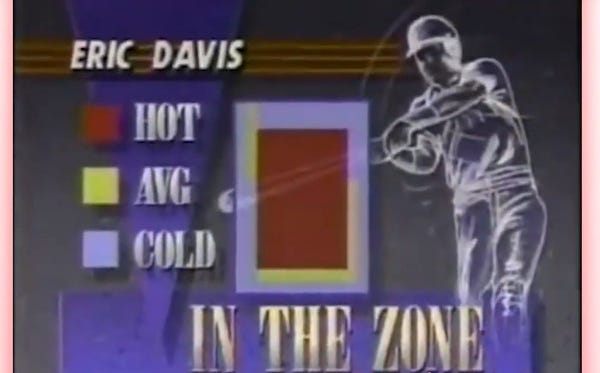

LOL Weekly: Analytics in 1990

lollll

Funding Weekly: Tomorrow Health

By combining technology-enabled operations with personalized service, we curate the home healthcare products, supplies and support best suited for the clinical needs of patients, deliver directly to their doorstep, and navigate insurance benefits on their behalf

Tomorrow Health raised $7.5M from Andreessen Horowitz. This appears to be a (lightly) managed marketplace — Tomorrow helps consumers discover and purchase equipment, but also includes services like navigating insurance benefits for consumers and specialized, high-touch support throughout the transaction.

Tomorrow’s long-term strategy is likely built around aggregating consumers, payors, and providers in one place, which would allow them to facilitate much more than just equipment transactions. I’d bet on the durable medical equipment marketplace as an effective wedge into the broader home health market.

Baseball Weekly: The Technology Era

Chad Jennings, The Athletic

“When I was in the minor leagues — Double A, Triple A — we had video,” J.D. Martinez said during spring training. “It was something you grew up with. You kind of always go back, and you can check something in your swing and it helps you throughout the game. To all of a sudden take that away is a little extreme.”

To be clear, that’s one of the greatest hitters in the game today, and what he finds extreme is not having access to immediate video of each at-bat.

This is an important article calling out the uncertainty technology has created about the rules of baseball. The line between what’s allowed and what isn’t is blurry — the Astro’s were severely punished, the Red Sox merely received a slap on the wrist. As Chad notes, there’s agreement that the Astro’s crossed the line, but establishing that line is difficult.

I’m of the mindset that the benefits of technology far outweigh the negatives — see J.D. Martinez’s quote above. The benefits warrant technology’s place in the game, even if it causes bad actors emerge and rules to be broken. Ben Thompson’s analysis of this phenomenon re: social media is a good analogue — the benefits of everyone having a voice far outweigh the negatives of misinformation.

Art Weekly: Cover Hole, Water (2019)

Kristina Matousch