Stealing Signs - Issue 28

Bon Appétit Goes Digital, Labor Marketplaces, The Prosumer Analyst, How to Pitch a VC, & Re-starting the MLB

Worth Reading

Bon Appétit’s Evolution from Traditional to Digital

Jerry Lu, Advancit Capital

Bon Appétit’s videos aren’t just popular in viewership, there’s a whole fandom that comes with it. The show has spawned various fan-generated product lines, including a podcast, fan fiction, tattoos, and even a Claire Saffitz action figure. And like icing on a cake, there’s even an Instagram meme account dedicated solely to Bon Appétit (@meme_appetit) with over 400k followers and growing.

This is a great breakdown of a flawless transition to the digital world from a brand that started when Eisenhower was President and Peter Pan was in theaters. It hits on themes from two articles in last week’s Stealing Signs (Issue 27):

Gavin Baker’s Why Scale and Loyalty are More Important Online

Bon Appétit doubled down on creator-driven content and played into meme culture by miming their own content post-production. They also incorporated extreme expressions of fandom from viewers in their videos. These tactics helped grow their audience and develop a loyal fanbase, which, as Gavin Baker suggests, are more important online. It’s more important because scale and loyalty helps reduce customer acquisition costs, and brands with highly engaged audiences can win Facebook and Google ad auctions with lower bids than brands whose ads are less likely to be clicked on. I’d bet Bon Appétit’s bet on creator-driven content and social relevance has paid off big time.

David H. Freedman’s Inside King Arthur Flour

Bon Appétit built a new digital relationship with customers via unique video content and social engagement, much like KAF did with online baking classes. In KAF’s case, this helped increase customer loyalty and engage with the massive influx of new demand driven by COVID lockdowns. In Bon Appétit’s case, the digital relationship is largely a customer acquisition strategy to increase scale. Both are impressive examples of offline brands making effective use of digital channels to build new relationships with customers and accelerate their growth loops.

The Next Generation of Labor Marketplaces

Pete Flint, NFX

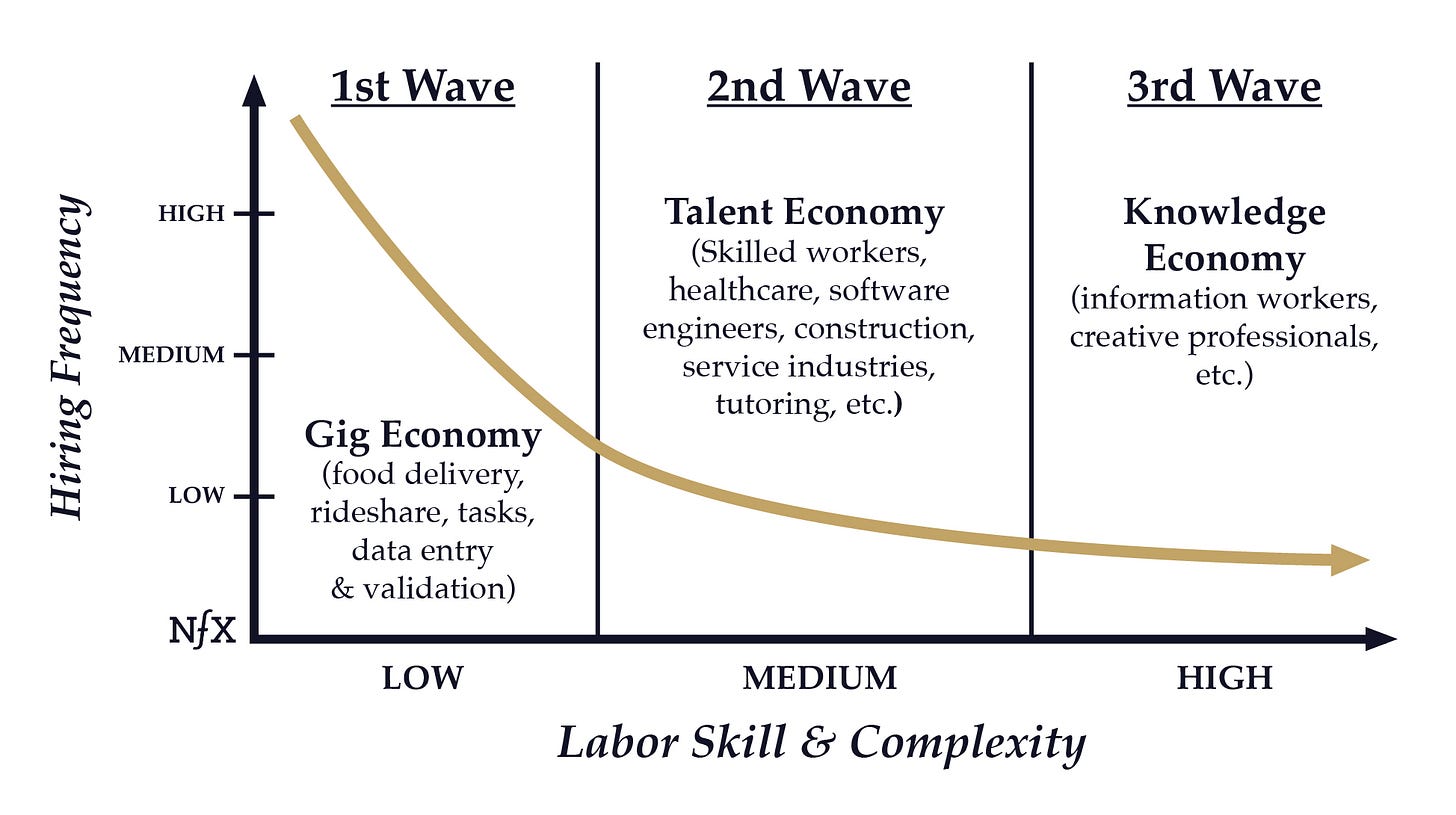

The talent economy is about identifying labor pools that are standardized and attributed enough that demand-side users can quickly find what they’re looking for with an attributed search enabled by internet marketplaces. RigUp is one company to emulate in this space. RigUp matches oil & gas workers to temporary jobs at oil rigs. The labor supply has explicit skilling — definable skills that are easy to assess and label. Also, the nature of the work requires a constant hiring effort.

Big fan of NFX and their consistently awesome marketplace content. Labor marketplaces are a particularly hot topic given the historically high unemployment rate and, as Pete notes, the eventual need for large scale job placement solutions. I like his breakdown of labor marketplace “waves”:

In the quote above he suggests we are currently in wave two, The Talent Economy. I believe healthcare will be one of the biggest beneficiaries of the Talent Economy because the talent pool is standardized enough to quickly match need with labor and the nature of work usually requires a constant hiring effort. One model I’ve spent a lot of time thinking about is a on-demand physical therapy. Mental health and emotional therapy solutions have received a lot of attention and rightly so, but I think physical therapy lacks the attention it deserves. The physical and occupational therapy market was ~$34B in 2018 and is projected to reach ~$46B by 2023. There are roughly 24,000 physical therapy companies of which 94% are single unit operations.

I’ve imagined a marketplace that allows patients to find physical therapists (PTs) for in-home care, since the biggest barrier for physical therapy patients is often mobility. Many exercises can be done in-home with minimal equipment too. The initial GTM strategy could be a SaaS tool to help PTs manage personal clients or run a solo practice, a classic SaaS-enabled marketplace play, which would help prevent disintermediation and allow the marketplace to capture the payment flow. Or, the marketplace could begin as a service for patients who prefer to pay out of pocket and schedule more than the sessions prescribed by their physician, which could work because in-home therapy must be prescribed by a physician to qualify for insurance coverage, and physicians often prescribe in-home therapy for just a few sessions per week for 2-6 weeks, even for rehab from major procedures.

The marketplace may also be able to ignore insurance all together and shift physical therapy more towards an “out of pocket” service due to the high demand from “common patients,” or those who aren’t prescribed physical therapy by a physician to recover from a procedure. I suspect the increasing elderly population will also increase the demand for preventative physical therapy over the next 5-10 years, which is likely a solid candidate for the in-home model.

Rise of The Prosumer Analyst

Jonathan Libov, Product at Bloomberg

While the future of independent business analysis might be impossible to predict, the relationship between analysts like Dediu, Evans and Thompson and their audience of tech professionals appears to be mutually beneficial. One can imagine a variety of ways in which the analyst can add to his toolkit by interacting with the community, while the tech professional acquires a business-grounded skill set that would be costly to acquire elsewhere.

Stumbled across this 2013 article surfaced by Packy McCormick (@packyM) on the rise of business analysts like Ben Thompson, Benedict Evans, and Horace Dediu — all household names in the tech and VC worlds nowadays. It reminded me of the Cambrian explosion of Substack newsletters we’re seeing in tech today. While Jonathan suggests it’s difficult to predict what the future of independent business analysis will look like, I think he did just that in second half of his sentence:

Dediu, Evans and Thompson and their audience of tech professionals appears to be mutually beneficial

A mutually beneficial author<>audience relationship. Exactly. Some of the best Substack newsletter authors leverage audience collaborations to reach new audiences and provide differentiated content to subscribers — it just so happens that many in the audience are newsletter authors too (the Cambrian explosion)! For example, from Packy’s latest breakdown of his lessons learned on the road to 1,500 subscribers:

The world of independent business analysis still revolves around Dediu, Evans, and Thompson, but the analysts and creators of today are leveling up the symbiotic relationship between author and audience and expanding the universe of intelligent analysis.

How to Pitch Founder Collective

Parul Singh, Founder Collective

We’re not a “life cycle fund” — meaning that we don’t typically join successive funding rounds. Some founders think this is odd, but it actually means our interests are aligned with yours going forward. We are never negotiating against your success in subsequent rounds, and there is no signaling risk to other investors if Founder Collective doesn’t join, because we have been very clear about how we typically participate. It also means we can provide truly unbiased guidance as you run your process for the next round.

Love this from Parul and Founder Collective. No fluff — just “this is how we operate,” all in the interest of helping founders better understand the firm and increase their odds of success when pitching them. The thinking behind “not following on” in future rounds is a bit against the grain — I was taught early on that an early investor not following on in a company’s next round is usually a red flag — but I like Founder Collective’s position here.

Parul’s explanation of their thesis, or lack thereof, is also quite interesting:

We’re stage-focused and sector agnostic. We treasure the weird and wonderful… What this means is that we’re not sitting around scoring markets, trying to find every opportunity in a particular space, or looking for a specific type of team composition. We make decisions based on our conviction that we can help you build an exciting, hugely profitable business.

I’m partial to this approach since it’s is very similar to how we operate at Founder Equity. I think it’s an effective strategy for a young fund building its track record and it reflects the focus both we and Founder Collective have on the people behind the companies we see.

<stuff> Weekly

LOL Weekly: Sourcing in a Nutshell…

lolll yup

Funding Weekly: FullStory

FullStory develops software that records user interactions on a website or app, providing product and support teams insight into the interactions of visitors and customers. By adding a script to any website, FullStory records user interactions during a visit, enabling session playback that can replay everything from navigation to mouse clicks exactly as each user experienced it.

FullStory raised $10M from Kleiner Perkins, Google Ventures, and Stripes Group. This is an extremely cool product. I highly recommend watching the demo video on their site. It seems like a powerful tool to help any company manage digital experiences and quickly fix bugs, but especially for the brands with limited digital experience who’ve been forced to accelerate their shift to eCommerce due to COVID.

It's worth pointing out that FullStory has raised nearly $60M in funding before this fresh $10M. This raise suggests either they’ve been hit hard by COVID and need extra help to survive, or that they’re growing so quickly that they need fast capital to execute and fund operations. I’m honestly not quite sure which one it is — think it makes sense to go with crazy growth, but the $10M in funding isn’t all that much for a 200 person operation that raised $32M last April. I’ll defer to the more experienced VC’s on this one.

Baseball Weekly: Re-starting the MLB

Roger Ehrenberg, IA Ventures

The owners have fixed costs (like stadium leases and/or maintenance, supporting the farm system and supposedly player contracts) that need to be covered regardless of revenues, so on a cash flow basis the lack of baseball is costing them real cash. But guess what — this is what being an equity owner is — benefiting from the ups but paying for the downs. But that’s not what the owners want — they want the highly compensated players to help cushion the blow massively, without any return for what is an implicit financing of the owners by these players.

This is a great perspective on the heated negotiations between MLB players and club owners to get the league re-started. MLB club owners own the equity, which means, like an equity owner of any other business, say, a VC, they benefit from the ups and pays for the downs. In this case, though, the club owners want the players to help cushion their losses via unfairly prorated salaries instead of “paying for the down” themselves like any other equity owner would be forced to do.

But, that’s not all. The players and owners already agreed to different prorated salaries (yellow) than what the owners came back with on Tuesday in their new proposal (red):

source: Redleg Nation Blog

Pat’s tweet sums it up pretty well:

Art Weekly: SHORT STORY

From the König Gallery in Berlin:

Short Story sets the stage for a match between two boys. When entering the gallery space visitors will encounter an almost full-size tennis court, slightly raised off the ground. A net in the middle divides the two players and creates a sort of horizontal diptych. The white lines painted onto the orange-brown ground surface not only indicate the set rules of the sport, but also visually remind us of the grid principles of Modernism and the road markings that regulate our behavioural patterns within public space.

That’s all for this week — thanks for reading!