Stealing Signs - Issue 30

Business is the New Sports, Social eCommerce, Amorphous Organizations, Value & Tech Investing, MLB Owners at it Again, & Squire Technologies

Worth Reading

Business is the New Sports

Packy McCormick, Not Boring Newsletter

Consumer software companies’ market dominance means a couple of things:

First, those that have "invested in what they know” like software companies have become super fans. Success deepens interest and fandom in the same way for businesses as it does for gamblers who pick the winner of March Madness. Early fans of software businesses have ridden that wave from amateur investor to seeming genius.

Second, we now care about companies’ strategies because strategy dictates both the returns our holdings generate and the products we use. Strategy guides product decisions, and product decisions guide our interactions - how long we stay on an app, how much we pay, how we speak to each other.

Business is the new sports. The two most interesting data points that support this claim are 1. CEOs are as accessible as ever and fans, or supporters, are able to interact with them like they do their favorite superstar athlete, and 2. “Investing in what you know” looks a lot like sports fandom.

CEOs = Superstar athletes. As Packy notes, Twitter democratized communication between CEOs and their fans. It’s never been easier to engage with the people running the largest, most successful companies in the world, and this has sprouted a CEO/Company fandom much like what exists in the sports world — fans idolize certain players or teams and actively engage with them through social media like Twitter and Instagram. For example, I learned through a series of tweets that Shopify CEO Tobi Lutke was a competitive Starcraft player growing up. His playing experience informs much of how he approaches business strategy and he even builds in budget to buy the game for any employee who wants it. Through these tweets and many more, Tobi has earned himself a passionate fan ;)

Investing in what you know = sports fandom. The “invest in what you know” strategy was first coined by famed investor Peter Lynch when advising retail investors on where to start their investment research — Love your new shampoo? Buy the stock. Today this looks more like, “Love your eCommerce platform? Buy the stock,” but it’s been an extremely profitable strategy for many. The biggest shift here is that the “what” in “what you know” has changed dramatically, similar to the shift in CEO accessibility mentioned above. The meteoric rise of business newsletters, twitter activity, and in-depth business writing on the internet has given everyone access to information and analysis of the most successful and exciting companies in the market, which mirrors the access sports fans have to their favorite teams — fan forums, in-depth player rankings and analysis, tweets from the top players — endless information.

We “know” as much about the companies we care about and interact with everyday as we do the stats of our favorite team and players, which has given rise to company and CEO fandom much like the hometown team and superstar athlete fandom that’s at the center of our society.

Pinduoduo & Social eCommerce

Li Jin, Andreessen Horowitz & Ada Yang, Pinduoduo

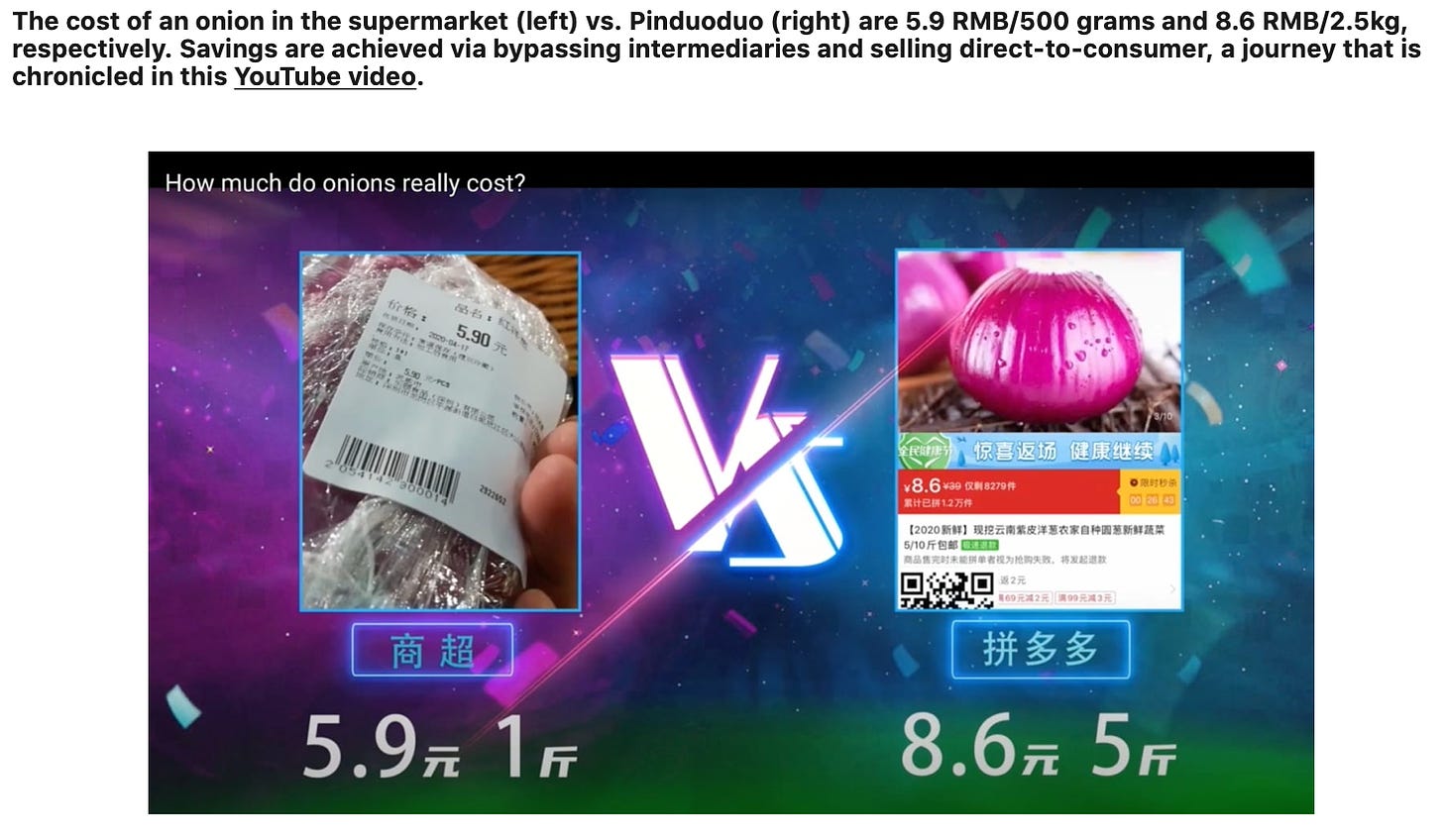

Farmers are seldom seen or heard but have found their voice on Pinduoduo, which has become China’s largest agricultural e-commerce platform. Agricultural sales represent nearly 15% of total GMV on the platform.

In mid-April, potato farmers in Shandong province hosted a livestreaming session, welcoming more than 600,000 users to visit their farms, virtually. Users saw in real-time how farmers dug up potatoes and could purchase them through the platform. It’s akin to the direct connection and relationship you might build with producers at a farmers’ market, but because of Pinduoduo’s digital platform, customers can purchase from merchants all over the country and enable them to become much bigger businesses.

Pinduoduo is pioneering social eCommerce in China and has laid a path that U.S. giants Facebook and Instagram appear to be headed down. A core component of Pinduoduo’s eCommerce platform is that anyone and anything can succeed. For example, agricultural products account for 15% of Pinduoduo’s GM, or $21.7B. Again calling from the quote above, potato farmers in Shandong province attracted 600k users to visit their farms virtually through the platform 🤯. Zooming out, Pinduoduo attempts to virtually recreate the in-person shopping experience with real-time interactions with friends, other shoppers, and shop staff — a problem yet to be solved in the U.S. market.

As both Ada and Li note, Facebook and Instagram appear to be following in Pinduoduo’s social eCommerce footsteps. Ada calls out key hurdles for FB and Insta related to U.S. consumers’ relationship with the internet, mobile, and payments, but it’s clear both companies are forging ahead. Ada also alludes to an important advantage for FB and Insta — Pinduoduo pioneered the social-recommendations model in eCommerce, but FB and Insta are much better positioned to apply these models because they have much richer social data from their users. FB and Insta have the advantage of being social network first, eCommerce platform second.

While their eCommerce offerings don’t pose legitimate threats to Pinduoduo today, FB and Instagram are following the path Pinduoduo paved with significant advantages in Pinduoduo’s primary competitive domain — social-recommendations in eCommerce.

Amorphous Organizations & YC

Vaughn Tan, The Uncertainty Mindset

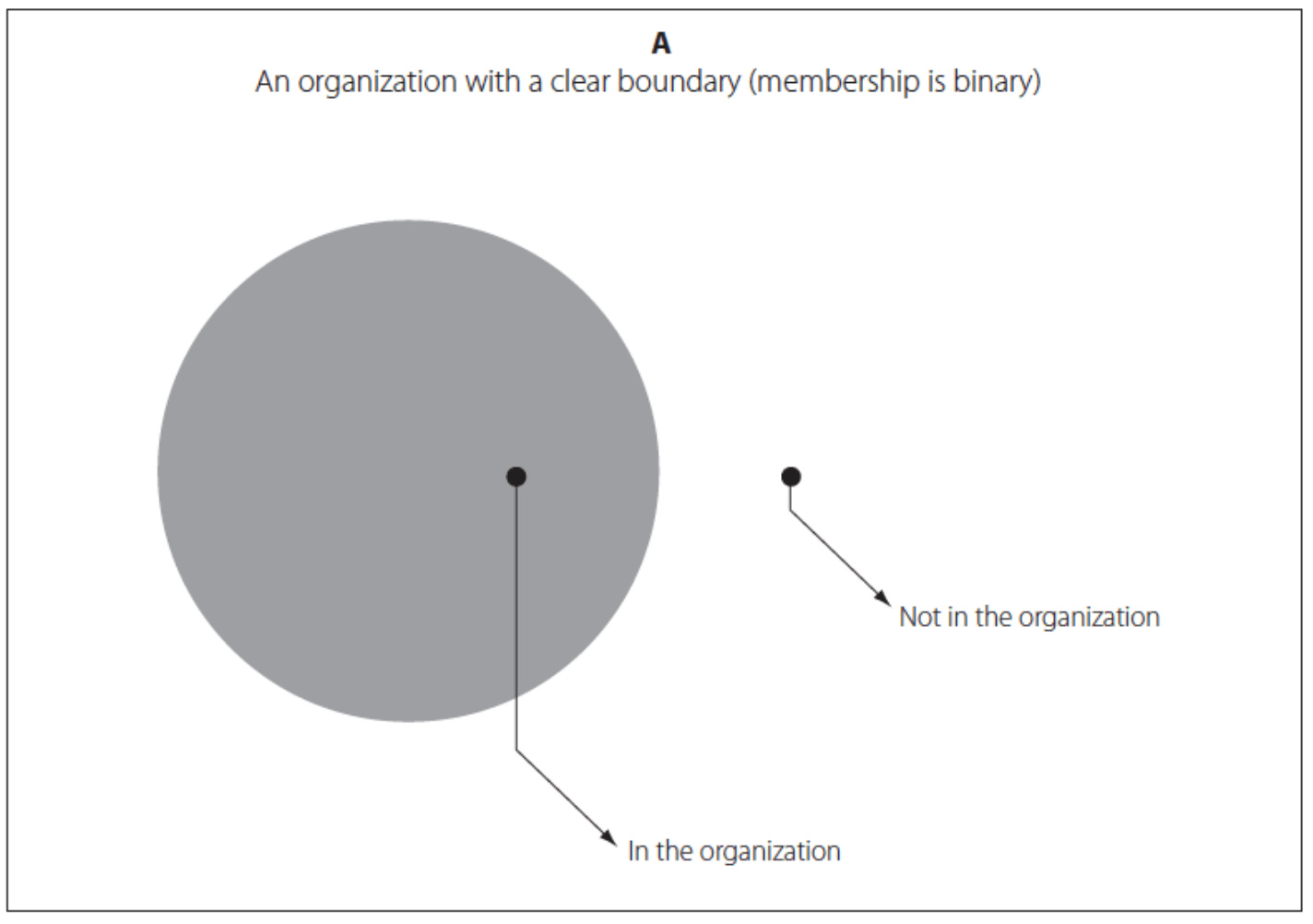

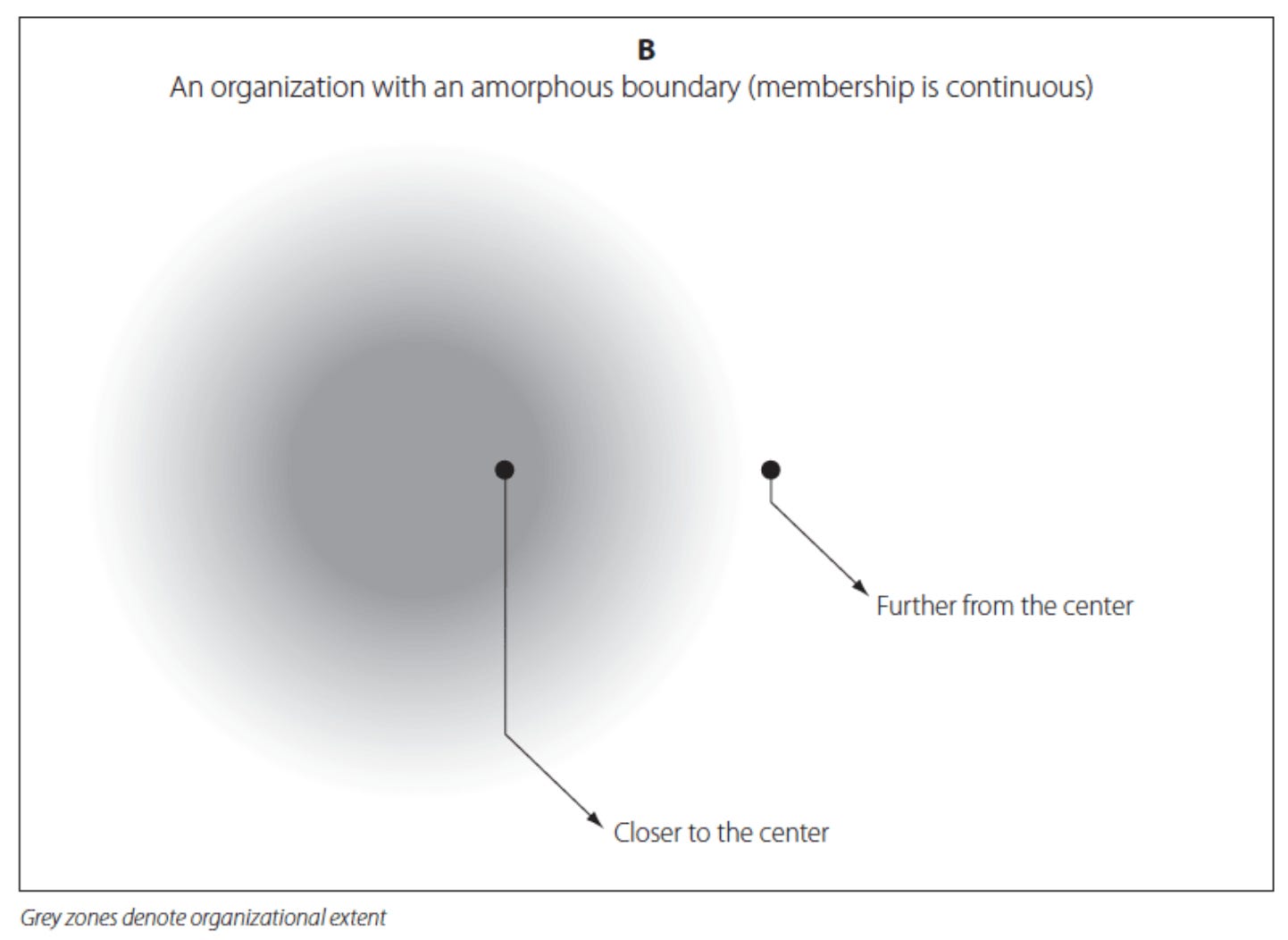

This is a logical property of amorphous organizations that arises from the diffuseness/ unclarity of their boundaries:

The less clearly defined an organization

→the less clearly defined the criteria for belonging to the organization→the more diverse the participants can be and the more diverse their ways of participating in the organization.

Vaughn’s analysis of amorphous organizations is both insightful and timely as we’re experiencing near peak “uncertainty” and organizational resiliency faces its toughest test in recent memory.

To summarize, amorphous organizations are more inclusive, more diverse, have more variable participant quality, and have more uncertainty about participant commitment. The notion that increased uncertainty about member roles and contributions in an organization creates better conditions for that org to adapt to uncertainty is counter-intuitive. But, take an early-stage startup, for example. I’d bet anything that if you ask an early employee at a young startup what they do, they’d say, “uhh, a little bit of everything…?” That’s because it’s true — they are doing a little bit of everything. And this is exactly what gives startups an advantage over incumbents and established companies. Early stage co’s are very good at adapting to uncertainty because roles and member contributions are undefined and open-ended, not in spite of them — this is very unlikely to be true at incumbent organizations. The roles at this org are likely well defined and they probably strive for as little uncertainty as possible, which creates poor conditions for adapting to uncertainty. This is why startups can win.

The Unified Theory of Value & Tech Investing

Ian Rountree, Cantos Ventures

Armed with this new framework (Helmer published 7 Powers in 2016) I’ve been judging Cantos’ investments in new light, notably with greater confidence intervals around upside potential which in turn allow me to flex my valuation standards when multiple powers are present and/or their magnitude is sufficiently high. The holy grail for me, especially given my dispositional focus on frontier tech, is when a cornered resource produces network economies, counter-positioning, and/or high switching costs.

Ian’s analysis of Hamilton Helmer’s 7 Powers, or business defensibility drivers, from the perspective of an early stage VC identifies arguably the toughest challenge in investing — identifying defensible moats before they emerge. He also identifies an important difference in the challenges modern investors face in moat identification and analysis compared to their historical counterparts — the emergence of technology-driven moats. These moats are built on software principles — near infinite scale and rapid growth — and are difficult to pin down because they can emerge from seemingly nothing and grow at paces we never though possible before. They’re formed and grow in different ways than non technology-driven moats.

<stuff> Weekly

LOL Weekly: Net Profitability

LOLOLOL

Funding Weekly: Squire Technologies

Led by Songe LaRon, co-founder and CEO, and Dave Salvant, co-founder and President, Squire provides barbers and shop owners with the ability to operate their businesses with cashless and contactless pay transactions, thereby streamlining service interaction and helping them earn and retain loyal clientèle as a result. Tools include Point of Sale, Scheduling, Payroll, CRM, and a host of other features.

Squire raised a $34M Series B round led by CRV, with participation from Tiger Global, San Francisco 49ers organization, and the former CEO and Chairman of Infor, Charles Phillips, and existing investors Trinity Ventures, 645 Ventures, Comcast Ventures’ Catalyst Fund and Y Combinator.

The first question I asked myself was “why do barber shops need special management and POS software?” I believe the answer is: they don’t. From poking around on Squire’s site, it doesn't appear they offer any significantly differentiated POS or management features — instead many things existing POS and business management software does today. The same things a sandwich shop or retailer might need. Y Combinator calls Squire the “OpenTable for barbershops,” which doesn’t quite feel right because restaurants didn’t have many digital reservation options at the time OpenTable came around. My guess is barber shops, on the other hand, face the same challenges retailers and sandwich shops face, and they have many POS vendors to chose from: Square, Shopify, ShopKeep, Revel, Vend…

So, how did Squire “win” here? Well, from the looks of it, they created a killer brand that resonated with barber shop operators. It's an interesting case of “build a brand to sell a product,” which is the MO for many direct consumer companies, but not many b2b companies. Their success to date is extremely impressive — I’m curious to learn more about how they got here. Was it the brand? Do barber shops have different needs than retailers and sandwich shops?

Baseball Weekly: MLB Owners — Capitalists in Good Times, Socialists in Bad Times

Roger Ehrenberg, IA Ventures

Reading the cries of poverty by multi-billionaire owners around short-term cash flow issues leaves me cold. But somehow, some way, they get mainstream media to go along with the notion that pandemic-induced cash flow problems are the players’ problem, and that the players have to be the ones to bridge a large share of the cash flow gap suffered by the clubs in 2020. So, in rough times, you effectively ask your creditors (read: players) to restructure their debt to help cushion your pain. Oh, and you use the court of public opinion to put pressure on your creditors to restructure or else they’re “greedy” or “ungrateful”. Conversely, in good times, you simply pay your creditors what you owe them and give them -0- of the upside associated with the rising tide.

Roger has knocked it out of the park with his analysis of the MLB player and owner negotiations to re-start Major League Baseball. This piece does not disappoint. It’s never been more clear to me that MLB owners simply do not care about bringing baseball back this season.

Art Weekly: Flowers with a few Colours

Nicolas Party