Stealing Signs - Issue 34

Moving FaaSt, Modern Brand OS, Empowerment Loops, The Rise of Superpower Tech, and Hallo x Founder Equity

Worth Reading

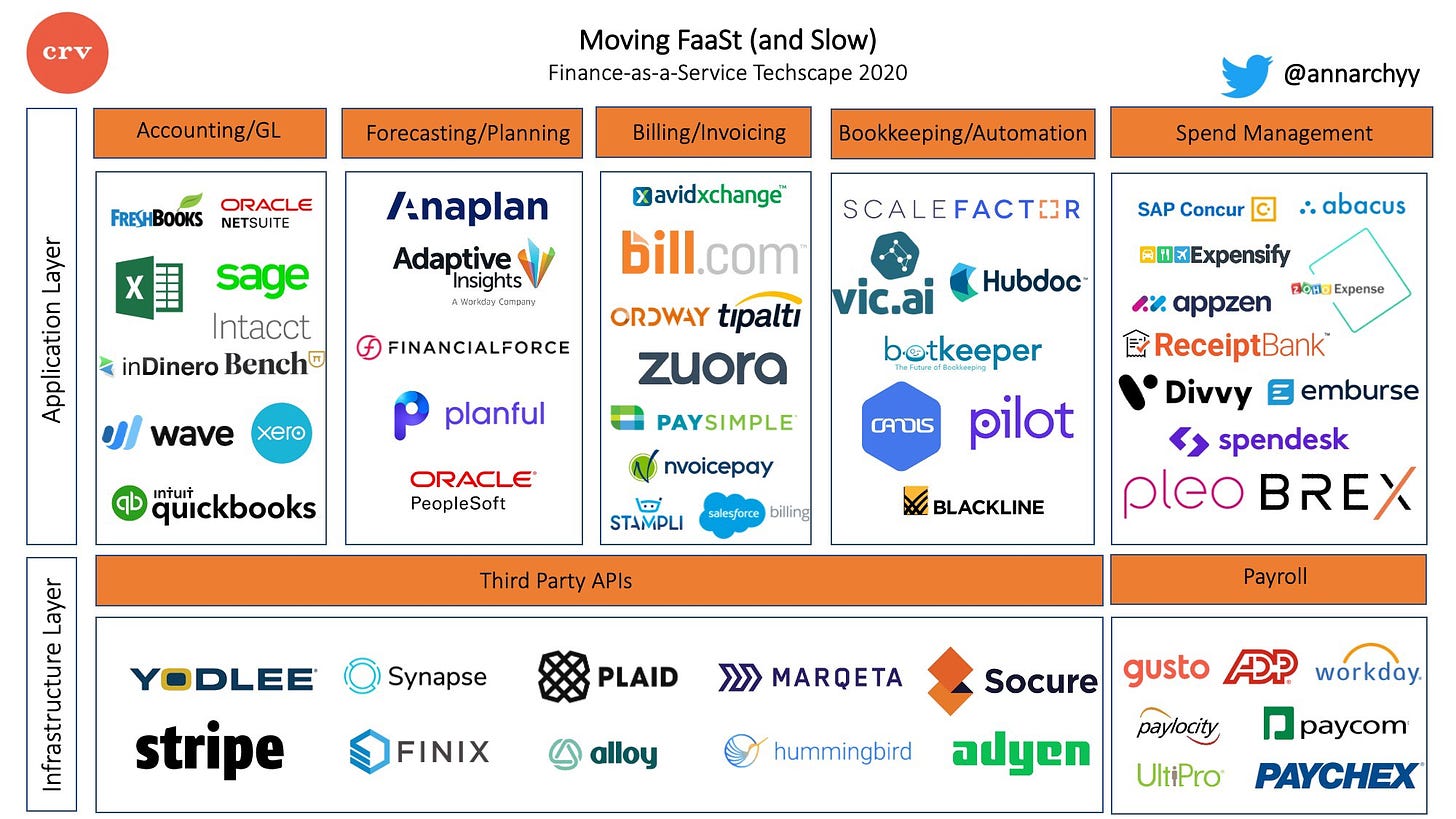

Moving FaaSt: The Finance-as-a-Service TechScape

Anna Khan, CRV

The first wave of innovation in FaaSt was an attempt to replace the general ledger. The majority of Intuit’s revenue was still coming from Quickbooks Desktop and they were struggling with their Quickbooks Cloud product, Quickbooks Online (QBO). This made others believe there was a window to build a better cloud version of what Quickbooks offered today. Lots of companies attempted to build a general ledger from scratch but found it incredibly hard. What seemed easy to replicate had actually taken years of infrastructure and product strength within Intuit.

Anna outlines the three waves of innovation in “finance-as-a-service technology” centered around the general ledger, which Intuit, the behemoth in this space, perfected to acquire an 80% marketshare:

Replacing the General Ledger

Unbundling Intuit

The Great Re-bundling

She suggests we’re in the later stages of wave 2 and slowly entering wave 3, The Great Re-bundling, where new cloud entrants are offering multiple solutions, not just bookkeeping or billing, thanks to robust infrastructure options and improving bank integrations. JIFFY.ai is one interesting company that fits with this re-bundling trend and may deserve a spot on Anna’s market landscape in the Bookkeeping/Automation or Forecast/Planning sectors. Their offering is centered around general task and process automation, but one core solution is finance and accounting automation:

Finance and accounting errors can lead to substantial losses, misrepresentation of earnings, and significant reputation impact. Many of the processes are susceptible to human error and oversight. A small mistake in one area could have repercussions throughout the company and beyond, and is a risk that you can’t afford. Finance and accounting teams need an automation tool that speeds up execution without compromising on accuracy.

JIFFY.ai raised an $18M Series A round from Nexus Venture Partners, Rebright Partners, W250 Venture Fund, and executives from Atlassian, AssetMark, Costco, Nissan, and SunGuard Wealth. My guess is their roadmap includes a strong push into finance over time and Anna’s post serves as a great starting point for which areas to attack.

Another company that may deserve a spot on Anna’s market landscape is Prophit.ai, a Cleveland, OH-based company using machine learning to optimize tax payments for enterprises. Prophit.ai identifies tax over and under payments before payment extraction to prevent overpayments and reduce reverse audits. According to their site, corporations pay ~$30B/yr in sales tax on purchases that are actually tax exempt and get charged 35% in reverse audit fees to recover that money. That’s a lotta dough!

The Modern Brand OS

Ana Andjelic, CMO of Mansur Gavriel

As a strategy, modern brands represent a specific business model. This model unlocks new sources of value at the time of economic involution. Modern brands make their products and services valuable beyond their function and utility; they build an architecture to deliver new value (like subscription or membership); and then find a new way to harness this value and turn it into profit.

Ana explores a critical strategy in the consumer world and one that’s increasingly present in the consumerization of enterprise: brand building. In this piece, Ana calls companies building brands as a path to a viable business “Modern Brands.” One characteristic of a Modern Brand worth digging into is “Awareness over accessibility.”

Awareness over accessibility. In other words, modern brand create fans before they create customers. This is readily apparent with consumer companies like Casper and Allbirds because competition is so fierce in this arena that competitive differentiation is rooted in brand and brand awareness, not product. Do customers relate to the brand and align with what the brand stands for? Are they fans of the company in addition to being customers? These questions are as important to answer for consumer companies as questions about margins and CAC.

We also see the increasing importance of brand building in software companies, especially enterprise software, as decision makers increasingly sit near the bottom of the org chart and organizations increasingly adopt consumer-like solutions for business use — the consumerization of enterprise. Decision makers in organizations no longer sit in the c-suite or siloed away in the IT department, rather any employee or team leader often has the power to use tools that fit their needs. Further, employees are increasingly bringing tools they use at home or for personal use into their organization for businesses cases. This phenomenon requires enterprise companies to build a strong brand because adoption and sales are now dependent on how passionate employees are about their tools. As discussed in the consumer world, passion for a company and their products or tools is rooted in users alignment with the brand.

Another sector where awareness precedes accessibility is the rapidly emerging creator economy. Creators in this economy start by building a following and then create a product or service, converting their followers into customers. It’s common among the new wave of Substack writers, social media influencers on TikTok and Instagram, and even individuals with expertise or experience in a particular domain branching out to start their own business. Social media both enables this strategy and amplifies it’s effects. Be funny, creative, or talented —> Build a following on Twitter by saying and creating interesting things, engaging with people with large followings… or building a brand —> charge money for a product or service to convert followers to customers. So, in this example, individuals can be Modern Brands, too.

Empowerment Loops

Brett Bivens, TechNexus Venture Collaborative & Venture Desktop Substack

The arc of progress is shaped by society’s ability to lower barriers to participation in valuable activities. We move forward when we ramp up accessibility. This is true across the spectrum — from sports and content creation to education and work.

Empowerment loops are “the cycle when a company makes participation in the core activity its product or service is built around more broadly accessible.” These loops lower the barriers to entry for an activity and in doing so create a new "economy" around the activity. The three core components of a company built on empowerment loops are:

They lower the barriers to entry and access

They shift the competitive goal posts

They create a new economy around the redefined activity

Brett cites three stellar examples in Nike, TikTok, and Figma, and below are three additional examples I think fit his framework well:

Substack empowers everyone to be a writer by lowering the barrier to creating a newsletter. Nearly everything is taken care of. I set Stealing Signs up in less than 5 minutes. I imagine Medium also had this loop in mind when they began, but I think Substack’s empowerment loop is stronger. Substack is the place to start writing, not just a place to write. As often mentioned in Stealing Signs, we’ve seen a Cambrian explosion of new newsletters over the last 6-12 months and, anecdotally, Substack has become a generic trademark. Much like Zoom got the verb treatment (let’s hop on a Zoom vs. let’s hop on a video call), Substack has become the term used for starting a newsletter — I have a Substack vs. I have a newsletter. Substack embodies all three components of a company built on empowerment loops — 1. Lowers the barriers to entry in creating a newsletter, 2. shifts the competitive goalposts by building the best tools for anyone looking to write, not just writers, and 3. created a new economy around the nuts and bolts of writing a newsletter by enabling writers to charge for subscriptions.

Shopify empowers anyone to turn their craft, hobby, or passion into a business. Shopify also embodies the core components of a company built on empowerment loops: 1. Lowers the barriers to entry to start an online business, 2. Built the best tools for anyone looking to build an online business, not just businessmen and women, and 3. Created a new economy around the nuts and bolts of selling online by being a platform on which external developers can build apps for Shopify customers.

Runway empowers everyone to understand business financials. Numbers are no longer locked away in the CFO’s office or the accounting department — instead they’re approachable and accessible to everyone in the business. From Andreessen Horowitz’s blog post on investing in Runway:

We see a similar opportunity around finance today. The CFO’s office spends so much time closing the books, nagging business unit leaders to fill out resource planning spreadsheets, and manually creating reports that they hardly have the time to be the strategic partner the CEO needs. And those in the company that are empowered to manage spend don’t have access to the data. I witnessed this firsthand as the general manager of US card and consumer at Credit Karma. Despite having sophisticated access to product insights, I had very little visibility into financial information, which limited my ability to invest in efforts focused on expanding margin or extending runway, for example. As we rely increasingly on data to guide important business decisions, it follows that a new set of products will be built for the leaders outside of the CFO’s office (like Runway), while a very different set of tools will empower those within the finance team (some of which we’ve outlined here).

Runway embodies component 1 and 2 of a company built on empowerment loops: 1. Lowers the barriers to entry in understanding and working with financial data, and 2. Shifts the competitive goalposts by creating financial tools for anyone in a company, not just the CFO’s office.

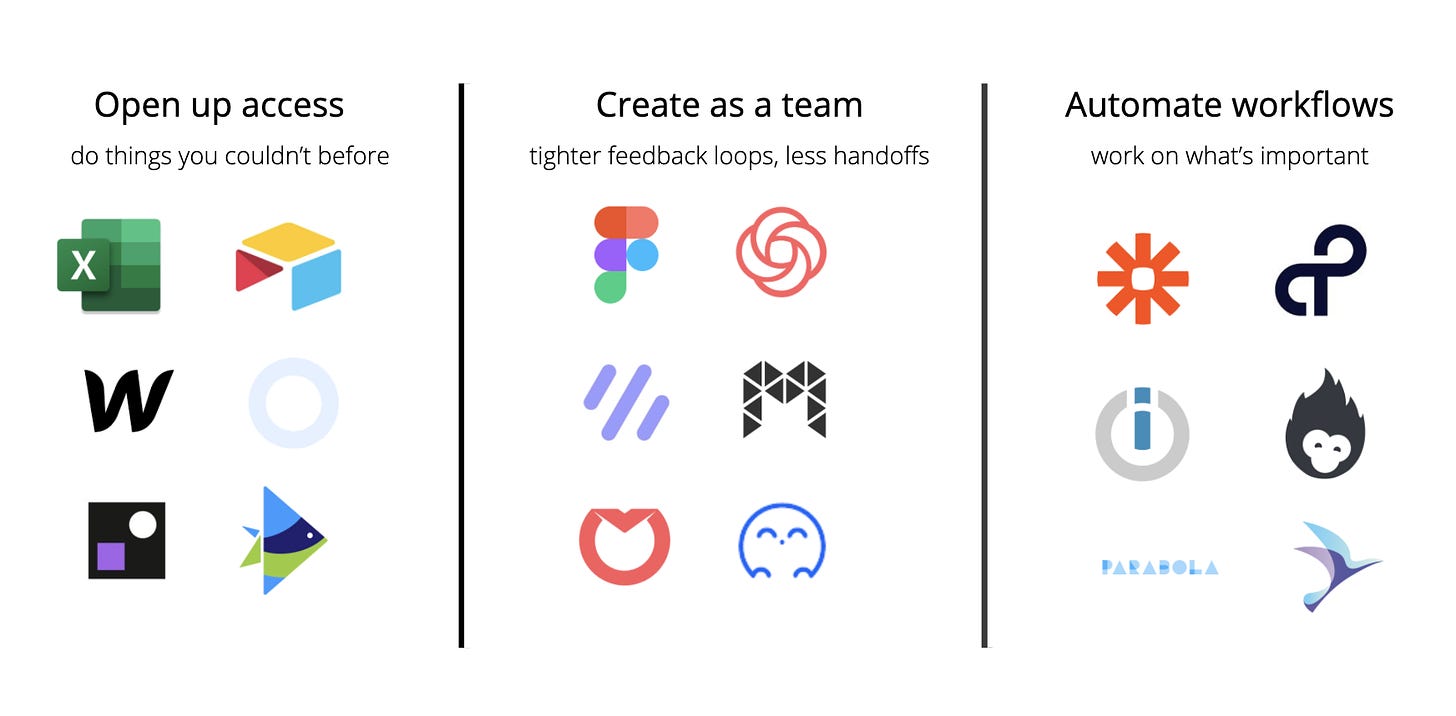

The Rise of Superpower Tech

Vedika Jain, Weekend Fund

For a long time, employees had no control over the tools they used at work. These decisions were made by the CIO, VPs in IT and other “higher ups”. When we started using Dropbox Paper at my last job at TrueLayer, it wasn’t a CIO decision. I chose it. Knowledge workers want to use tools that best serve them (better UX, more efficient, etc.) leading to bottom-up adoption.

This pairs nicely with Brett’s post above on empowerment loops. Vedika highlights four key trends driving the rise of “superpower tech”:

Open Up Access

Create as a Team

Automate Workflows

Cross-Category Superpower Tools

The selected quote above indicates the importance of superpower tech tools for knowledge workers specifically, which Brett also identifies in his post. The first tool that came to mind when reading this post was Slack, who’s been in the news quite a bit lately with their recent acquisition of Rimeto and launch of Slack Connect, which allows up to 20 different organizations to communicate and collaborate together. Slack is a pioneer in the superpower tech category as they successfully opened up access to seamless inter-org communication for every employee. No longer is communication stuck in email chains or siloed in 4 different chat apps, and documents can easily be broadcast to anyone and everyone in an organization — Trend #1 in Vedika’s post. One could argue that Slack also helped drive trend #2, Create as a Team, but I think their value proposition, at least initially, was focused on communication rather than creation.

The launch of Slack Connect, though, does hit on trend #2. While it appears that Slack Connect simply enables communication between many different organizations in the same workspace, I’ll argue it also enables creation. The difference is that Slack’s enablement of inter-org communication, its core value prop to date, slots into an organization’s existing tech stack — in other words, Slack doesn’t necessarily enable new communication within orgs, just shifts it to a new, better app, and is unlikely to displace the existing collaboration and creation tools already in place in an organization.

Slack Connect, however, is the first tool in a cross-organization tech stack — that tech stack did not exist to any meaningful extent prior. So, Slack actually is enabling collaboration and creation between new orgs because it’s the first tool in their collective tech stack — the foundational connector between them — and, thus, is more likely to capture creation and collaboration than Slack used for inter-org communication.

<stuff> Weekly

LOL Weekly: Everything is Fintech

lolllllll

Funding Weekly: Hallo

Vern Howard & Phil Bauman, Co-Founders of Hallo

Now more than ever, there are many of us who stand for bringing equal opportunity to every person, regardless of whether they’re a high school grad, college student, or working professional. At Hallo, we’re focused on having a positive impact on college students and their transition into the “real world,” bringing them the information they need to make informed key life decisions about the first steps in their career.

Hallo raised a $1.5M Seed Round from Canaan Partners, CR2 Capital Partners, Expa, Revolution, Kleiner Perkins, Tribe Capital, Upfront Ventures, and Founder Equity. Yes, that’s us! Hallo is the latest member of the Founder Equity portfolio and we couldn't be more excited.

Vern, Phil, and the rest of the Hallo are transforming the way college and high school students discover, learn, and begin their careers driven by a suite of digital experiences and by aligning the incentives of students (jobseekers) and recruiters (employers). Experiences include digital conferences, career fairs, tech talks, all-hands meetings, and AMAs where recruiters can learn more about prospective new hires and students can learn more about potential employers. It’s a transparent, collaborative process — in stark contrast with the opaque and confusing recruitment process today.

Not only is Hallo re-thinking hiring and recruitment, but they’re doing so on a grand scale. Hallo gives companies access to thousands of employees across the country and students access to thousands of companies. That’s not even the best part! Leveraging the digital experiences mentioned above, recruiters and students can engage with one another, building deep, authentic relationships so that each student and recruiter can find the perfect match. It’s brilliant.

We’re pumped to be on this journey are and grateful for the opportunity to work with Phil, Vern, and the Hallo team 🚀🚀🚀 Now, let’s ride.

Baseball Weekly: Quirks of the 2020 Schedule

Sarah Langs & Matt Kelly, MLB.com

The season also ends with seven Interleague series. Since Interleague Play expanded to occur throughout the season in 2013, there has yet to be a season with more than one Interleague series to close it out.

Two local rivalries will be on display in those series, amongst others, with the Angels ending at the Dodgers and Cubs ending at the White Sox.

Sarah and Matt give us some extremely interesting quirks from MLB’s shortened, 60-game 2020 schedule. A few of my faves below:

The Chicago Cubs will travel a total of 4,071 miles this season, the second lowest mileage in the league and 10,635 fewer miles than the league-leading Texas Rangers, who’ll travel 14,706 miles this season

The Marlins will play 52 of their 60 games against teams that were at or above .500 last season… oof. Tough break for arguably the worst team in the league.

And the saddest quirk of all — the Cubs will not play any Friday day games for the first time in club history. These are arguably my favorite part of Chicago summers — 1:20pm games in blistering heat, a bright blue sky, Anthony Rizzo in long sleeves, packed bleachers, the bustling streets of Wrigleyville filled with fans from across the Midwest… They’re the perfect start to a Chicago summer weekend and, though there will be no fans this year, I’m sad to see them go. Until next year…

Art Weekly: Golden Sunroom, 2018

Daniel Heidkamp