Stealing Signs - Issue 36

The Lost Art of Early Stage VC, Software is More Profitable Than Content, Investing in Composer, & The Empowered Economy

Worth Reading

The Lost Art of Early Stage Venture Capital

Adam Besvinick, Looking Glass

It requires knowing how well every company is performing against plan and in the context of the broader market (startup ecosystem and its particular sector); having transparent, communicative, and strong relationships with founders you’ve backed; and having a sufficiently large reserve pool to execute this approach while investing early enough to get meaningful exposure to companies and the ability to track them closely over the course of multiple subsequent rounds. It is a strategy that some of the best early stage venture capitalists still execute today, but increasingly, it feels like a lost art.

Adam suggests the art of early stage venture capital has been lost with the dramatic rise in fund sizes, check sizes, and valuations. He identifies the historically core components of early stage investing and implies this approach — small fund sizes, having conviction and investing as early as possible, writing checks frequently and writing multiple checks into one company over time to build up ownership vs. one large check later on — is optimal.

A few of the strategies Adam mentions remind me of Nikhil Basu Trivedi’s The Rise of the Solo Capitalists post from a few weeks ago. Specifically, Adam’s call out of the strong and transparent relationship investors should have with the founders they invest in. This is a primary differentiator for Solo Capitalists — In addition to being experts in a specific field or discipline and investing frequently on a small scale, deeply personal relationships with founders are inherent in their model because Solo Capitalists are the firm. Prominent examples include Jeff Moris Jr. of Chapter One and Brianne Kimmel of Work Life VC.

Jeff is an expert in social and consumer products, and Brianne is an expert in marketing and design. They've used this expertise to build incredibly strong personal brands and large followings which, as Solo Capitalists, changes the relationship between investor and founder from VC <> Founder to Jeff or Brianne <> Founder. Their brands are so strong that founders even seek them out specifically — not a fund — to work with. It’s a deeply personal relationship rooted in the investor as a person, not an entity, which is the same type of relationship I think Adam alludes to in his post.

Are Solo Capitalists the future of seed investing? They could be. And if Adam’s suggestion that deep and transparent relationships with founders are the optimal early stage investing approach, Solo Capitalists are unique positioned to succeed.

This is very clearly an unbundling of seed investing… so when, or will it, ever be re-bundled? A re-bundling might look very similar to the business writing bundle that is the Type House and will likely end up looking much like a traditional VC firm today — a group of individuals investing as a collective with shared risk and reward. That said, I doubt seed investing is re-bundled anytime soon. We’re in the early innings of unbundling.

Why Software is More Profitable Than Content

Adam Keesling, William Blair & Napkin Math Newsletter

Content products talk to humans, while software products talk to computers. That’s why the value of content decays faster than the value of software. And it’s also why software is the better business.

This is a very helpful framework for thinking about content businesses and software businesses. There are many similarities between the two at the product layer, as Adam notes, like the lack of distribution constraints, upfront fixed costs and zero costs once in the wild, and benefits of short feedback loops enabling rapid and frequent iteration. On the business layer, though, the differences between software and content are what make software the more profitable of the two. The differences can be distilled to the following:

Software provides a utility while content provides entertainment, and content is ephemeral while software products don’t decay.

What first came to mind for me was writing on the internet. This obviously falls in the content bucket in Adam’s framework, but aren’t there writers whose content does not decay? Say, Ben Thompson’s or Matthew Ball’s long form pieces? This type of content sits at one end of the “barbell of content,” which consist of two, opposites:

Long form, evergreen content

Short, contextual content

Matthew Ball is a prime example of #1 — he writes very long form breakdowns of the gaming and media industries, large companies in those spaces, and the key technologies around which they orbit. His essays are evergreen in that they aren’t closely tied to current events and are more less as valuable in 10 years as they are when he hits publish. Fred Wilson is a prime example of #2 — He writes a blog post a day of a few hundred words on topics more closely correlated with current events, which means his content is much more valuable when he hits publish than 10 years down the road. Ben Thompson threads the needle brilliantly. He writes with an unprecedented mix quality and consistency and many of his short form daily updates hold value for years after they’re written despite a heavy dependence on the context of current events.

Matthew and Ben’s work don’t decay, though, as Adam suggests it should. While I’m sure this is a generalization, it holds true that there exists content that looks more similar to software products than the typical content product. This content is durable and provides both utility and entertainment, and at least Ben has turned this into what’s likely a highly profitable business.

It’s ironic that I write about the barbell of content in a newsletter that does neither :)

Not Boring Investment Memo: Composer

Packy McCormick, Not Boring

I first saw the seeds of the idea that grew into Composer over hundreds of text messages with the company’s co-founder and CEO, Ben Rollert, my former colleague at Breather and the smartest person I know. When Ben gets a problem in his head, he doesn’t quit until he figures out the answer. For Ben, trained as a data scientist and evolved into a VP Product, the problem was: there isn’t an easy way for a relatively savvy investor to get the type of market-beating risk-adjusted returns that hedge funds and their clients have access to.

Public investment memos!! Packy McCormick started a syndicate tied to his excellent newsletter Not Boring to invest in early stage startups. The syndicate x newsletter crossover takes the form of public investment memos for the companies in which he invests.

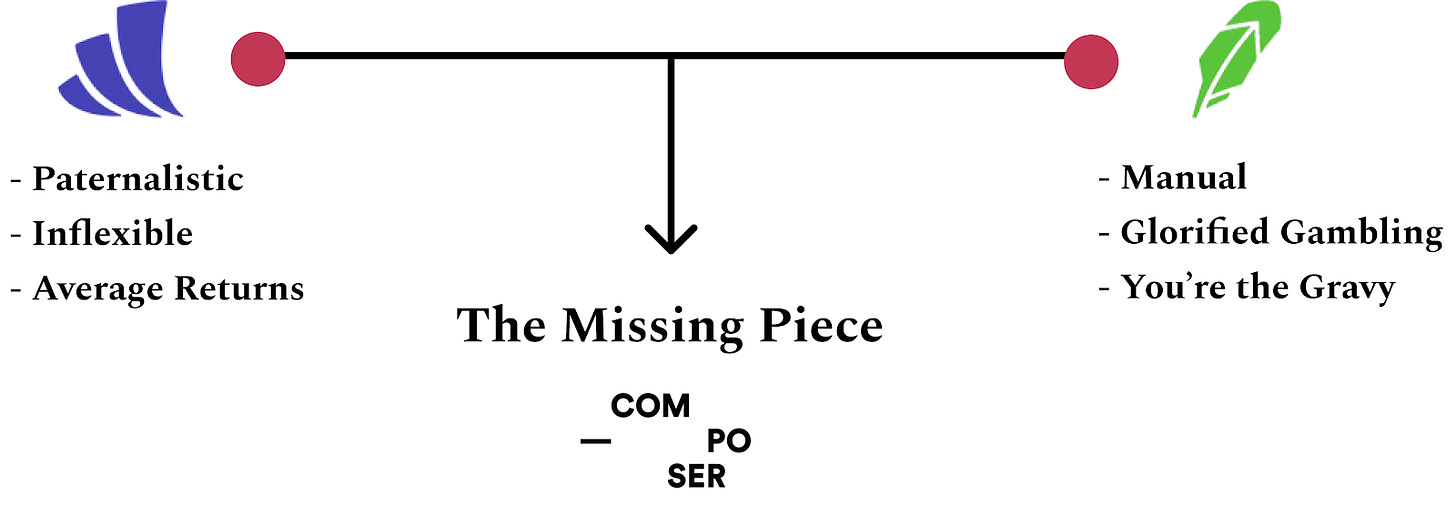

Onto the company. Composer makes it easy to for retail investors to create and test automated investment strategies with one line of code — smack dab in the middle of Wealthfront, a fully automated robo-advisor, and Robinhood, the lawless retail trading product that allows anyone to play the public markets. After tackling the consumer market of retail traders, Composer’s plan is to infiltrate financial institutions via bottom-up growth a la Slack and Figma.

Packy makes a strong case that there’s a gap in the retail market for Composer’s balanced approach — some automation with freedom and flexibility to tinker with investing strategies. I’m on board with this for now, but I do wonder if that market is as large as it seems to be. Or, rather, I wonder if there’s a sizable number of customers willing to pay for Composer. Being in the middle sounds brilliant and, on the surface, appears to fill an open gap, but this approach also runs the risk that Composer doesn't do enough for the retail investors looking to tinker but is also not as frictionless and lacks the entertainment value that Robinhood provides. After reading Packy’s analysis, it seems the bigger of the two opportunities is with financial institutions:

Ultimately, Composer will sell an Enterprise version, featuring security, customization, admin control, and bank-level SLAs - into hedge funds and other large financial institutions. These institutions spend billions annually on IT, and many still run on software invented 35 years ago.

While sales cycles and legacy systems pose significant challenges with this segment, if Composer truly provides a revolutionary user experience paired with the ability to tinker with sophisticated investing strategies, there’s no telling how quickly it could catch fire in the institutional world.

Lastly, a few things I’d love to see in future Not Boring investment memos:

Projected Return. Few early-stage venture-style investments are made without the belief that a company could become a unicorn, but I’d love to see how Packy is projecting growth, especially with two different customer segments here: retail investors and financial institutions. Composer’s subscription business model is distinctly different from the majority of finch companies, too, which makes for unique growth and customer acquisition curves in the fintech world.

Timeline of Events. Packy provides background on his relationship with the founder, but I'm super interested in the timeline from when Packy first considered Composer as a legitimate investment prospect to close. How long did it take for him to get comfortable with the D2C approach and potentially high costs associated with acquiring customers? Has Packy been looking for fintech companies to invest in and was Composer exactly what he’d been looking for? How long did it take understand the potential of selling into financial institutions and did he speak with institutional investors — what did they say that convinced Packy of this approach?

Potential Seed & Series A Investor Fits. If all goes according to plan, it’s safe to assume Composer will take on additional financing. Which downstream investors are ideal fits for Composer and why? Which investors might add unique value for Composer? Why not use Packy’s star power and the reach of the Not Boring newsletter to tee up future investment — raise awareness and generate buzz? Seems like a unique advantage for Packy :)

Some of these details are certainly confidential and it’s no doubt difficult to walk confidentiality line, but I’m super curious about the diligence process for the Not Boring Syndicate.

Finally — @Packy, what do you think of Titan? I’m a big fan and current customer. Excellent user experience, consistent and insightful research, plus a winning strategy to date ;). Would love to hear Ian Kar’s thoughts on both Composer and Titan, too. Also worth noting that my thoughts on Composer are not yet half-baked and are reactions to Packy’s investment memo infused with learnings from my short time as a VC. I welcome feedback on what I got wrong, right, and what I missed!

The Empowered Economy

Jomayra Herrera, Cowboy Ventures

Digital platforms have, in many ways, democratized access to generating income but we are far from being able to say that we have created an ecosystem that allows us to have this desired flexibility with the security we need. True independence cannot exist without a system of security.

As we fight for a more equitable economy, I believe we will need to develop an ecosystem where we put power back in the hands of employees while still enabling employers to be flexible in a fast-changing economy. Some of this will require tech. Some of it will require regulation. Some of it will require behavior change. But what we definitely know is that deliberate organizing and building of power precedes change.

Labor markets! A highly relevant topic with U.S. unemployment rates at 11% and especially as the creator and passion economies take off with individuals creating businesses as just that — individuals.

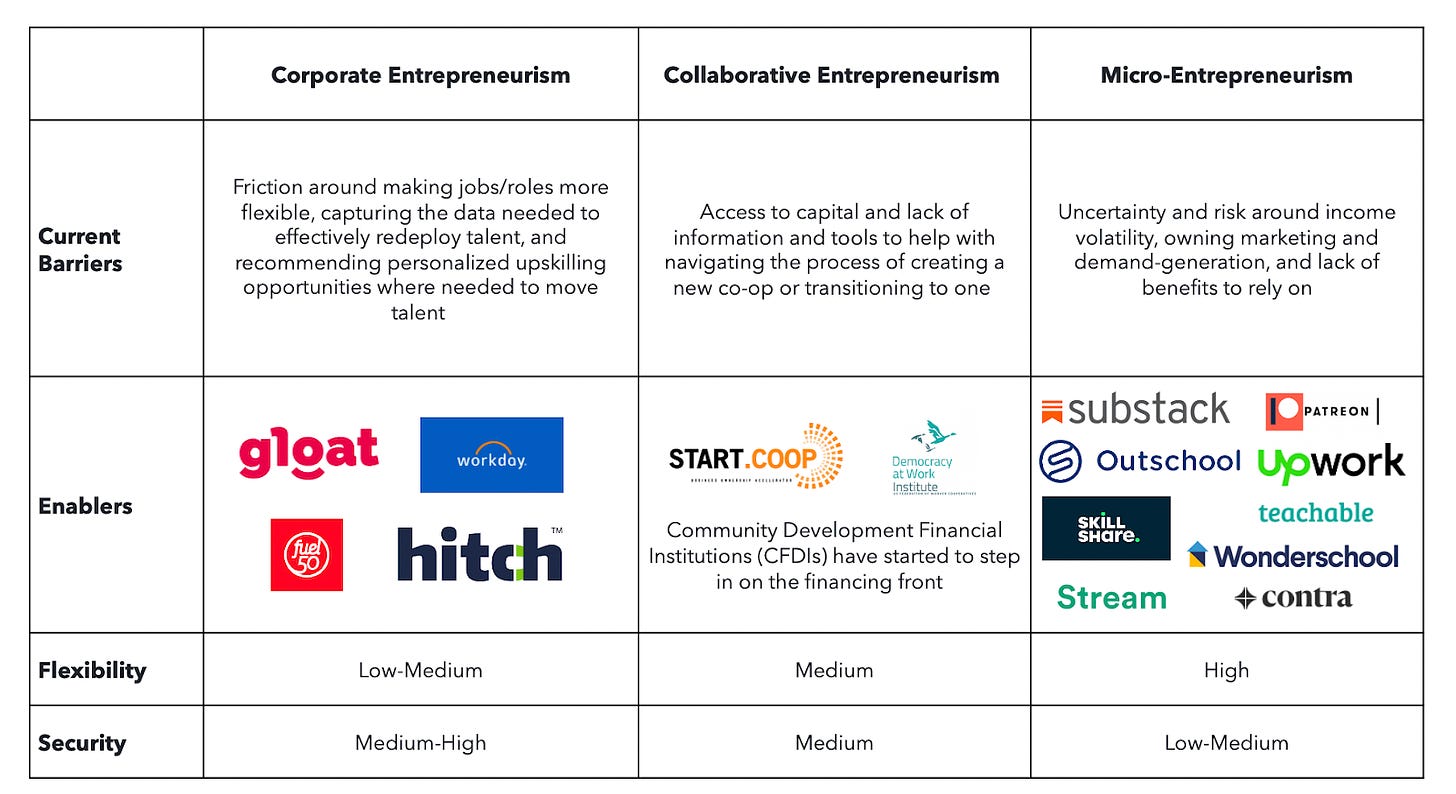

Jomayra covers the evolution of labor markets in the U.S ranging from the agrarian economy to wage labor and unions to the gig economy. She also weighs the tradeoffs between independence and security, and suggests true independence cannot exist without job security.

One point I want to dig into is Jomayra’s assessment of how entrepreneurism will manifest in our economy over time. Specifically in the corporate environment:

We will see an increased focus on internal mobility and redeployment of talent within an organization. Relatedly, there may be a rise of internal “gig marketplaces” where employees can pick up projects that align well with their skills (or that they can take on easily with quick upskilling). Historically, the challenges around adopting this type of model have been behavioral, given existing commitment to the idea of a particular job or functional group. As the need for flexibility starts to quickly outpace the need for stability, better internal mobility becomes necessary. This also caters to the large group of employees who want to work in a corporate setting and have the stability of having an employer.

This will be looked back on as a prescient observation — corporations will look more like early stage startups than they ever have, or at least they must in order to attract knowledge workers increasingly focused on independence and flexibility. They’ll also need tools to evaluate skills and match employees to projects.

Initially, this will be chaotic, looking much like an early stage startup where employees wear many hats. As optionality and freedom is introduced in the organization, the employee<>project match won’t be optimal. But, over time, these processes will be optimized with the help of tools that go beyond skill evaluation to factor in individual disposition, creativity, passions, and unique advantages for each employee. The optionality and freedom will evolve into a strength rather than a weakness.

Further, independence and optionality will become as important as the work itself. Allowing employees to work on projects they’re passionate about and uniquely positioned to execute effectively becomes core to the organization — the work itself becomes a second tier concern, almost taking care of itself. This mindset — a focus on the employee vs the work — will be the optimal approach for organizations over time not just in execution, but in talent acquisition and retention, too. The passion and creator economies are prime examples of the way entrepreneurism is manifesting in our economy and how corporations will shift to meet the needs of employees — the individual, then the work.

<stuff> Weekly

LOL Weekly: MLB = Guess Who??

lolllll

Funding Weekly: Rah Rah

Campus life is rapidly evolving, and students tell us there is information overload from the myriad of campus platforms and a lack of integration and relevancy. COVID-19 has taught us many lessons – one of which is how important community and relevancy is. Traditional student life software was designed for marketing or focused on one particular function like student organizations. Rah Rah provides easy, one-stop access to critical campus resources, groups, and events that are relevant for students, administrators, faculty, employees, and the campus community at large.

Rah Rah raised a $2.8M Seed Round from Workday Co-Founder & Chairman Dave Duffield and Workday Vice Chairman Phil Wilmington. A connected digital experiences is very timely offering for universities. Student Life is surprisingly disjointed and often lacks any digital presence whatsoever. While Rah Rah appears to be tackling this problem in the context of a traditional university experience — one where students are on campus — their approach translates quite well to an online, distributed university experience. It’s easy to see how they could back into a digital campus offering, recreating on-campus life for students and seamlessly connecting them to university resources digitally. In an online, distributed university environment in which many students are questioning the value of attendance, this could serve as a powerful student acquisition and retention tool, helping universities maintain relatively stable enrollment numbers with an attractive digital experience. This is a company to keep an eye on.

Baseball Weekly: Guide to the 2020 Season

Joseph Pompliano, Huddle Up

Fox Sports, Major League Baseball’s broadcast partner, will utilize virtual fans for it’s MLB game broadcasts beginning Saturday. Originally a far-fetched idea, Fox believes virtual fans will offer tv viewers a better experience than empty stadiums or cardboard cutouts (Source). Surprisingly, it looks somewhat realistic. What do you think?

Great quick primer on the shortened 2020 MLB season and some of the tactics the league is taking to make up what will amount to $4B in lost revenue. I’m a fan of the virtual fans highlighted above — I think it’s a fantastic idea, though as I’m writing this I’m watching the first game of the 2020 season, Yankees v. Nationals, which does not have fans and it’s not nearly as big of a difference in viewer experience as I anticipated it would be. The league will also be piping in crowd noises using audio from the MLB video game MLB the Show — hilarious and awesome.

On a more serious note, Nationals phenom Juan Soto tested positive for COVID on Thursday morning and is now out until he tests negative two times. Wishing him the quickest of recoveries, but it also got me thinking about the potential downstream effects of a single player testing positive. What happens if 25 players on a team test positive? Do they forfeit the season? Will they decide to forge ahead with minor leaguers? I can’t imagine the latter option is attractive for players or owners, and they’d certainly be hard-pressed to find enough minor leaguers in shape to compete on such short notice because Minor League seasons are suspended and many players have had to take on regular jobs to stay afloat.

Lastly, Joseph’s newsletter, Huddle Up, is one of the best sports newsletters out there. Very excited for future editions and he’s already dropped a few fire posts about Patrick Mahomes’ new mega-contract and the business prospects of the Professional Lacrosse League.

Art Weekly: Splitting Horizon No. 9

Meguru Yamaguchi

Yamaguchi achieves a uniquely chaotic, vibrantly intense and visually robust abstraction, through a technique he’s invented and refers to as “Cut & Paste”. The method entails laying out paints on plastic sheets to dry, then cutting, peeling and pasting them onto other surfaces, as if collaging three-dimensional brushstrokes. Through this process of layering and arranging, the seemingly unrelated colors converge into highly intricate forms, reminiscent of a physiognomy or landscape, but appear as fresh, enmeshed, and rhythmic compositions. Yamaguchi's earlier work mainly focused on subjects culled from social media imagery and was then dubbed a “digital Impressionist”; his recent work is pushing the possibilities of painting, gesture, and form by creating a new kind of sculptural paintings, in which the paint strokes seem to leap off any semblance of surface.