Stealing Signs - Issue 42

Peloton's Pivot, The College Health Opportunity, The On-Demand Enterprise, Investing in Founders w/ Previous Exits, & Capchase raises $

Worth Reading

Peloton’s Promising Pivot

Rob Litterst, Profitwell

But whether or not we buy a bike is beside the point! The point is that we don’t need to. With their new focus on classes, Peloton can bring a completely new type of customer into their ecosystem. Along with that new customer, Peloton can shift more of their revenue into things where they build it once, and can sell it infinitely (zero marginal costs)! Currently, their subscription revenue falls in this bucket, but their hardware clearly doesn’t. Shifting their revenue equation further into subscriptions allows them to capture more pure profit as they expand their user base.

Peloton’s shift from hardware company to content company, as Rob calls it, unlocks millions of additional customers, higher quality classes, better instructors, and opportunities to build new revenue streams like merchandise and data.

Without shifting to a “content company,” or what is really a software focused company, Peloton had a relatively low ceiling compared to the potential unlocked by this shift. It’s the difference between high-end, niche hardware and more or less ubiquitous software.

The most interesting opportunity for Peloton post shift from hardware to content company lays in becoming a tool for creators. Again, I’ll equate “content company” and “software company” here as the benefits and mindset for Peloton are the same — a focus on zero-marginal cost goods accessible for a large user base. A focus on content is just the first step towards becoming a creator tool:

The content flywheel has obvious advantages. As Peloton creates better classes and acquires better instructors, the advantages of building a robust tool for their instructors become clearer. A logical next step is for Peloton to allow instructors to sell personal merchandise and experiences through Peloton itself, rather than forcing their instructors to rely on Instagram and other channels to monetize their following. In doing so, Peloton would be building tools for their creators. This tool would be beneficial not only for Peloton instructors, but all fitness instructors — it’s not far-fetched to suggest Peloton could become the dominant creator tool in the fitness space.

The College Health Opportunity

Nikhil Krishnan, Out of Pocket

While the student health plans are actually not a great deal for students already under their parent’s health insurance, they’re fantastic for adults because the risk pool of students is great. This post walks through some of the reasons why (including some fun actuarial math where risk is actually mispriced relative to age). But the main takeaway is that it’s actually way better to be in a university plan than the individual marketplace plans because of how the risk pool works.

Nikhil offers a very helpful overview of the college healthcare industry and hidden complexities of college health plans, which have historically been areas of little, if any, innovation. Startups are the natural first thought here — why don’t more startups target college students? There are many reasons, a few of which include contracting with universities is a pain, colleges already offer their students health plans, and most students will churn when the graduate or leave campus.

However, now may be the right time for healthcare startups to target college students. The increasing shift to online/remote education reduces friction for startups to acquire student customers. As Nikhil says, “care isn’t localized to college anymore.” This is an excellent insight and I’ll bet the increased shift to remote learning increases the number of healthcare startups targeting college students over time.

Nikhil also suggests mental health is the next frontier for healthcare startups targeting college students. He cites compelling data that students lack sufficient access to mental health resources despite it being one of the most commonly cited issues on campus.

The On-Demand Enterprise

Jerry Chen, Greylock Partners

Internal enterprise tooling stands to benefit from the same transformations which will turn a company into an “On-demand Workplace.” An on-demand workplace turns internal IT and HR help desks into real-time, AI-powered solutions, removing the days-long wait for help in situations where employees need instant answers. Instead of filing tickets for hardware help, or asking HR for advice, employees can get answers immediately, or escalate to the right resource in the company without needing to hunt for them. Spoke is leading this on-demand workplace revolution. Spoke allows employees to use Slack, email, or text to access office information or make requests of the company by intelligently routing the requests to the right department within a company.

Chatbot is a popular tool leveraged by enterprises to improve consumer experience and is certainly a favorite in the shift to “on-demand.” If you’ve used a chatbot from your bank or insurer, you know we' aren’t quite there yet with this experience — it’s still pretty “dumb” and inefficient. There’s still hope for chatbots, though — what about for employees instead of customers? I recently came across Nesh — an automated internal knowledge repository with a chatbot interface for employees to pull internal and external data. The chatbot interface allows employees to ask questions instead of write queries, which makes the data analyzed on Nesh’s backend accessible for a much larger portion of the enterprise. I think the internal chatbot use case is more promising than the customer-facing chatbot since it’s probably easier to train (smaller set of inputs) and employee productivity gains could be much more significant relative to user experience improvements for customers.

Investing in Founders with Previous Exits

Andrew Vasylyk, Startup Soft

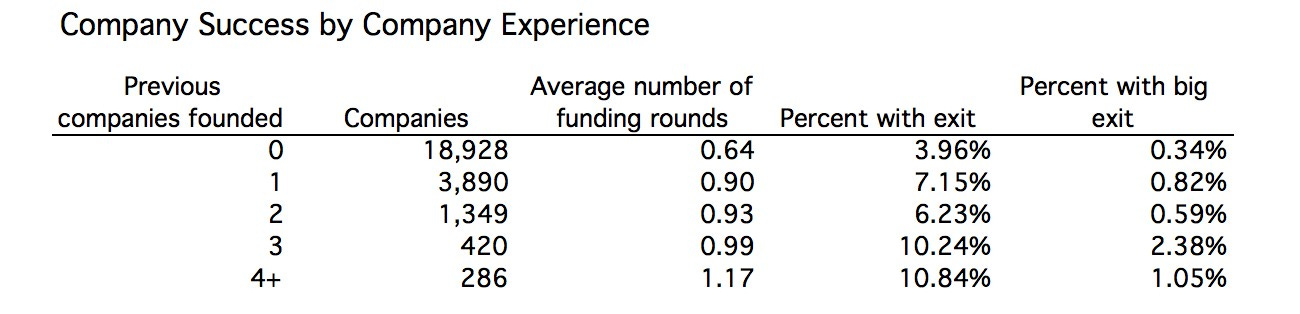

As Aileen Lee mentions in her analysis of unicorns, founders of unicorns have lots of startup and tech experience.

Nearly 80 percent of unicorns had at least one co-founder who had previously founded a company of some sort. All but two companies had founders with prior experience working in tech/software.

Good overview of why it’s often much easier for founders with previous exits, a successfully acquired or IPO’d startup, to raise venture capital. Andrew links to a few studies that show previous exits are correlated to revenue performance of a founder’s subsequent startup and that later successes are often larger than previous successes. These dynamics, among others, often make VCs more comfortable with investing in successful serial entrepreneurs. A lot of this boils down to risk mitigation and reducing uncertainty, which is more or less the name of the game, especially at the early stages.

Andrew polled 50 Angels and VCs to test the “successful exit” thesis using the following scenario:

Who do you think will generate better results — 5 founders with previous exits or 50 founders without previous exits? In other words, would you bet $1m on 5 exited founders at $200k each or 50 non-exited founders at $20k each (assuming all else is equal)?

80% of respondents chose exited founders. While not shocking, I was a bit surprised. Do the advantages of investing in exited founders outweigh the benefits of a widely diversified portfolio? I doubt it — I’d take the 50 non-exited founders at $20k each.

<stuff> Weekly

LOL Weekly: Zoom’s Earnings via TikTok

lolololol. Excellent work.

Funding Weekly: Capchase

As founders, we would love to get financing that doesn’t imply selling equity, that doesn’t affect our leverage ratio and that is easy to get and material enough to make a difference. There had to be a solution that would make both SaaSCos and their customers happy. But there wasn’t. So we built Capchase.

We don’t take equity and we are not debt. We simply advance revenues that SaaSCos would get in the future from customers they have already won and signed. Now customers can pay monthly — which has a huge value for them — but SaaS companies see all the cash upfront.

Capchase raised a $4.6M Seed Round from Caffeinated Capital, Bling Capital, SciFi VC, BoxGroup, ONEVC, Amara Venture Partners, and Lorimer Ventures.

Capchase seems to do for business contracts what Klover and Earnin do for employee paychecks — create more flexibility for the earner to realize the wages they’ve earned. Instead of waiting for payment on traditional terms, get paid for the work you complete when you complete it. Very, very cool company.

Baseball Weekly: Bad Call, Blue!

Mark T. Williams, Boston University

Botched calls and high error rates are rampant. Between 2008 and 2018, MLB home plate umpires made incorrect calls over 12 percent of the time. In the 2018 season, MLB umpires made 34,246 incorrect ball and strike calls for an average of 14 per game, or 1.6 per inning. Last season, 55 games – 2.2 percent of the total played – ended with an incorrect call.

Mark Williams and team analyzed over 4 million pitches from the 2008-2018 seasons to determine umpire accuracy on ball and strike calls. The results… aren’t great. A few highlights below:

When batters had two strikes, the error rate for all umpires increased – incorrect calls happen 29 percent of the time

the highest error rates did not come from younger, less experienced umpires; they came from the older, veteran umpires

the top performers between 2008 and 2018 had an average age of 33 years old and had less than three years of experience at the big league level

I’m all for robocalls-umpires. This data is compelling, but it’s obvious to the regular viewer that bad calls behind the plate are far too common. To be clear, umpires absolutely have a place in the game, but for 99% of ball and strike calls, robs-umpires are the better option. In the meantime, the MLB can invest in a stronger umpire development program and more frequent, rigorous performance evaluation. That said, there’s a ceiling on the accuracy of any one umpire, so training program and performance evaluation enhancements won’t solve the problem.

Art Weekly: I am Here (2017)

Haurm Ori @ Whitestone Gallery Karuizawa

Born in Tokyo, Ori grew up in the multi-cultural environments of the United States and Malaysia: the artist is now based in New York, the city of diversity. “I am Here” is a series of comprised artworks that Ori has been presenting since 2001: using plastic mesh, which is usually used in construction sites, she develops a new concept of sculpture which transforms the floating moments of our everyday life into eternity. Besides, her works are known for its ‘site specificity’. For this exhibition, the artist will visit Karuizawa to produce a new work based on the town.