Stealing Signs - Issue 43

Restoration Hardware & Luxury, On Linear Commerce, SMB Retailers Move to Shopify, Roberto Clemente Day, & Iron Ox Raises $$$

Worth Reading

Restoration Hardware: What is Luxury?

Bill Brewster, Sullimar Capital Group

“Many investors and analysts are seduced by the notion of a capital-light retail strategy, and completely overlook the fact that the ongoing advertising expense to market an invisible online store is an unproven, and we believe, unsustainable model. Also interesting is when retailers or companies tout their online growth rates… We know of no store-based retailer that significantly increased their operating margins by growing online faster than retail”

Bill offers a deep look into Restoration Hardware’s growth mechanisms through the lens of CEO Gary Friedman. This deck is full of excellent quotes from Gary paired with thoughtful analysis of Restoration Hardware’s earnings and tests of assumptions Gary puts forth on earnings calls.

Gary’s explanation of Restoration Hardware’s digital & physical strategy is particularly interesting. He notes that it’s not about physical or digital, rather physical with digital… unless one is positioned as the low-price leader or selling commodity goods, neither of which is Restoration Hardware. Gary insists the capital light, digital only model, which many D2C eCommerce brands employ today, is not as attractive as it seems. Online only retailers are stuck in a cycle of increasing ad spend and struggle more than their physical + digital counterparts to build a compelling, lasting brand. This reminds me of Casper CEO Philip Krim’s recent comments on the effects of physical stores on ecommerce:

“We have 20 now and are going to keep opening a bunch. They’re doing really well. We see it boost our eComm business — in markets where we have retail, eComm is growing faster. It’s a great additive, synergistic part of the consumer journey… it helps with awareness — it’s like a billboard — and it helps conversion.”

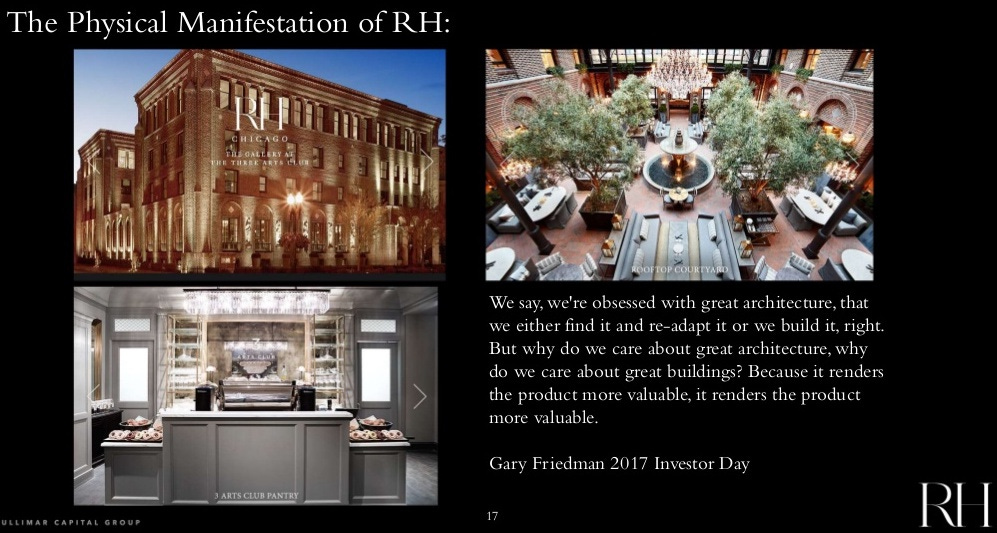

Gary sings the same tune. He suggests Restoration Hardware retail stores are a physical manifestation of their aspirational brand, and that physical experiences render their products more valuable.

Another interesting point in this deck is Gary’s comments on Restoration Hardware’s membership program, or Grey Card. Simply put, their membership is access to a desired group. It works especially well because they sell luxury products and have built an aspirational brand, which translates to the value of a membership, creating a powerful retention loop.

On Linear Commerce

Web Smith, 2PM Inc.

Law of Linear Commerce: the lines of demarcation between media and commerce are fading. For the brands that are most suited to the modern retail economy: media and commerce operations work to optimize for audience and sales conversion. This is the efficient path for sustained growth, retention, and profitability.

Brands will develop publishing as a core competency, and publishers will develop retail operations as a core competency.

Excellent breakdown of a phenomenon I believe Web coined as linear commerce. It’s much like the recent trend in the creator economy, where creators first build an audience or a following (come for the network, stay for the tool applies here, too), and then monetize them with products and services, turning them into customers. The same principles work effectively for brands — a vibrant, engaged user base increases the likelihood of conversion. As Web says, an audience-driven business monetizes by providing value that captures attention, otherwise you’re “paying people" to show up at your party,” or paid marketing, which is getting more expensive and less sustainable by the year.

The audience first approach, or an intense focus on audience-building, allows for ultimate monetization optionality. Instead of engagement with one product or service, audience-driven brands have an user base engaged with the company itself — the ethos, mission, and values — which means all products and services are more appealing, thus increasing the likelihood of transaction.

SMB Retailers Move to Shopify

Chris Zeoli, Base 10

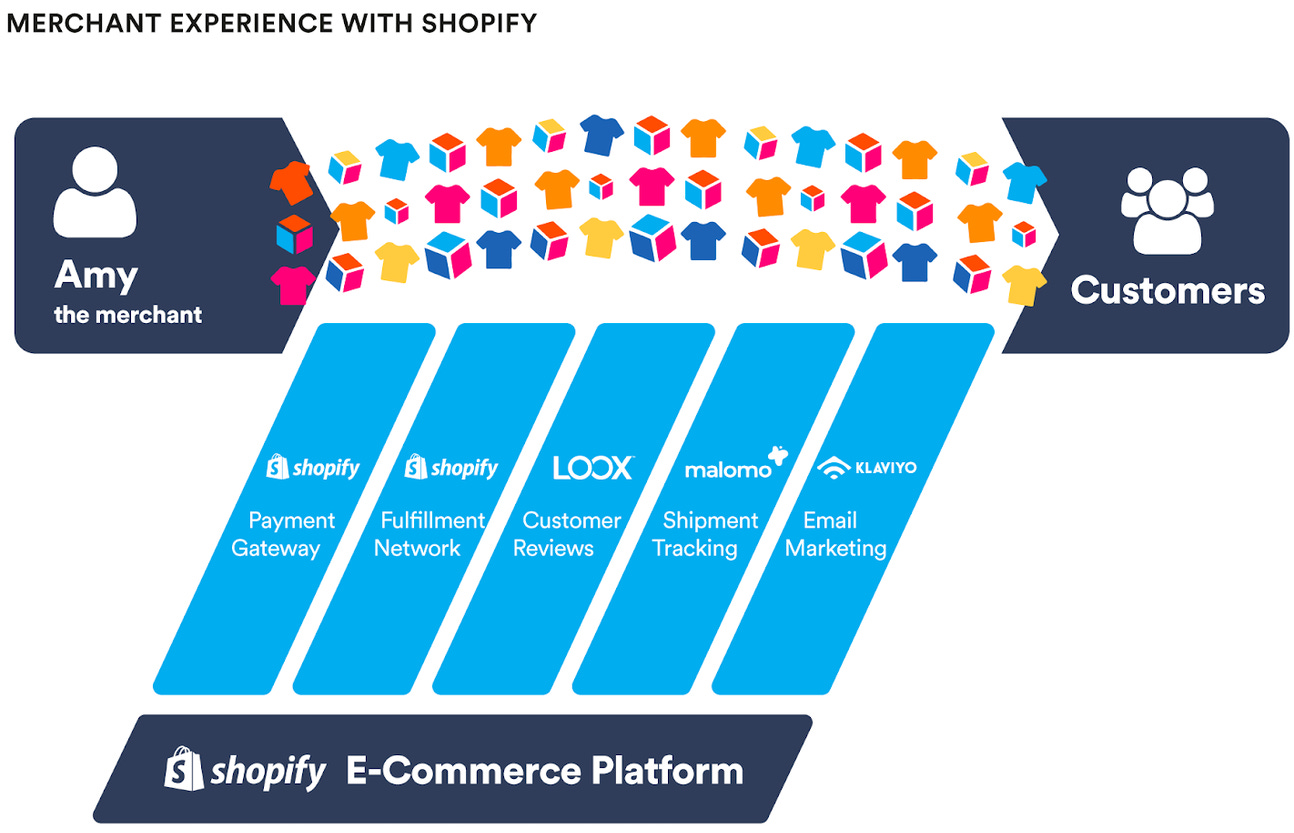

Shopify has launched competing products in its ecosystem before (e.g. Shopify Email), which becomes particularly dangerous considering Shopify can prioritize visibility for its own products, and has even gone so far as to delist companies with competing products like Mailchimp for violating terms of service. Despite this increasing competition from Shopify itself, there have been plenty of companies that have rapidly grown their business on Shopify before diversifying revenue streams to other e-commerce platforms and go-to-market models.

Chris weighs the pros and cons for developers building on the Shopify platform and investors looking to fund Shopify apps. He suggests the capital-light growth prospects are worth the risk, but cautions both developers and investors that we’re approaching a key infection point — when, or will, Shopify begin to build their own tools for their eCommerce customers, siphoning 3rd part developer revenue and growth prospects? This is called platform risk, a topic in the news recently with Apple’s ban of Fortnite from the App Store and that has a long history with Facebook, Google, and Salesforce. In Chris’s breakdown of Shopify’s revenue channels, he notes 45% comes through payments alone, which suggests revenue from apps wouldn't move the needle much or are at least not the optimal growth strategy. That said, Shopify has a massive decision to make. My bet is they forgo the incremental revenue and continue supporting their already health app ecosystem.

Instead of adding revenue from platform apps, Shopify could leverage their recently launched Shop app, where customers can track orders and easily re-order and find new merchants. There’s a clear opportunity for an advertising business in the Shop app, which would certainly outweigh the revenue from cannibalizing their 3rd party app ecosystem. This approach is favorable for merchants as it’s a new marketing channel likely cheaper than Instagram and Facebook. While intriguing, the growth potential is limited by the merchants using Shopify today, who are largely SMB’s and spend less on advertising than the large players. As more SMBs move onto Shopify, though, and potentially even some larger players, a Shopify ad network could be meaningful in eCommerce.

<stuff> Weekly

LOL Weekly: Travis Scott x McDonald’s

lol well played

for reference: Travis Scott x McDonald’s collab

Funding Weekly: Iron Ox

Iron Ox raised a $20M Series B round from Crosslink Capital, Amplify Partners, ENIAC Ventures, R7 Partners (Chicago firm), Tuesday Ventures, At One Ventures and Y Combinator.

This is such a cool company. I once heard a description of the first step in their farming automation process — the robots place each plant an exact distance from one another, and each day moves each plant fractions of a centimeter away from one another to reach the optimal growing distance. Iron Ox also creates proprietary nutrient compositions to feed plants, which is much more effective and efficient than traditional fertilizer. I’ve also heard they can grow heads of lettuce, for example, much, much faster than traditional farming methods, which means they have much more frequent ‘turns’ and can grow much more than a traditional farm.

Baseball Weekly: Manny & Roberto

Nathalie Alonso, MLB.com

The friendship blossomed from there.

During Spring Training in Fort Myers, Fla., Clemente would discourage Sanguillén from going with their teammates to the racetrack, inviting him instead to partake in one of his favorite hobbies: making ceramics. Sanguillén chuckles at the memory of sitting around after games, molding clay with Clemente.

“I told him, ‘Clemente, thank you for this blessing, because if I don’t make it in baseball, I can make a business out of this,” Sanguillén said.

In honor of Roberto Clemente day this week (Wed, Sept 9), this touching story of how Roberto Clemente took Rookie Manny Sanguillen under his wing and guided him to a successful 13 year career is worth a read.

Art Weekly: Great Picture Book of Everything

Katsushika Hokusai (葛飾北斎), 1829

Japanese painter and printmaker Katsushika Hokusai, best known for his iconic The Great Wave print, created small-scale drawings for an unpublished book titled Great Picture Book of Everything in 1829. The British Museum in London has now acquired 103 of these works, which were held in a private collection in France for more than 70 years before resurfacing just last year.

These detailed drawings depict scenes from history, mythology, literature, religion and the natural world, while shedding light on Hokusai’s work methods. “These works are a major new re-discovery, expanding considerably our knowledge of the artist’s activities at a key period in his life and work,” said Tim Clark, honorary research fellow. “All 103 pieces are treated with the customary fantasy, invention and brush skill found in Hokusai’s late works and it is wonderful that they can finally be enjoyed by the many lovers of his art worldwide.”