Stealing Signs - Issue 45

Embedded Lending, Roblox's Gaming Ad Platform, Why Media Formats Take Off, Cash App's Potential, & Minerva raises $

Worth Reading

Embedded Lending

Alex Hartz, SciFi VC

The Embedded Lender’s biggest underwriting advantage is the ability to extract signals that are highly predictive of loan performance from proprietary data furnished by brand partners. Ideally, brand partners would share data on all of their customers so that the Embedder Lender has a wholistic understanding of what best-in-class customers look like and can make targeted loan offers. This proprietary data will augment a foundational model using traditional underwriting signals. A key hypothesis here is that Embedded Lenders will be able to normalize proprietary signals across multiple brands offering the same loan product. For gig economy drivers, this could mean directly comparing income, reviews, time on platform, and earning potential across Uber, Doordash, Instacart, and other platforms. An obvious benefit of normalization is increasing the size of the risk model’s training data set. A less obvious benefit is that if normalized well, these models would work for newly onboarded brand partners out of the box, potentially short-circuiting years of work needed to extract value from these signals.

The last few months have seen embedded finance emerge as the next frontier of fintech. It's a fascinating concept and lending specifically poses a compelling opportunity. The most important dynamic of the embedded finance model, at least as Alex outlines, is that the brands are responsible only for distribution. A successful embedded finance product will serve as both the infrastructure, underwriter, operator, and customer support for the financial product, and let the brands focus on mobilizing their audience. Otherwise, brands will be overburdened with the headaches of offering a financial product, which reduces their capacity to effectively distribute it to their customers.

While Alex’s embedded lending concept is promising, I see a few significant risks in the model:

Brand Risk: Are brands willing to risk their reputation to offer a financial product? Though the lender is responsible for customer support, it’s easy to imagine a brand’s customers directing blame at the brand rather than the lender. Further, are brands confident they can sell financial products? One could argue brands launching gambling products is a decent comparison, but lending, or insurance, for example, are distinctly different and require greater customer education efforts, introduce more complexity, and are likely ‘further from the trunk’ for most brand product offerings.

Data Value: Is a brand’s unique customer data set actually an advantage? Does this data meaningfully impact underwriting models? I’m skeptical. This data set is certainly differentiated from the data lenders currently use, but I question it’s impact on underwriting practices. On the other hand, which brands have data that would meaningfully impact underwriting models? Alex identifies one data point I think could be meaningful, which is earning potential across gig economy platforms like Uber and DoorDash.

It’s important to note that the value of individual unique data points isn’t necessarily the focus, rather that the aggregation of data across all brands will improve underwriting models and help the lender under more customers, as Alex mentions.

To be clear, I think this model will work. I subscribe to the theory that consumers will increasingly use financial products from the brands they love.

Roblox is the Next Big Games Advertising Platform

Eric Seufert, Mobile Dev Demo

Roblox essentially owns the entire ecosystem value chain: production, distribution, and monetization. Not only could Roblox use this end-to-end ownership to build a transparent, measurable ads infrastructure, but it could also provide development and analysis tools to help its developer ecosystem better monetize and engage users. But a good first step would be simply allowing advertisers to track revenue to ad spend at the campaign level, which is uncomplicated given that all user activity happens within Roblox-owned properties while users are logged in.

“Each of the arrows with dotted borders below represents a step in the advertising process that is unattributed, or not measured, from the initial ad click.”

Roblox has the infrastructure for a huge gaming ad network. However, while game developers can advertise their game and pay to be in Roblox’s “Featured Apps” section, they’re severely limited in their ability to track spend and attribution. Many of the metrics an advertiser can track in other ad networks are unavailable in the Roblox ad network. Eric alludes to one reason why this ad network remains relatively simple which is that the vast majority of Roblox users are children, and any data privacy, security, or exploitation of their attention could result in a significant blowback. While Eric doesn’t explicitly link this risk to the relatively undeveloped ad network, I think it’s likely the primary driver. The mere notion of robust monetization tools for advertisers, even if they are game developers, unnecessarily risks the loyalty and support of their audience, or, rather, the parents who monitor them.

Roblox’s obviously massive opportunity to build a robust ad network suggest platform businesses like Shopify and Substack could build the same. It seems only media businesses are better suited for the ads model than platform businesses. In fact, platform businesses have a key advantage over media businesses — incentive-aligned demand and a more targeted audience. Platform business customers are typically users of the platform’s software. This means targeted ads for tools which enhance said software and improve customers’ business are extremely valuable — both the platform and its users are incentivized to engage with relevant advertisements for this reason. Further, platform business users are typically in the same industry or perform similar functions, which means advertisements are likely to have higher click through rates and the platforms are able to better target ads to the right users. Take Shopify, for example. Ads for 3rd party eCommerce apps can be targeted at eCommerce customers specifically and those ads are likely more valuable to ad viewers than an ad for grocery delivery on my local newspaper’s website.

Why Media Formats (Like Snap Stories & TikTok Tok Music Videos) Become Hits

Eric Feng, Commerce Incubations @ Facebook

Media formats don’t typically form out of thin air but instead evolve slowly, borrowing traits from each other, inspiring unique creative behaviors, until they eventually become an entire new form of expression. Stories was very much an evolution. It borrowed shortform videos and made them easier to create and more accessible, and made images and shortform text richer and more expressive. And through this evolution, Stories has carved out a new position on the Format Map that’s incredibly valuable.

Eric offers an excellent framework for why media formats gain traction based in understanding creator behavior and user experience. Too difficult for creators to use and you limit adoption. Too limited in narrative creation and you limit engagement.

Eric’s analysis of Vine in the context of this framework is particularly interesting. Vine was too difficult for creators to use and too limited in its capabilities. When one opens the Vine app, they’re presented with a camera and a blank slate, as Eric describes. The ‘blank slate’ is high friction for users to create content and the six second video limit was too restrictive for compelling story telling. Alternatively, TikTok offers users more robust tools to create content with templates and intuitive editing capabilities.

In short:

Stories are a perfect compromise of ease of creation and richness of resulting media narrative.

What do Sign Stealers think is the next dominant media format? One possibility is the equivalent of a ‘retweet.’ All social platforms rely on engagement for which the ‘retweet’ is a perfect tool. What better way to get users to engage than to easily clip and repost user content? Both Instagram and Snapchat offer this feature, but imo they are limited. In Instagram, recycling or reusing others’ content is really only possible in stories. Same for Snapchat. I recognize this feature isn’t truly a unique media format, but it is similar to Snapchat stories in that it’s a feature of an existing social platform. Further, the ‘retweet’ feature is applicable to many other content verticals like streaming and gaming content.

Cash App’s Potential

Maximilian Friedrich, Ark Invest

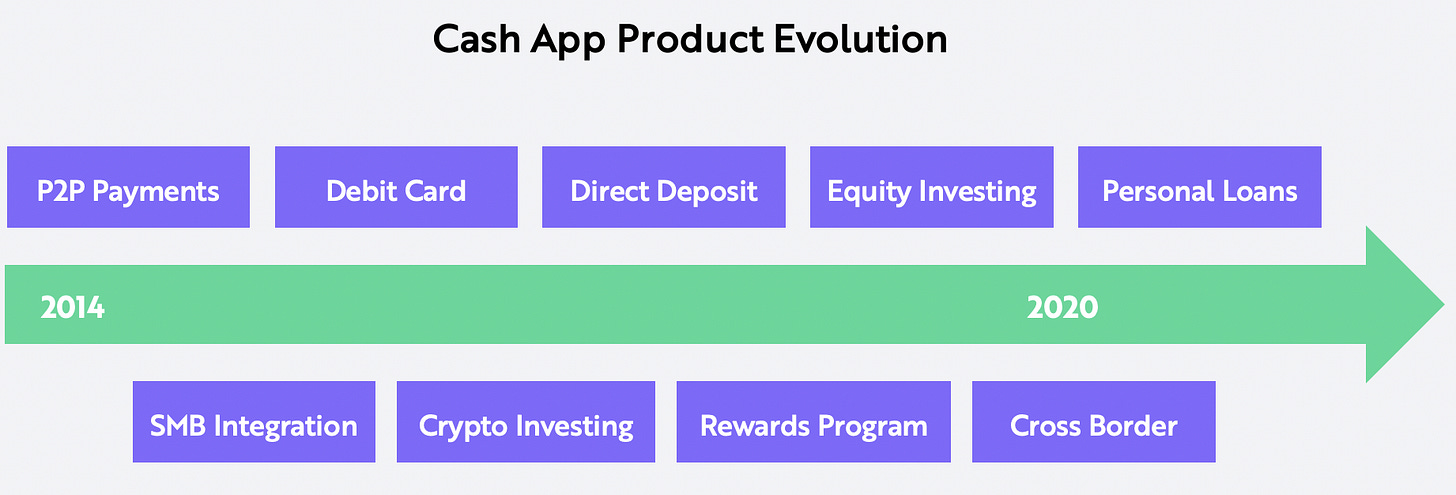

Cash App has evolved considerably since it emerged from a Square hackathon in 2013, as shown below. Today, Cash App offers users banking services such as direct deposit, debit cards, ATM access, a platform to invest in equities and bitcoin, a rewards program, free transfers from the US to the UK, and integration with Square sellers. In the future, we anticipate that Cash App will offer a range of services comparable to that of traditional banks today, including personal loans, credit cards, mortgages and insurance. Ultimately, we believe that Cash App will offer a better and more personalized user experience at a much lower cost than traditional banks. Moreover, as a comprehensive Digital Wallet incorporating Square’s seller ecosystem, Cash App could integrate offline and online commerce, distinguishing it from both traditional and challenger banks.

CashApp is one of the most exciting products in fintech. Their wedge into the crowded, high-CAC consumer banking market is their target customer — on average, much younger and lower income (thus average revenue per user) customers than those of the incumbent banks and many other D2C banking products. They’ve quickly built a young user base and emerged as the preferred payments product for GenZ.

In addition to the opportunities to expand their financial product offerings, much of the excitement around CashApp’s potential lays in their ability to move up market. They’ve made significant dent in the low end of the market and any successful move up-market will improve meaningfully improve their economics.

CashApp’s social influence plays an important role as well. They consistently generate tremendous social engagement with cash giveaways, brand partnerships, and influencer collaborations. They clearly identified a gap in financial product marketing and, more importantly, are leveraging channels where their core users reside and with methods that resonate with their target audience. For example, their collaboration with Travis Scott generated 22k retweets and 93k likes, and their partnership with Burger King generated 89k retweets and 40k likes. This approach’s impact on acquisition costs likely lessens the blow of below-average revenue per user.

<stuff> Weekly

LOL Weekly: Poof! The YouTube Partner Program…

lololol

Funding Weekly: Minerva

At the heart of Minerva’s solution is a proprietary action-based sensing engine (FADE: Framework for Action Detection and Execution). While enabled, Minerva captures the actions you take, automatically creates documentation, and collapses the process into a shareable link with clickable instructions embedded. Professional documentation creators have reported the time it takes to produce these documents is dramatically reduced, often by 10 times or more.

Minerva raised $1.1M from Charge Ventures, Max Ventures, Sagehill Capital, New York Venture Partners, Bayes Capital, and Tribe Capital.

This looks like an awesome product. Their tagline alone, “document any process on the internet,” is awesome. Minerva could re-invent employee onboarding, training, and, more broadly, user experiences across the internet. I plan to dig in and create embedded instruction sets for our investment diligence process sometime soon. I also see a significant opportunity to re-invent the notoriously underwhelming chat bots on eCommerce sites. This application would be closer to a text-based concierge than document instructions, but I the value proposition holds.

On another note, I think you’ll enjoy what one of my good friends had to say about this post:

What I took away from this article is that the AWS user interface was so bad that it spurred innovation

Baseball Weekly: Supreme Court Denies MLB Request to Dismiss Lawsuit Seeing Increased Minor League Wages

Jeff Passan, ESPN

"The ultimate goal is pretty simple: to get MLB to comply with the same laws that Walmart and McDonald's comply with," said Garrett Broshuis, the attorney and former minor league player who filed the initial lawsuit. "Whenever they ask players to go to spring training, they should be paying their employees for it. During a season, there's no reason for players to be making $7,500 or $8,000 a year."

The Supreme Court denied MLB's request to dismiss a lawsuit filed on behalf of minor league players, clearing a path for a case in which players seek to receive fair compensation for hours worked. In short, this lawsuit challenges MLB’s longstanding protection from minimum wage laws and is the most promising progression of Minor Leaguers’ efforts to receive fair compensation. This case should resume in the next few months and has significant implications for the state of both Major and Minor League baseball, specifically for the size of the minor league system, player development, and competitive dynamics.

Art Weekly: Brushstroke, 1965

Roy Lichtenstein

In 1965-6 Lichtenstein made a series of paintings depicting enlarged brushstrokes. Ironically, the motif was taken from a printed source, the comic book story entitled The Painting, printed in Strange Suspense Stories in October 1964. Here Lichtenstein used it to make a direct comment on the elevated content and loaded brushwork of Abstract Expressionism. The brushstroke, as the token of the artist's personal expression, is depersonalised. The motif is screenprinted onto paper in a manner usually associated with advertising or publishing to the effect that it seems banal and everyday.