Stealing Signs - Issue 52

How Tech can Promote Mental Wellness, Bad Incentives Ruined the Internet, Headless Commerce, Google Has Come to Banking, & Segmed Raises $

Worth Reading

The Good Fight: How Tech can Promote Mental Wellness

Brad Baum (Lightbank), & Patrick Harmon Lopez (Morpheus Ventures)

we, as a society, focus so much time and money on preventative care for something as surface level as our teeth, yet this normalized attention to dental care is not at all mimicked when it comes to caring for arguably our most important organ, our brains. If anything, we should be considerably more concerned about our mental health compared to our dental health. Yellow teeth or a cavity won’t kill you…but neglected mental health issues very well may. Yet, dental health drives us to visit the dentist for “check-ups/cleaning” twice a year to avoid harm, while mental health simply does not…yet.

In this excellent, short 4-part series, Brad and Patrick shed light on the mental health crisis and the ways in which technology and new business models can help solve it.

Mental health awareness has grown tremendously in recent years thanks to public accounts of struggles with mental health from athletes and celebrities, and COVID proved to be fuel on this fire. Mental health awareness, support, and treatment programs are being adopted by large employers as employee benefits — this is not only validation of the problem and importance of a solution, it’s a critical step in improving access to mental health treatment and support.

In addition to unpacking the emergence mental health awareness and treatment, Brad and Patrick surface and opportunity for mental health startups to better serve the population: preventive care. They compare this model to dentistry — most dental care is preventative and most importantly it’s routine. They suggest mental health should be the same.

Lastly, the two extrapolate a potential broader healthcare trend from their view on the evolution of mental health: vertical healthcare SaaS, or condition-specific platforms. I think there’s promise in this thesis and will offer a slight variation of it: vertical labor marketplaces. I do believe vertical healthcare SaaS is likely to grow in the near future, but much of healthcare requires an in-person interaction and is driven by the care provider, so labor marketplaces play an important role in increasing liquidity in a market, which, in turn, improves access for patients. What’s very likely, too, is that vertical SaaS and vertical labor marketplaces will merge into SaaS-enabled vertical marketplaces, increasing access for patients and helping providers reach patients and run their business.

Bad Incentives Ruined the Internet

Jad Esber (Co-Founder of Koodos)

It’s a well established belief that reliance on extrinsic motivators, especially financial ones, are not enough. User's intrinsic motivation, and, specifically, perceived enjoyment, is a more explanatory variable of continued use. This is especially the case for products that offer catharsis as a service.

At their core, consumer platforms incentivize, promote, and reward content in their best interest (maximizing attention) rather than the user’s interests (maximizing value).

Jad surfaces the important point that intrinsic motivation is the driver of continued use of a social platform, not attention or money. This is difficult to align on given the relative ease with which anyone in the world can rise to prominence on TikTok, for example, with relatively little effort — is every creator with one million followers intrinsically motivated? Maybe. This concept reminds me of the Bilibili post covered in last week's issue. The key driver of Bilibili’s success appears to be the intrinsic value both users and creators derive from use of the platform, which is largely driven by its focus on a niche community.

Back to the incentive structure of consumer platforms — an interesting exercise would be to segment each platform by content format. For which content formats are user attention and value most closely aligned?

Shopify’s Partner Ecosystem & Headless Commerce

Interview with Mike Duboe (General Partner @ Greylock)

Headless buys you flexibility to have a broader set of options on decoupling your front end from your backend…but the benefit of Shopify is how integrated everything is. If you are on that ecosystem, installing an app doesn’t require engineering support most of the time; there is a value to actually being locked into one ecosystem.

Once you are at a certain scale where these milliseconds in speed are really going to be impacting conversion [then headless makes more sense]. Which is why the investment I made in Builder — they are focused more on mid-market plus and enterprise businesses, versus others who are building headless for SMBs.

This interview is an excellent primer on the evolution of merchant behavior and technology tools in eCommerce. In Mike’s comments on the elephant in the eCommerce room, Shopify, he offers an insightful take on the way in which merchants should use the platform and what it means for the future of eCommerce tools.

Shopify is an excellent tool for SMB merchants. That is their focus after all. Mike emphasizes that their fully integrated product is a tremendous benefit for merchants, but it’s not a one-size-fits-all platform. In fact, Shopify’s greatest asset is also their biggest threat — many merchants have and will reach a point where a single, integrated platform isn’t the optimal solution. Shopify’s biggest threat is merchants building their own tech stack. Enter headless commerce.

Headless commerce tools, “which essentially decouples the front-end or customer-facing part of the e-commerce experience from the back-end — to allow companies to better customize their page,” are a growing trend in the eCommerce world. These tools enable merchants to customize their site to tweak and optimize the minutiae of eCommerce functionality, and they’re an important piece of a custom tech stack. Mike developed a prescient investment thesis around headless commerce tools in large part to take advantage of the explosive growth of eCommerce during the pandemic. The fact is, many large merchants are still behind the times, especially in regards to eCommerce capabilities, and it’s clear Mike is betting on the acceleration of eCommerce to push many, many more merchants to the point at which a custom tech stack is the optimal choice.

Google Has Come to Banking

Lex Sokolin (CMO @ ConsenSys)

The outcome of the launch is then a very large consumer B2C footprint receiving a near-free or entirely-free banking experience, powered by API integrations into hand-picked financial partners that will be happy to provide capital without usurping the user experience. It allows Google to index finance consumer spending transactions they way they have indexed other data sets. That in turn is a Pandora's Box for artificial intelligence and machine learning. It is still hard to know the unintended consequences of building out our financial robot doppleganger. Knowing the experience of the average person with social, on the margin they will trade all of their private data for a $5 iTunes rewards card.

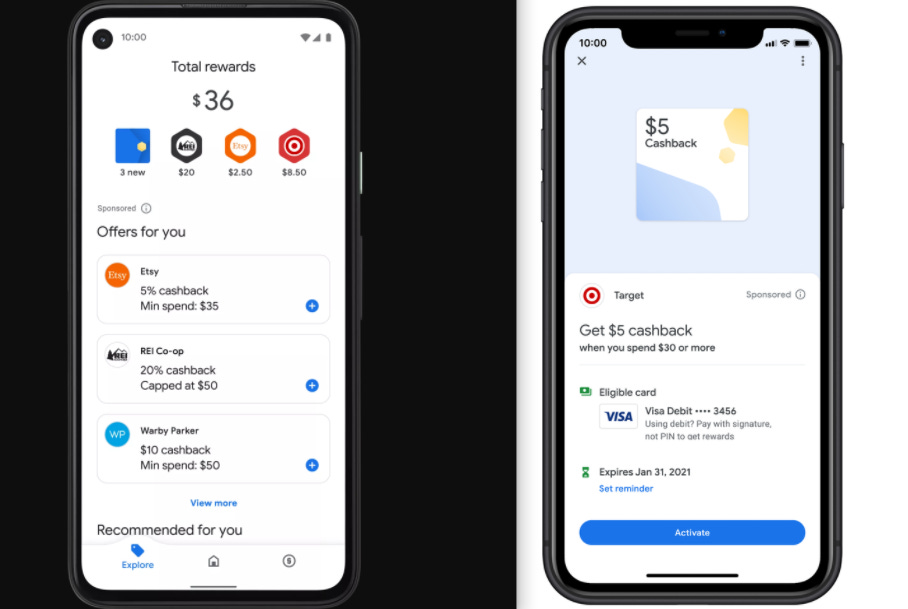

Lex offers a unique take on Google’s recent update to Google Pay and broader finance strategy. The key points include:

Google is better at indexing and structuring data than anyone in the world, and finance is a perfect domain for these strengths

Google’s proficiency in advertising can be applied to delivering rewards and discounts in a user’s Google Pay wallet. Plus, the rewards function is fully integrated with payments, which is a differentiator

Google’s data dominance and willingness to apply it to consumer finance should worry finance chatbots and expense cutting products. Data is king here.

Google has a massive distribution network for banks via Android smartphone users, on which Google Pay will undoubtedly become a default app.

The most intriguing part of Google’s new approach in finance is the consumer rewards and digital receipts, in part because we’ve backed a company in this space: Banyan aggregates receipt data from merchants and transaction data from fintech companies and banks to provide each with a deeper understanding of their customers’ purchasing behavior, all driven through an elegant dynamic receipt in a user’s digital wallet. Check out one of their latest feature releases, NetZero, where Banyan unlocks new revenue for merchants via receipt monetization and reduces costs for restaurants, for example, by covering transaction fees!

Banyan turns transactions from restaurant POS systems into digital receipts that are delivered to customers’ bank, budget and health apps. When a receipt is delivered, banks pay Banyan a fee that we share with restaurants to reduce their card processing fees. As a sign-on bonus, Banyan will cover $200 of your transaction fees per restaurant location. After that, every time Banyan monetizes your receipts/data, we'll share 70% of revenue back to your restaurant until the entire transaction fee is covered, up to $1.00, getting you to net zero transaction fees.

Check out the latest episode of Growth Stage where Immad Akhund, CEO of Mercury, and Mark Goldberg, Partner at Index Ventures, discuss digital banking, startup banking needs, innovation at incumbent banks, and new business models in fintech.

Please let us know what you think and if you enjoy the podcast, rate and review!

<stuff> Weekly

LOL Weekly: GLUE

Funding Weekly: Segmed

Segmed takes curated medical datasets and turns them into useful tools medical researchers can use. All the data is anonymized, standardized and HIPAA compliant. Segmed partners with hospitals and medical professionals to market and distribute their data to AI developers and academic researchers, creating a passive revenue stream for partners and while furthering healthcare research.

Segmed raised $2M from Nina Capital and Blumberg Capital.

An important piece of Segmed’s solution is the “hands-off” nature of the product. Simply supply Segmed with healthcare data and they’ll take care of privacy, data standardization, and monetization. Their one-liner is “turn your data from a cost to a profit.” To monetize the data, Segmed supplies it to researchers working on healthcare-specific applications of AI, suggesting each data partner can meaningfully impact the advancement of AI in healthcare. It’s a neat mix of intrinsic + extrinsic motivation for potential customers.

Zooming out, Segmed is effectively a marketplace. The supply is healthcare providers and their data, and the demand is AI researchers/initiatives.

A few questions regarding the long-term viability of Segmed:

How much is healthcare data worth? How much is it worth to AI researchers specifically? And ow many healthcare providers have the data which is highest demand from AI researchers?

How many AI researchers are working in healthcare and at what scale? What customer segments exist here?

What are the hurdles for healthcare data providers to begin providing data to Segmed and do so consistently in a hands-off way?

Is the value of healthcare data asymptotic? Will AI researches need a continuous flow of what I’ll guess are largely overlapping data points? What impact does each marginal data point have on AI algorithms?

Baseball Weekly: Fastball - Where’s Waldo?

So… John Lackey, Dan Haren, and Jon Lester are all just the same pitcher. Soft-throwing veterans who nibble low and away to induce weak contact or, better yet, avoid it altogether.

This haunts me with memories of the thousands of Jon Lester cutters that missed low and way, in the dirt, and were largely non-competitive pitches. Though this graphic spans the last 12 seasons, I’d bet the majority of fastballs that secured Lester the entire bottom-left section of this graphic were thrown while pitching for the Cubs.

Jon Lester is one of my favorite pitchers so it’s sad to watch his decline over the last couple of years. He’s one of the best pitchers to take the mound for the Cubs in my lifetime and is, by all accounts, a great human. But, I’m not above giving veteran (read: old) pitchers schtick for their approach on the mound :)

Art Weekly: Cooperative Kinetics #10, 2016

George Goodridge

[George] is best known for his three-dimensional stretched canvas works which he refers to as dimensional paintings or object paintings. The works may question diversity, visual kinetics, identities, or real-world concerns. Many of his works could be thought of as somewhat figurative and nonrepresentational while blurring the lines between painting, sculpture and installation.

A good first step to better mental health is to stop using things like Facebook and Twitter because, unfortunately, overall both of them are bad for you. Worse than junk food.

https://iamcolorado.substack.com/