Stealing Signs - Issue 54

Modern Suppliers, Data Games, Consumer is BACK, How Narvar Succeeds in Silence, The Future of Marketplaces, & Voxie Raises $$

Worth Reading

Modern Suppliers

Blake Robbins (Ludlow Ventures)

Most of the modern suppliers, today, are focused on fairly broad use-cases. However, there are endless opportunities for new suppliers to emerge. The more complex and regulated an industry is, the more opportunities there are for suppliers. Modern suppliers that specialize in heavily regulated industries help abstract away the intricacies of these industries.

If you zoom far enough out, is it possible that software companies in the future are either suppliers or marketing businesses?

Blake makes the case for software as the new class of suppliers, or modern suppliers. The thinking is that companies will end up focusing on their core competency and outsource most everything else. It’s efficient and cost-effective (depending on scale).

If this is true, there exists an increasing need to help businesses manage a growing number of suppliers across a broad range of services. Just like complex businesses in the world of atoms spawned enterprise vendor management solutions, the world of bits is likely to produce supplier management solutions as software proliferates throughout the business world.

An important difference between this opportunity in the world of bits vs. atoms is that businesses are increasingly relying on modern suppliers for mission critical services. Examples include privacy, compliance, security, finance, and insurance. Just like the efficiency tradeoff made in outsourcing vs. insourcing a capability, there’s a risk tradeoff in working with suppliers that provide critical capabilities. The better a business can manage modern suppliers — data, visibility, permissions, user management — the easier the decision to outsource to them.

Data Games — The Battle of The Cloud

Tom Noyes (Founder of Commerce Signals)

Ad Dominance of Google, FB, Amazon. As a corollary to Retailers’ success in data is the abject failure of [digital] advertising industry. Last October, Commerce Signals found that 80% digital advertising (outside of Goog/FB/Amzn) fails to produce value. The ad industry continues to push measures of success that do not matter (ie “clicks and engagement”) because they know what sales data shows. The ad industry is largely powered by data of unknown quality and source. As one CEO said “do I have a list of men over 40 that shave with Gilette? Yes. Do I know where the data came from or how old it is? No.. because I would have to pay for it.” Retailers have thus created their own data and ad teams (ex Target, Walmart, Kroger, Amazon). Agencies are quickly shrinking to creative, design and rote execution of well informed client plans.

The context for this excellent piece is as follows: Understanding flows of data, and the structures in which it is controlled, provides a map of: value, power and margin. What is changing in the flow of data?

A few topics from this excellent post that stuck out:

1. The Changing Advertising Landscape

The ad industry is largely powered by data of unknown quality and source. As one CEO said “do I have a list of men over 40 that shave with Gilette? Yes. Do I know where the data came from or how old it is? No.. because I would have to pay for it.” Retailers have thus created their own data and ad teams (ex Target, Walmart, Kroger, Amazon).

2. Retailer Data Usage

Retailers like Amazon, Target and Kroger have become new forces in data. Retailer’s key advantage? The ability to act… Retailers have become data and advertising giants… Within the last 5 yrs, they have unmask virtually all card transactions tying consumer to purchase items (cards are no longer anonymous). While banks and tech platforms face enormous privacy scrutiny, retailers have thus far avoided it, making them the #1 leakage point for payment data.

3. The Importance of Alternative Data

Each Fortune 500 company treats the management of data intersections similarly: bring your data into my environment and we will assess. You can imagine a discussion between Google and a large bank. Specialists like Axciom/LiveRamp historically played an intermediary role. To analyze data combinations in a well defined mutual objective, with anonymized results (see blog). Value can only be assigned to data where it flows. Regulated companies have challenges sharing data AND creating an economic model where value is shared (see Trust Network for more info). Alternative data does not (currently) have this challenge (ex location data).

I’m still wrapping my head around this piece and will surely come back to it often.

Consumer is BACK

Jay Drain (Maven Ventures) & Tasha Kim (Marcy Venture Partners)

Over 50M people consider themselves to be creators and rely on an expanding number of platforms to help them monetize and strengthen relationships with fans. These include Substack (paid newsletters), Patreon and Only Fans (exclusive content), and Cameo and Pear Pop (customized appearances). Creators now rely on so many different sources of incomethat platforms like Stir have emerged to consolidate their finances.

Jay and Tasha review the year “consumer” rose to power, highlighting the top trends of 2020 including audio, the creator economy, Sustainability, Inclusivity & Diversity, the Metaverse, and EdTech.

A telling indicator of the power independent creators now hold in the tech world is the rise in finance and management products built specifically for them, like Stir. These companies aim to help the 50M “creators” monetize their audience and manage it like a business.

Related is the verticalization and specialization of consumer. Stir is the best example of a horizontal management product for creators, but we’re seeing an increasing number of similar products built for specific segments of creators, most notably for musicians and wellness/fitness creators. It’s one clear sign that the creator economy is here to stay.

As Jay and Tash point out, scaling from zero to viral can occur faster than ever these days, but often scale does not breed efficiency or even monetization. It’s likely we’ll see more iterations of Stir that focus on specific creator types, much like we’ve seen the verticalization of SMB tools like Squire for Barbers and Boulevard for Salon, and specialization of fintech products like Daylight for the LGBTQ community.

How Narvar Succeeds in Silence

Sidhartha Jah (Mastercard)

Partnerships across clients: how can it leverage its existing clients to help other clients. For example, what if Lululemon offered every Walgreens store as a pick-up or drop-off point? Can a unified experience be created with Narvar as the linchpin holding it all together? Can it build bridge the gap between the empires and the rebels? For me, that would be the most fascinating version of the company.

Sid offers a solid analysis of a company you’ve probably never heard of, but certainly interact with nearly every day. Narvar helps retailers drive customer loyalty with an end-to-end post-purchase experience. In other words, if you’ve ever purchased anything online, you’ve probably used their platform.

2020 has, in all likelihood, been a killer year for Narvar. Sid cites a few tailwinds likely driving massive growth for Narvar, which include the rapid growth of eCommerce, the increasing value to retailers of a unified experience, and the complexities in successfully executing a physical and digital operation, which many retailers must grapple with today. The marriage of physical and digital is critically important for retailer success, and it’s increasingly difficult for the legacy retailers to keep up as, for most, their core competency in physical retail. It’s no many of them are Narvar customers.

Many of these customers fall into what Sar calls “the big belly of brands.” They aren’t quite SMBs but also aren’t the behemoth eCommerce aggregators. Examples include Patagonia, Marine Layer, Rebecca Minkoff, and Tumi. While Narvar has thrived selling to the big belly, Sar believes this is also a long-term risk. And I agree. They could attack the larger crop SMB retailers, but this segment is highly fragmented, less likely to adopt SaaS tools (although this is changing rapidly), and Narvar must acquire a larger volume of them to make up for lower contract values. Or, they could attach larger retailers that wish to separate themselves from the aggregators. These customers come with a large contract values and scale, but sales cycles can be lengthy, they likely already have a suite of individual tools for the post-purchase experience, and may opt to to build anything new in-house for greater efficiency.

I think they should go the SMB route because this market is growing much faster than the larger retailers, though spread across many verticals, and SMBs are increasingly adopting SaaS products, especially in eCommerce. SMB retailers face stiffer competition as it becomes easier to spin up a brand and monetize an audience, so SMBs must find ways to optimize, which will rarely result in software development. A unified 3rd party system like Narvar makes a lot of sense.

The Future of Marketplaces

Dan Hockenmaier (Founder of Basis One)

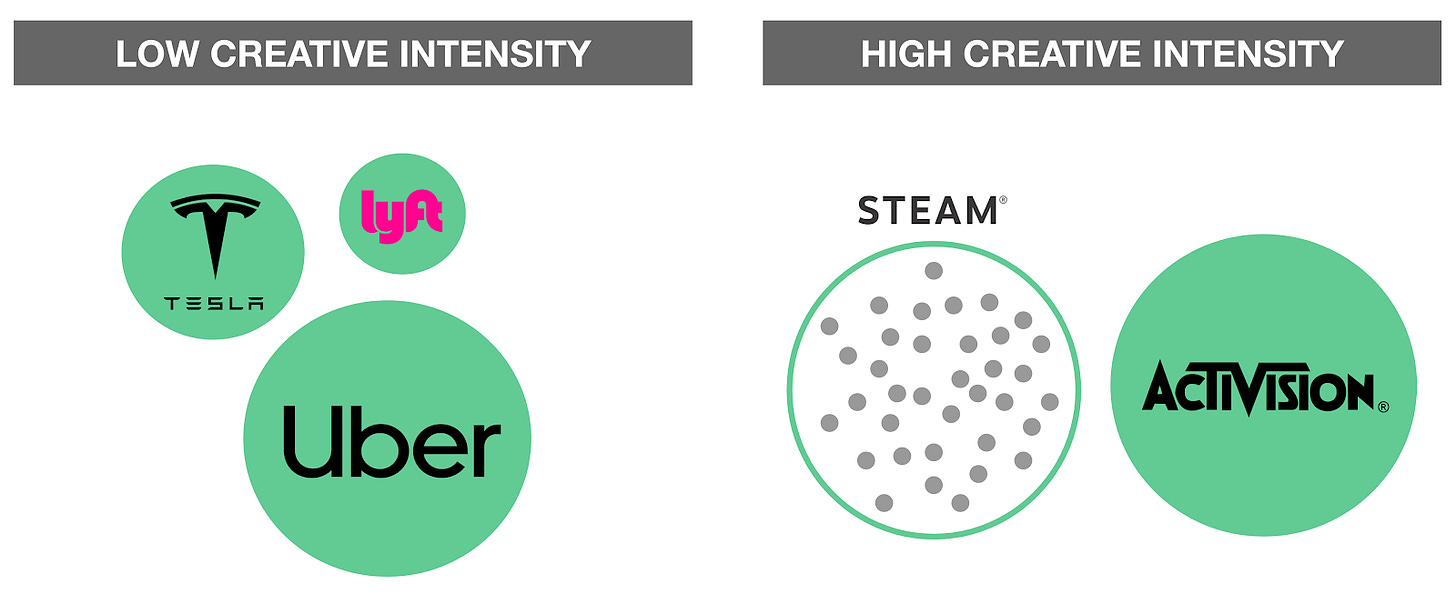

…in creatively intense industries, marketplaces will own some of the market in the long term, but they will not be the only game in town.

That’s because there are still customers that are optimizing for some mix of quality, speed, and cost, while others want selection and innovation. In video games this is the difference between people who want to play Call of Duty 47, and those who want to continually seek out new and interesting indie games. In pizza it is the difference between people who want the reliability and cost of Dominoes, and those who want to seek out the best local slice.

This is an excellent framework to evaluate both marketplace businesses and the industries they’re in. It’s a truly unique analysis of marketplaces, which is rare.

In short, marketplaces will continue to improve in areas like trust (between supply and demand), managing risk (underwriting transaction risk), matching (optimal supply<>demand match), and logistics and infrastructure (fulfillment, last mile delivery), but will fail to make progress in creativity.

This dimension is not exactly defined by whether customers want homogeneous or heterogeneous supply. It is closer to the rate at which current products go stale, and thus the rate at which they have to be created all over again. Let’s call this dimension creative intensity.

Industries with low creative intensity like transportation and home services will consolidate into a few “super-suppliers” because supply is commoditized and buyer needs are constant. Industries with high creative intensity like gaming and food will support thriving marketplace models because buyer needs are more diverse and dynamic, thus more difficult to serve, which requires a more diverse and dynamic supply.

<stuff> Weekly

LOL Weekly: If only…

lolol

Funding Weekly: Voxie

…compared to other text marketing tools, messages sent via Voxie feel like a real, personalized conversation — even though 80% to 90% are actually automated, with the rest of the messages written by people. Plus, Voxie will allow businesses to send their messages from a normal 10-digit phone number (rather than the more common five-digit numbers used for marketing).

Voxie raised a $6.7M A Round from Noro-Moseley Partners, Circadian Ventures, Engage Ventures, and Atlanta entrepreneurs Wain Kellum, Andy Powell, David Cummings, and Fred Castellucci.

I’m bullish on text messages as a “commerce channel” and one that retailers will increasingly use to build a direct, personal relationship with customers. We’ve seen some success in this space with peer-to-peer tool Community, and brands are increasingly looking for ways to mirror the relationship individuals/creator have with their audiences.

That said, I’m skeptical that a “more conversational” interaction with brand interaction will significantly impact sales, but the immediate incremental lift from better customer engagement and loyalty is clear. Though at scale, incremental can be significant…

Baseball Weekly: Stars Accused of Cheating

“Hey Bubba, it’s Gerrit Cole, I was wondering if you could help me out with this sticky situation,” the pitcher wrote, adding a wink emoji. “We don’t see you until May, but we have some road games in April that are in cold weather places. The stuff I had last year seizes up when it gets cold.”

Ex-Los Angeles Angels staffer recently made public his history of (allegedly) helping, among many others, star pitchers Justin Verlander, Gerrit Cole, Max Scherzer, Felix Hernandez, Corey Kluber, and Adam Wainright cheat.

The ex-Angels employee, Brian “Bubba” Harkins, claims numerous major league pitchers (allegedly) contacted him frequently over the course of their careers to acquire a special mixture of rosin and pine tar to help enhance their grip on the ball.

The alleged claims were entered into evidence in an MLB internal investigation and Harkins says he was wrongfully terminated for his involvement in the alleged scheme, claiming the Angels coaching staff and players were aware of his actions.

imo MLB should allow foreign substances. At this point it’s clear that most pitchers use mixtures of pine tar, rosin, sunscreen, and other homemade aides — all of which are banned — and that the MLB has no control or ability to enforce the rules prohibiting them. Sure, these substances add a few RPMs to a fastball and make for a sharper slider, but it’s a lost cause. And, imo, it doesn’t give the pitcher an unfair advantage, especially given the recent changes to the MLB ball, which give an advantage hitters due to lower air resistance.

Art Weekly: Summer Rain 1 (2020)

Julian Opie