Stealing Signs - Issue 55

Tinkoff, Walmart & Ribbit's Fintech, Exclusivity vs. Inclusivity in Luxury Goods, The New Career Stack, The 3-0 Count Dilemma, and Abound raises $$

Worth Reading

Walmart & Ribbit's "Fintech"

Jason Mikula (Fintech Business Weekly)

Reduce cost of processing payments

Remember, this was the original play when Walmart sought to start its own ILC back in 2005. To achieve this, Walmart needs to go beyond its current “Walmart Pay” offering to create a closed loop effect where it is on both sides of the transaction - cutting out fees paid to third parties like Chase.

To do this, Walmart would need to capture consumers’ direct deposit into their fintech offering. This would allow Walmart to process payments from a user’s affiliated payment cad/wallet in-store or online essentially as a ledger transfer, cutting the third party out of the loop. Walmart would also earn interchange for payments to other merchants.

Walmart recently announced a partnership with Ribbit Capital, investor in Affirm, Robinhood, Wealthfront, and Credit Karma, to launch a fintech company.

In this post, Jason outlines Walmart’s history in fintech including their partnership with Amex for a prepaid card which, in hindsight, seemed doomed to fail from the outset, a partnership with GreenDot for yet another prepaid card, and their more recent partnership with Affirm to open a “buy now, pay later” option to Walmart customers, another partnership which seemed doomed to fail from the beginning given 89% of Walmart’s business is still done in-store.

The obvious outstanding question in this partnership is “will Walmart build or buy?” I think it’s a lock that Walmart will “buy,” in part because Ribbit’s expertise is investing in fintech, not building (and Walmart certainly doens’t have a track record of building financial products), but mostly because there are just so many acquisition / investment targets. The U.S. has 60+ neobanks alone and there are new infrastructure companies popping up daily.

Outside of the Ribbit partnership, I’m interested in Walmart’s relationship with PayPal. Walmart was PayPal’s first partner for offline transactions back in 2018 and PayPal recently launched a partnership with CVS to allow customers to pay with PayPal in store. They’re nearly ubiquitous online and are clearly pushing deeper into offline transactions, so there may be more in store for this partnership in the future.

Tinkoff, Russia’s Capital One

Marc Rubinstein, Net Interest

More recently, the bank has begun to offer non-financial products too. With this it is replicating the super app strategy prevalent in Asia. Tinkoff launched its super app in December 2019 and offers travel services and entertainment via partners. The company has said that it will develop partnerships with businesses of any size, from Instagram bloggers to Russia’s largest B2C companies.

I recently discovered Tinkoff, the largest online bank in Russia, through Patrick O'Shaughnessy’s interview of Oliver Hughes, Tinkoff’s CEO.

This post is an excellent history of how Tinkoff rose to prominence, including Tinkoff’s unique founding story, leveraging age old growth strategies, and product and banking innovations.

For example, Tinkoff heavily leveraged direct mail for customer acquisition, a strategy borrowed from founder Oleg Tinkoff’s time in the U.S., during which his mailbox was flooded with credit card offers. The strategy paid off as Tinkoff achieved an average response rate roughly 4x higher than in the U.S..

Tinkoff also owns the largest independent media resource in Russia, the Tinkoff Journal. The publication produces financial literacy and wellness content and boasts over 8M monthly active readers. Despite its reach, the company does not advertise in the Journal — it’s a pure customer acquisition and retention channel.

As for product innovations, Tinkoff was the first financial institution in the world to integrate a “stories” feature into their mobile app. Yes, these are the same “stories”you’re thinking of — those found in Snapchat and Instagram. Tinkoff leverages stories much like the social media giants, showing users personalized, relevant content to increase time spent in their mobile app.

Yet another compelling aspect of Tinkoff’s model is access to SKU data. Thanks to the Russian tax online reporting system, Tinkoff can see exactly which products their customers purchase. Not just the transaction and merchant ID, but data on each individual product in a transaction. This data is incorporated into the mobile app so their customers can see which products they’ve purchased and for how much, and Tinkoff leverages it provide customers with targeted brand offers. For context, this is not possible in the U.S. today — transaction and receipt data is scattered across retailers and banks, and often silo’d within their respective systems.

Juggling the Paradox of Exclusivity & Inclusivity

One student from Ghana asked whether luxury can exist in the absence of wealth, noting that in his country local artisanal craft is most valued. Miuccia Prada responded that fashion must evolve to be more open and accessible, closing with, “If you have anything to propose, stay in touch!” That exchange between a student and the head of a global fashion powerhouse illustrates a new level of approachability and inclusivity that has been emerging in the luxury industry.

The new luxury is virtual, collaborative and innovative. Successful brands will have the ability to balance referencing their history while evolving to remain aspirational to a new generation.

Luxury brands have been forced to evolve in response to the COVID-19 pandemic and evolving consumer preferences. 83% of millennials want brands to align with their own values and consumers now expect immediacy and transparency from the brands they interact with — a far cry from the way luxury brands have operated historically.

In response, luxury brands have experimented with new platforms and technologies to connect with consumers. A few examples:

Miu Miu launched the Miu Miu Twist fragrance inside a video game

Balenciaga produced it’s Fall 2021 fashion show as a video game

Gucci now sells second-hand pieces on luxury resale platform The RealReal

A notable omission from luxury brands’ innovative efforts are NFTs, or Non-Fungible Tokens. An NFTs are is cryptographic token that represents something unique. They are easier to store, sell, authenticate, collateralize, tokenize, value and have stronger property rights than physical assets. Current examples include works of art and “moments” in sports history.

While this clashes with luxury brands recent diversion from a culture of exclusivity, NFTs offer a new medium to convey exclusivity and certainly qualify as a new, innovative, and accessible consumer experience.

The New Career Stack

Jomayra Herrera (Principal @ Cowboy Ventures)

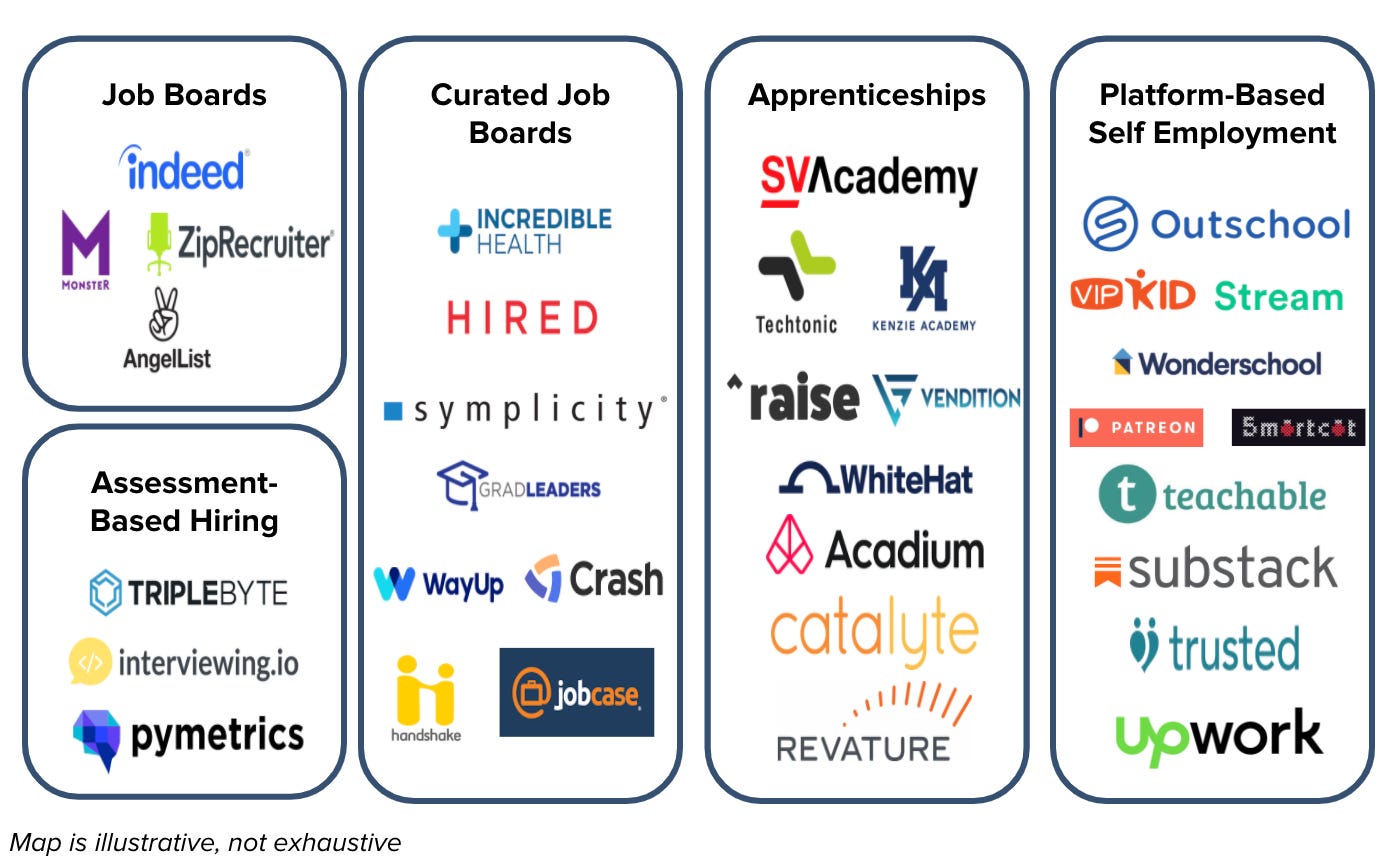

While companies like Indeed and Monster currently have market dominance in job search, companies that offer more curated offerings (e.g. Incredible Health and Handshake), on-ramps into careers (e.g. apprenticeships), and the ability to employ yourself are starting to create new opportunities for finding and getting access to jobs. That said, the process of democratizing access to finding work still has a lot of room for improvement.

Jomayra breaks down the “new career stack,” which enables a more empowered career journey, into five categories:

Exploration: Identifying A Career Path

Placement: Finding And Getting The Job

Application: Thriving On the Job

Learning: What You Need To Learn to Grow In Your Career

Professional Identity: Who You are and Who You Know

A few opportunities in the Exploration category are “Glassdoor 2.0” and “better predictive data.” Glassdoor 2.0 feels like the next LinkedIn 2.0 as the creator economy emerges, remote work intensifies, and workers look for more fulfilling career opportunities. And while it’s unclear which data is relevant in the opportunity for better predictive data, I’d bet the plethora of HR and Payroll startups have an advantage here.

As for the Application category, better tools for finding a job have been quite popular in recent years. I’m a big fan of vertical solutions like Incredible Health, a job platform for nurses, which are compelling because they have have an advantage in the homogeneity of their users (nurses), which they can parlay into offering additional products and services purpose built for their users. One step further would be labor solutions for specific customer segments e.g. LGBTQ or Seniors, which may gain momentum over time, much like we’ve seen them emerge in financial services.

Lastly, there likely exists an opportunity for “automated team formation” tools, especially for large enterprises like consulting firms. This solution would select employees based on strengths, performance, and preferences to create optimal project teams. The model has popped up a few times over the years, but the transition to remote work feels like an inflection point for this business.

Not a subscriber yet? Click below to subscribe!

<stuff> Weekly

LOL Weekly: A Juicy Investigation

lol — So apparently Chrissy Teigen tried a bottle of $13,000 wine and hated it. The founder of Vinovest, a wine investment platform, did some investigative work to get to the bottom of it…

Funding Weekly: Abound

Companies like Stride Health and Thimble are making it easier for independent workers to select benefits providers, but independent workers are still in search of an easy way to set aside enough for taxes, healthcare, retirement, and savings — avoiding crippling financial shocks.

Abound says it has solved this challenge with its independent benefits API for businesses that serve independent workers, letting these apps embed individual benefits and automate contributions in a tax-optimized way for the worker.

Abound, a tax filing and management API created to assist independent workers in payment and filing of taxes, raised a $6M round led by Point72.

Abound seems well-positioned to ride both the fintech and creator economy waves. Abound services numerous fintech apps, which means they benefit from the growth of the overall fintech industry, and I suspect they’ll prove to be an extraordinarily sticky product. Add them to the growing list of API fintech companies…

Related — Grace Isford of Canvas Ventures put together a neat API Directory

Baseball Weekly: The 3-0 Count Dilemma

FanGraphs

The pitcher has a much riskier decision to make than the batter. The difference in their respective decisions is a [weighted on-base average] wOBA value of 0.21, while the batter’s decision has a difference of 0.05. This makes sense given the excellent position the batter is in. A 3-0 count is terrible for the pitcher, so the outcome of their decision puts them in much greater risk. Also, they don’t have as much say in their decision as the batter. A batter can choose if he swings or not, while a pitcher can try to put the ball in the strike zone, but he can not be certain. A pitcher in a 3-0 count likely doesn’t have their best stuff, so the outcome of their pitch will likely have a greater variance. In short, someone with less control over the outcome will face a greater risk.

Art Weekly: Retinal, 2

Jennifer Steinkamp, 2019

Retinal (2018) was made in direct response to architect Steven J. Holl’s design for an addition to the Bloch Building of the Nelson-Atkins Museum of Art in Kansas City, Missouri (it was featured in “Open Spaces,” an exhibition curated for the museum and surrounding Swope Park by Dan Cameron in 2018). Discovering that Holl refers to the structure’s windows as “lenses,” Steinkamp produced an eye-like animation that hints at the translucent, refractive appearance of optical veins. The work’s drifting clusters of green, pink, and purple forms have the slick look and acidic coloration of candy, while the amorphous shapes and busy, all-over composition forge links to biomorphic and expressionist abstraction.