Stealing Signs - Issue 57

A New Era in Food Delivery?, The Battle for Checkout, YouTube of the Future, Hyperleveraged Companies, NBA Top Shot for MLB, Stone Sushi, & Patch raises $

Check out the latest episode of the Growth Stage Podcast: Grocery Understated (Micro-fulfillment), where Jett Fein, Partner at e.Ventures, and Pradeep Elankumaran, founder of Farmstead, discuss the paradigm shift in grocery, delivery, and the rise of micro fulfillment.

Worth Reading

The Beginning of the End

Dan Teran (Managed by Q) via Packy McCormick’s Not Boring Newsletter

New entrants like GoParrot (2016), Lunchbox (2019), and Bikky (2020) are combining traditional online ordering with sophisticated CRM and marketing automation that helps keep diners engaged and loyal. With this technology, restaurants can not only capture direct order volume, but convert customers from third party to first party ordering. Paying 30% of sales for a new customer is tolerable, paying 30% in perpetuity is not, and thanks to these firms it is now an option.

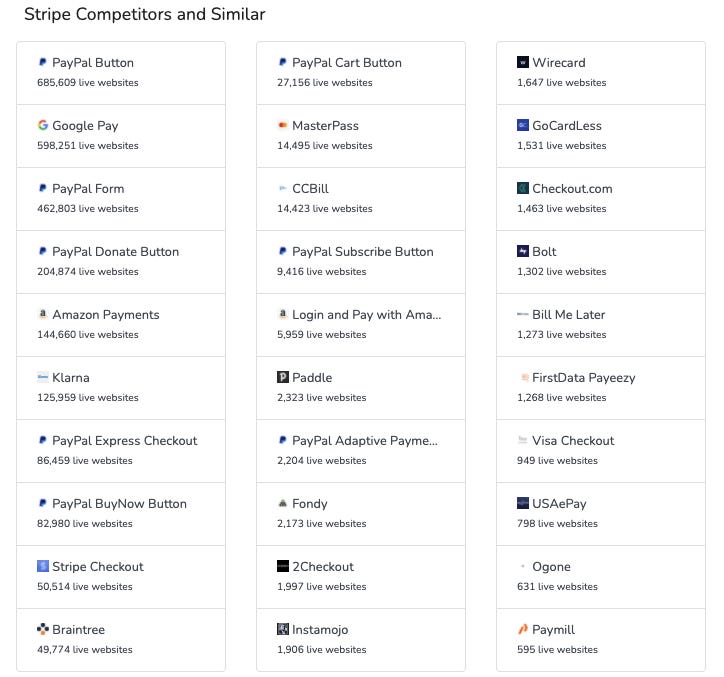

Food delivery aggregators (UberEats, DoorDash, GrubHub) are a bad deal for restaurants. Just take a look at the P&L above. The more a restaurant uses the big guys, the worse their economics become.

Dan highlights new entrants in this space like GoParrot, Lunchbox, and Bikky, that help restaurants combat the predatory aggregators by in-sourcing delivery and building a direct relationship with customers. These tools are not only valuable because they’re alternative options to the big names, but they also help restaurants convey their brand and differentiation from other restaurants, much like the dine-in experience. However, this is a flawed approach because the value proposition in food delivery is fundamentally different the dine-in experience. Brand, atmosphere, service… the unique experience isn’t important in food delivery. Customers want convenience and certainty when ordering delivery, not the bells and whistles of a dine-in experience. Often, consumers don’t even care which restaurants are available on a delivery service. They want convenient Mexican food — rarely do they seek out a specific Mexican restaurant, and the delivery aggregators are the best at delivering this experience.

The Battle for Checkout

Michael Jenkins (MBA Candidate at Berkeley Haas)

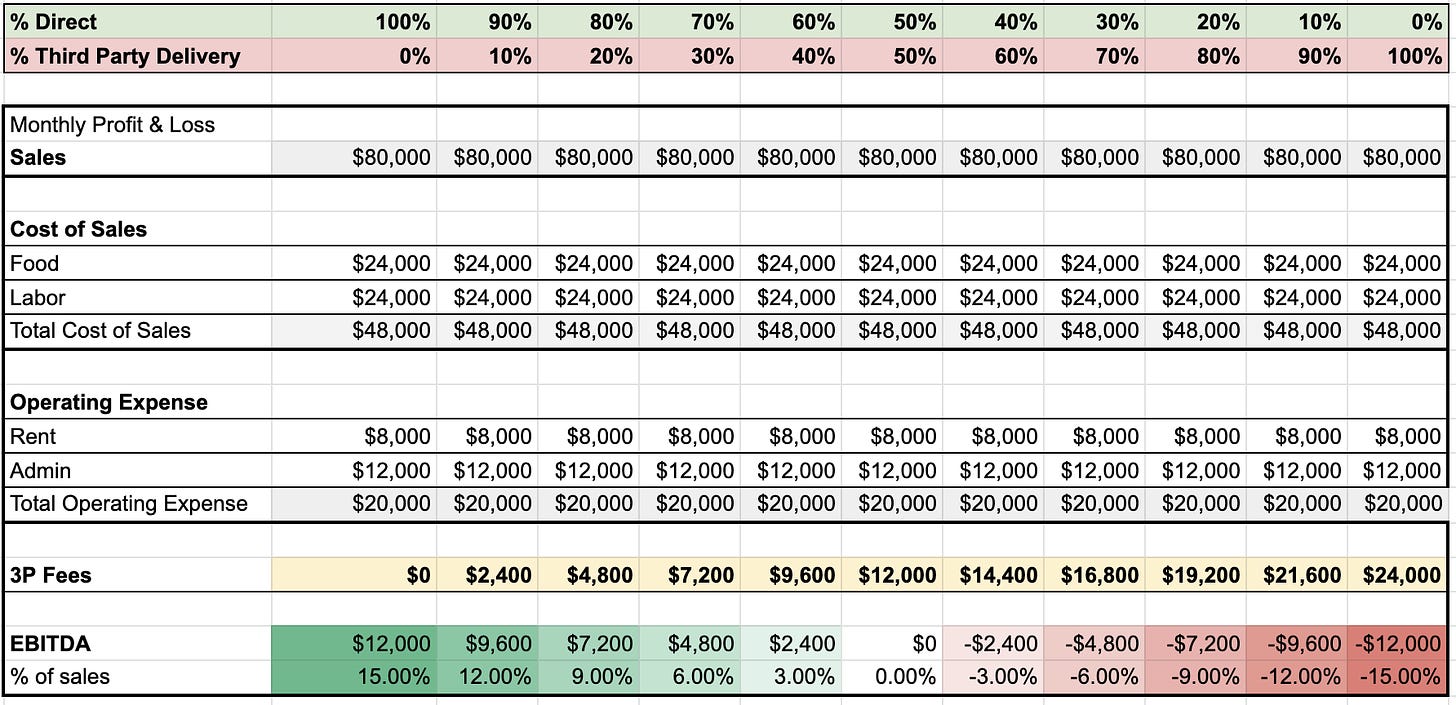

The universal checkout companies are figuring out distribution by partnering with e-commerce platforms and I think they face the largest uphill battle given the lack of consumer recognition. Stripe is the ace in the pocket for Fast though and integration with its Stripe Checkout or Stripe Elements solutions would immediately throw them into serious contention. Bolt’s strategy of going after independent retailers in the clothing and fashion space who want creative license and customisation not always possible on large platforms. Like BNPL providers, I predict these universal checkout companies to create their own shopping apps to drive traffic to their merchants in the future, demonstrating their value by bringing merchants net new customers.

This is fantastic breakdown of the battle between upstarts, card networks, and tech giants for checkout real estate. It’s a long but worthwhile read. A few thoughts below:

PayPal seems to have a hand in every inch of the fintech arena, but I think they’ll be best served by doubling down on offline transaction capabilities. PayPal is present on the vast majority of websites in existence and their checkout button is on 77% of the top 477 of internet retailer websites. So, while they’ve already deeply penetrated online transactions, they’ve made little headway where the vast majority of transactions still occur, offline. The recent partnership with CVS is a good example of their appetite to capture offline transactions, but they haven’t been able to figure out how to capture, analyze, and take action on this transaction data yet. PayPal is sitting on a multi-billion dollar opportunity in making offline transactions as valuable a data source as online transactions.

BNPL products have little, if any, defensibility. Simply splitting payments is not a durable competitive advantage and we’ve seen many, many similar products pop up over the last year. Further, giants like PayPal, Visa, and AmEx are rolling out BNPL solutions to compete with well-funded startups. To differentiate, BNPL products must focus on the data piece, providing merchants deeper insights into who their customers are.

As for one-click checkout products, Fast and Bolt lead the way in startup land. Fast seems to lack the merchant coverage Twitter might lead you to believe they do, and it’s increasingly common to see “I dont know anyone who uses Fast” tweets. That said, they definitely can’t be counted out with Stripe and Lee Fixel behind them. It just feels weird.

The key to success here is merchant adoption. Whoever wins distribution wins the one-click checkout race. Fast doesn’t appear to be the leader here and Bolt is TBD. ShopPay is an interesting player but seems focused on building their own merchant marketplace. And, for my sake, I hope ApplePay wins!

The real winners, as Michael notes, are the card networks:

These other solutions attempt to provide more convenient ways to use your card, which only helps grow the Visa and Mastercard duopoly. Although they would prefer consumers use their “click to pay” buttons because of the increased data they get, expanding card usage is their ultimate goal.

YouTube of the Future

Eric Feng (Commerce Incubations at Facebook)

That difference between video creation and video hosting is important because hosting alone is undifferentiated. YouTube is terrific at storing and streaming videos, but so are other services like Twitter or Facebook. There’s only so much you can do with hosting before the creator can’t tell the functionality apart. At that point, creators can simply take the video they’ve created elsewhere and cross post it to multiple platforms in addition to YouTube (or in a worst case scenario instead of YouTube). And for viewers, watching the same video posted on multiple platforms is also undifferentiated. It matters far less where I watch a video when both the content and the viewing experience are the same.

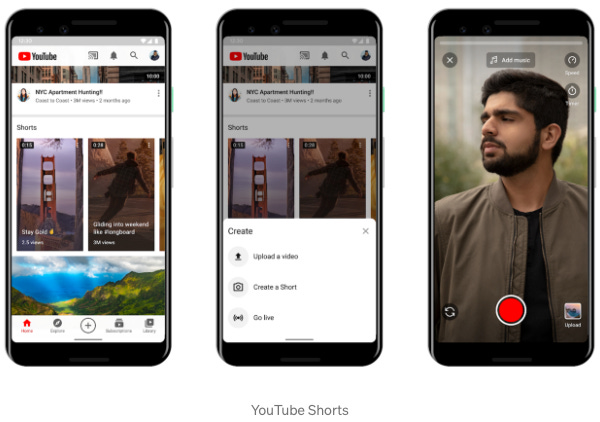

Eric offers a few feature proposals for the “YouTube of the Future” including robust video creation tools, creator to viewer communication, and social features.

Native video creation seems pretty important given all other social video platforms have this capability, but my initial reaction to this post is that the social features may be more important than video creation.

Social features may include an indicator to show a user is online (like a green light icon) and real-time communication with between online users, which can immediately enhance the existing YouTube experience. The features change little about the way in which users use YouTube, but fundamentally changes the way in which they interact with other users — a shift from asynchronous communication to synchronous communication, which immediately makes YouTube a social product, benefiting both users and creators.

Hyperleveraged Companies

Tanay Jaipuria (MBA Candidate at HBS)

The goal for employees is to maximizeleverage i.e., maximize the impact they have for a given amount of effort, rather than efficiency, i.e., minimizing effort for a given amount of impact

If the existing employees failed to create enough leverage to grow the company themselves, then the company needs additional help, and so hires additional people.

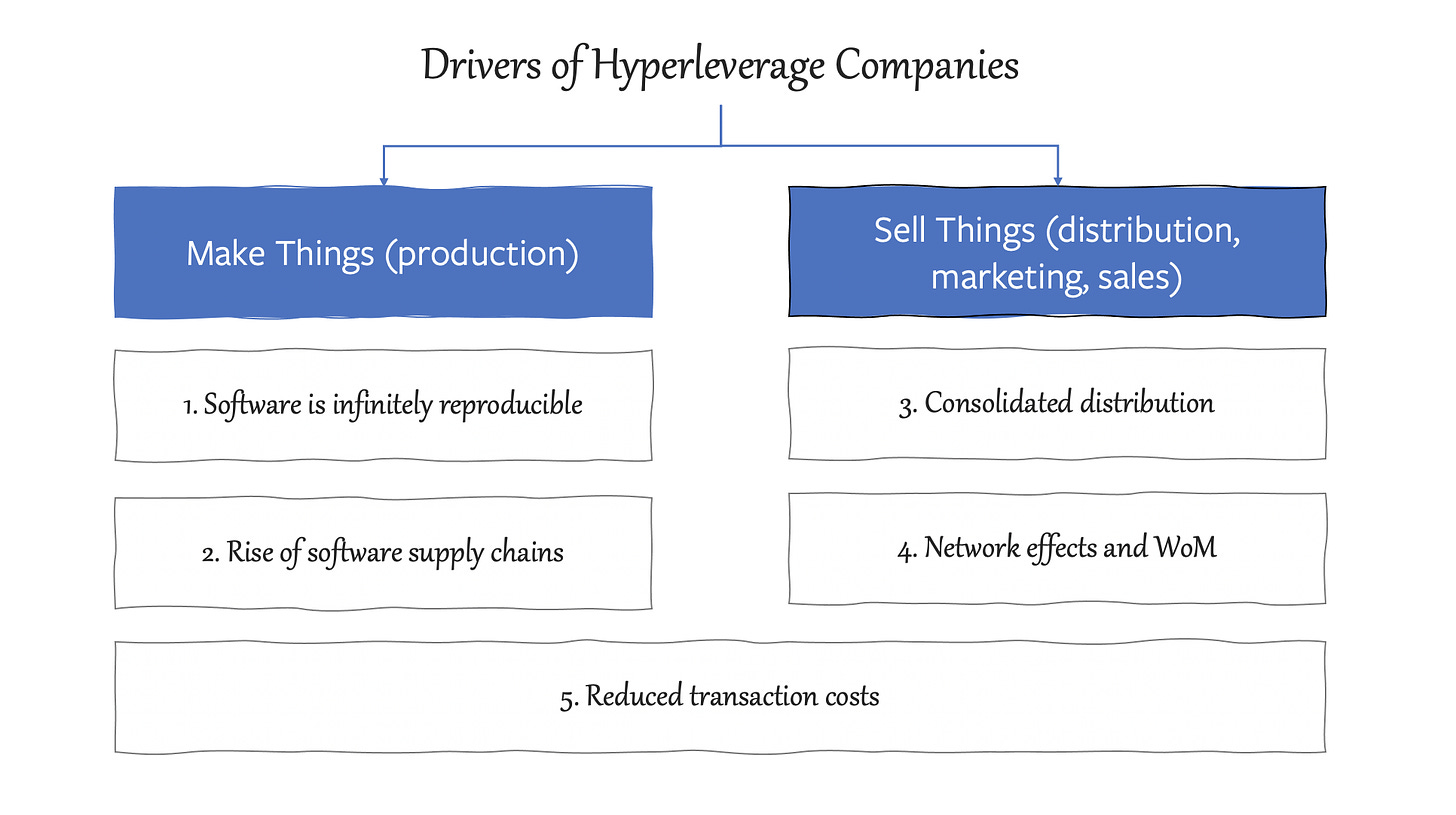

Nice framework for thinking about the early days of company building and the proliferation of API businesses. Companies can focus on their core competency and outsource nearly everything else, which, Tanay notes, is likely to increase the number of billion dollar companies built by very small, or hyper leveraged, teams.

Not a subscriber yet? Click below to subscribe

<stuff> Weekly

LOL Weekly: This website… isn’t free

lol “this website is free” are my favorite Twitter jokes. Gone but not forgotten.

Funding Weekly: Patch

The company’s code can integrate into the user experience on a company’s internal site to track things like business flights for employees, recommending and managing the purchase of carbon credits to offset employee travel.

The software allows companies to choose which projects they’d like to finance to support the removal of carbon dioxide from the atmosphere, with projects ranging from the tried and true reforestation and conservation projects to more high-tech early-stage technologies like direct air capture and sequestration projects, the company said.

Path raised a $4.5M Seed round from Andreessen Horowitz, VersionOne Ventures, MapleVC, and Pale Blue Dot Ventures.

It seems cleantech is back! If not quite at the height of 2005-06 wave, we’re well on our way there. While Patch is more management software than fintech, a key function of their product is project financing decisions, and the intersection of clean tech and is heating up, too. Nik Milanovic highlights the plethora of new entrants in to clean-fintech here, and we’re seeing many companies leverage growing consumer interest in climate efforts to offer specialized financial products.

Baseball Weekly: NBA Top Shots for MLB

I’m not the first and won’t be the last to suggest this, but an MLB version of NBA Top Shot would be incredible. The NBA has the benefit of a culturally relevant league, but Top Shot has garnered attention from many outside the core NBA audience, which is exactly what baseball needs.

For this to happen, the MLB owners and Players Union would need to mend their relationship — the owners are greedy and the players feel like they’ve been cheated. Bridging this divide is an extremely tall order. However, it may be the most important opportunity the for the game since video streaming and can make baseball relevant again unlike any other initiative I can think of.

Art Weekly: Stone Sushi

Hama

japanese art student hama has crafted sushi pieces from natural, hand-polished stones that resemble the traditional japanese dishes. created for their art university thesis project, the platter reveals at a closer inspection, not only tuna, shrimp, negitoro and uni, but also body parts like lips, ears and fingertips.

currently on show at the joint graduation exhibition of 5 art universities in tokyo at the national art center, the sushi pieces boast their natural color, meaning that no paints of artificial coloring was used. hama explains that the theme of the project is directly related to their part-time work at a restaurant where fresh fish is serve, therefore being waste one of its strongest references. by adding body parts, the artist aims to create a dialogue about the life and death cycle.